Insurance is a critical part of financial planning, and getting a GEICO insurance quote is an essential step toward securing your future. Whether you're looking for car insurance, home insurance, or other coverage, GEICO offers competitive rates and reliable service. In this article, we'll delve into everything you need to know about obtaining a GEICO insurance quote, ensuring you make informed decisions.

Insurance plays a vital role in safeguarding your assets, and GEICO has established itself as one of the leading providers in the industry. With decades of experience and a commitment to customer satisfaction, GEICO offers personalized policies that cater to individual needs. Understanding how to get a GEICO insurance quote can help you save money while ensuring you're adequately covered.

This article will guide you through the process of obtaining a GEICO insurance quote, highlighting key factors to consider, tips for saving money, and insights into the company's offerings. Whether you're a first-time policyholder or looking to switch providers, this comprehensive guide has everything you need to know.

Read also:Best Foundation For Combination Skin A Comprehensive Guide To Flawless Complexion

Table of Contents

- About GEICO

- Why Choose GEICO?

- How to Get a GEICO Insurance Quote

- Types of Insurance Offered by GEICO

- Factors Affecting Your GEICO Insurance Quote

- Tips to Save Money on Your GEICO Insurance

- GEICO Customer Service

- Common Questions About GEICO Insurance

- Comparison with Other Insurance Providers

- Conclusion

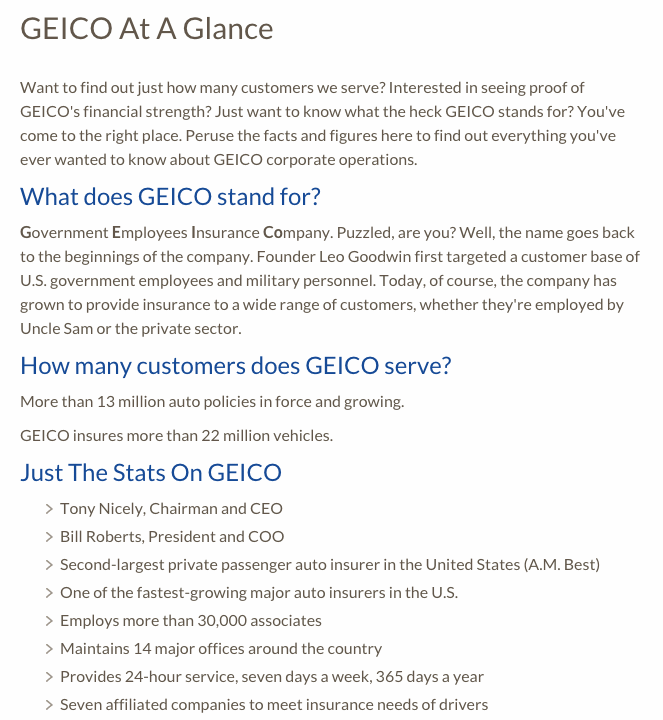

About GEICO

GEICO, which stands for Government Employees Insurance Company, was founded in 1936 and has since grown into one of the largest auto insurance providers in the United States. The company initially offered policies exclusively to government employees but expanded its services to the general public in the 1950s. Today, GEICO serves millions of customers across the country, offering a wide range of insurance products.

GEICO is renowned for its competitive pricing, exceptional customer service, and innovative solutions. The company consistently ranks high in customer satisfaction surveys and has received numerous awards for its commitment to quality.

History of GEICO

GEICO's journey began with a vision to provide affordable insurance to government employees. Over the decades, the company has evolved, adapting to changing market dynamics while maintaining its core values of affordability and reliability. Its acquisition by Berkshire Hathaway in 1995 further solidified its position as a leading insurance provider.

Why Choose GEICO?

When considering insurance options, it's essential to evaluate what makes a provider stand out. GEICO offers several advantages that make it an attractive choice for many consumers:

- Competitive Pricing: GEICO is known for offering some of the lowest rates in the industry, making it accessible to a wide range of customers.

- Excellent Customer Service: GEICO provides 24/7 customer support, ensuring you have access to assistance whenever you need it.

- Variety of Coverage Options: From auto insurance to home insurance, GEICO offers comprehensive coverage tailored to individual needs.

- Convenient Online Tools: GEICO's user-friendly website and mobile app make it easy to manage your policy, file claims, and obtain a GEICO insurance quote.

How to Get a GEICO Insurance Quote

Obtaining a GEICO insurance quote is a straightforward process that can be done online, over the phone, or in person. Here's a step-by-step guide to help you get started:

Step 1: Visit the GEICO Website

To get a GEICO insurance quote online, visit the official GEICO website and navigate to the "Get a Quote" section. You'll be prompted to enter basic information such as your zip code, vehicle details, and driver information.

