Shopping at Home Depot with no interest offers can be a game-changer for your home improvement projects. Whether you're renovating your kitchen, upgrading your bathroom, or simply looking for appliances, understanding how no-interest financing works is crucial for making smart financial decisions. This article will provide you with detailed insights into no-interest offers at Home Depot, helping you save money while enhancing your home.

No-interest financing at Home Depot has become increasingly popular among homeowners and DIY enthusiasts. With the right knowledge, you can take advantage of these offers without incurring additional costs. However, it's essential to understand the terms and conditions to avoid any surprises down the line.

In this guide, we will explore everything you need to know about no-interest financing at Home Depot, including eligibility criteria, how to apply, and tips for maximizing your savings. Let's dive in!

Read also:Brown Blood Before Period Understanding The Causes And What It Means For Your Health

Table of Contents

- Biography

- What is No Interest Home Depot?

- Eligibility Requirements

- How to Apply for No Interest Financing

- Advantages of No Interest Financing

- Common Mistakes to Avoid

- Types of Products Available

- Tips for Maximizing Savings

- Frequently Asked Questions

- Conclusion

What is No Interest Home Depot?

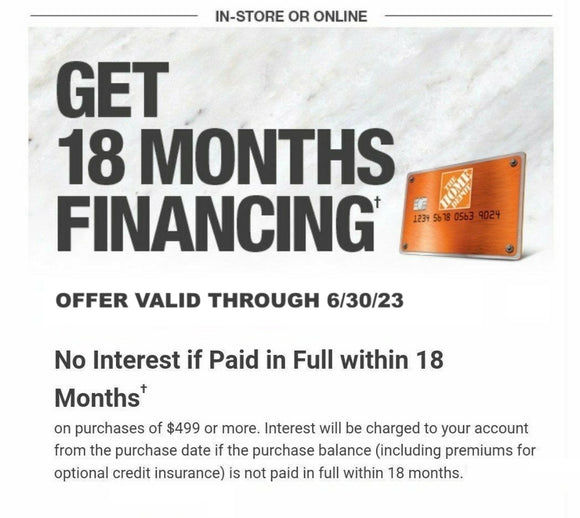

No Interest Home Depot refers to the special financing offers provided by Home Depot for certain purchases. These offers allow customers to buy products without paying interest for a specified period, typically ranging from 6 to 12 months. This can significantly reduce the overall cost of your purchase, especially for high-value items such as appliances, furniture, or major home improvement tools.

How Does No Interest Financing Work?

No-interest financing works by deferring the interest charges on your purchase for a specific period. If you pay off the balance within this promotional period, you won't incur any interest charges. However, if the balance is not paid in full, interest will be charged retroactively from the purchase date.

Eligibility Requirements

To qualify for no-interest financing at Home Depot, certain criteria must be met. Below are the key requirements:

- Have a valid Home Depot Credit Card or apply for one during checkout.

- Make a purchase that qualifies for the no-interest offer.

- Ensure the purchase amount meets the minimum threshold set by Home Depot.

It's important to review the specific terms and conditions associated with the offer to confirm eligibility.

How to Apply for No Interest Financing

Applying for no-interest financing at Home Depot is a straightforward process. Follow these steps to get started:

- Visit your local Home Depot store or shop online at homedepot.com.

- Select the product you wish to purchase and proceed to checkout.

- During checkout, apply for a Home Depot Credit Card if you don't already have one.

- Choose the no-interest financing option and complete the application process.

What Happens After Approval?

Once approved, you will receive a confirmation of your financing terms. Make sure to review the agreement carefully and understand the repayment schedule to avoid any unexpected charges.

Read also:Best Foundation For Combination Skin A Comprehensive Guide To Flawless Complexion

Advantages of No Interest Financing

No-interest financing at Home Depot offers several benefits:

- Cost Savings: By avoiding interest charges, you can save a significant amount of money on your purchase.

- Flexibility: Spread out your payments over a longer period without incurring additional costs.

- Convenience: Simplifies the purchasing process for high-value items, making it easier to manage your budget.

Long-Term Financial Benefits

Using no-interest financing wisely can improve your credit score by demonstrating responsible financial behavior. Consistently paying off your balance on time can have a positive impact on your credit history.

Common Mistakes to Avoid

While no-interest financing can be beneficial, there are common pitfalls to watch out for:

- Not paying off the balance within the promotional period, leading to retroactive interest charges.

- Ignoring the terms and conditions, which can result in unexpected fees or penalties.

- Using the credit card for non-qualifying purchases, which may not be eligible for no-interest financing.

How to Avoid These Mistakes

To avoid these common mistakes, create a repayment plan before making your purchase. Set reminders for payment due dates and ensure you have the funds available to pay off the balance in full before the promotional period ends.

Types of Products Available

Home Depot offers no-interest financing on a wide range of products, including:

- Appliances

- Power Tools

- Furniture

- Outdoor Equipment

- Home Improvement Supplies

Check the specific product page or consult with a store associate to confirm eligibility for no-interest financing.

Seasonal Offers

Home Depot often runs seasonal promotions, offering no-interest financing on popular items during specific times of the year. Keep an eye on their website or sign up for their newsletter to stay updated on these offers.

Tips for Maximizing Savings

To make the most of no-interest financing at Home Depot, consider the following tips:

- Plan your purchases in advance to coincide with promotional periods.

- Compare prices with other retailers to ensure you're getting the best deal.

- Utilize additional discounts or coupons available during the promotional period.

Creating a Budget

Before making a purchase, create a detailed budget to ensure you can comfortably pay off the balance within the promotional period. This will help you avoid unnecessary interest charges and maximize your savings.

Frequently Asked Questions

Q1: Can I use no-interest financing on all products at Home Depot?

No, no-interest financing is only available on select products. Check the product page or consult with a store associate for eligibility.

Q2: What happens if I don't pay off the balance within the promotional period?

If the balance is not paid in full, interest will be charged retroactively from the purchase date.

Q3: Is there an annual fee for the Home Depot Credit Card?

No, the Home Depot Credit Card does not have an annual fee.

Conclusion

No-interest financing at Home Depot is an excellent opportunity to enhance your home without incurring additional costs. By understanding the terms and conditions, planning your purchases carefully, and paying off the balance within the promotional period, you can save money and improve your financial well-being.

We encourage you to share this article with others who might benefit from it and leave a comment below with your thoughts or questions. For more informative content on home improvement and finance, explore our other articles on the website.

Data Source: Home Depot Official Website