Read also:Why Is Missouri Called A Spelunkers Paradise

Step 2: Provide Vehicle Information

When obtaining a car insurance quote, you'll need to provide details about your vehicle, including the make, model, year, and VIN (Vehicle Identification Number). This information helps GEICO assess risk and determine your premium.

Step 3: Enter Driver Information

GEICO will ask for details about the primary driver, including age, driving history, and credit score (if applicable). Additional drivers can also be added to the policy during this step.

Step 4: Review Coverage Options

Once you've entered all necessary information, you'll have the opportunity to review and customize your coverage options. GEICO offers a variety of policies, including liability, collision, comprehensive, and more.

Types of Insurance Offered by GEICO

GEICO provides a wide range of insurance products to meet the diverse needs of its customers. Here are some of the most popular types of insurance offered by GEICO:

- Auto Insurance: GEICO's flagship product, offering coverage for cars, motorcycles, and other vehicles.

- Homeowners Insurance: Protect your home and belongings with comprehensive coverage tailored to your needs.

- Renter's Insurance: Ideal for individuals renting apartments or houses, GEICO's renter's insurance covers personal property and liability.

- Life Insurance: Secure your loved ones' future with affordable life insurance policies from GEICO.

Factors Affecting Your GEICO Insurance Quote

Several factors influence the cost of your GEICO insurance quote. Understanding these factors can help you make informed decisions and potentially lower your premiums:

- Location: Where you live can significantly impact your insurance rates. Urban areas tend to have higher premiums due to increased risk of accidents and theft.

- Driving Record: A clean driving record can lead to lower premiums, while accidents or traffic violations may increase your rates.

- Coverage Level: The type and amount of coverage you choose will directly affect your premium. Opting for higher deductibles can reduce costs.

- Credit Score: In some states, credit history is used as a factor in determining insurance rates. Maintaining a good credit score can result in lower premiums.

Tips to Save Money on Your GEICO Insurance

While GEICO offers competitive rates, there are additional steps you can take to save money on your insurance:

Bundle Policies

GEICO often provides discounts for bundling multiple policies, such as auto and homeowners insurance. Combining policies under one provider can lead to significant savings.

Take Advantage of Discounts

GEICO offers various discounts, including safe driver discounts, military discounts, and multi-car discounts. Ensure you're eligible for these savings and apply them to your policy.

Improve Your Driving Record

Maintaining a clean driving record can lead to lower premiums. Avoid traffic violations and consider taking defensive driving courses to qualify for additional discounts.

GEICO Customer Service

GEICO prides itself on providing exceptional customer service. Whether you need assistance with obtaining a GEICO insurance quote or filing a claim, their dedicated team is available 24/7 to help. GEICO's customer service is consistently rated highly by consumers, making it a reliable choice for insurance needs.

Contacting GEICO

You can reach GEICO through their website, phone, or in-person at one of their local offices. Their customer service representatives are trained to assist with a wide range of inquiries, ensuring you receive the support you need.

Common Questions About GEICO Insurance

Here are answers to some frequently asked questions about GEICO insurance:

How Long Does It Take to Get a GEICO Insurance Quote?

Obtaining a GEICO insurance quote typically takes just a few minutes. The process is quick and convenient, whether you're doing it online or over the phone.

Can I Change My Policy After Getting a Quote?

Yes, you can modify your policy at any time. GEICO allows customers to update their coverage options, add or remove vehicles, and make other changes as needed.

What Happens If I Miss a Payment?

If you miss a payment, GEICO will notify you and provide options for resolving the issue. It's important to address missed payments promptly to avoid policy cancellation.

Comparison with Other Insurance Providers

When evaluating insurance providers, it's essential to compare their offerings. While GEICO is known for its competitive pricing and excellent service, other providers may offer unique benefits. Consider factors such as coverage options, discounts, and customer service when making your decision.

GEICO vs. State Farm

Both GEICO and State Farm are leading insurance providers, but they differ in certain areas. GEICO generally offers lower rates, while State Farm may provide more extensive coverage options in certain regions.

Conclusion

Getting a GEICO insurance quote is a simple and effective way to protect your assets and ensure peace of mind. With competitive pricing, excellent customer service, and a wide range of coverage options, GEICO stands out as a top choice for insurance needs. By following the tips and insights provided in this article, you can make informed decisions and potentially save money on your policy.

We encourage you to share your experiences with GEICO in the comments below and explore other articles on our site for more valuable information. Remember, securing your future starts with a single step—get your GEICO insurance quote today!

Data Source: GEICO Official Website