Home Depot 24 months financing offers an incredible opportunity for homeowners and DIY enthusiasts to upgrade their spaces without breaking the bank. Whether you're remodeling your kitchen, replacing old appliances, or enhancing your outdoor living area, understanding Home Depot's financing options can help you make smarter financial decisions. This article delves deep into the benefits, terms, and conditions of Home Depot's 24-month financing plan, helping you maximize its value.

Home Depot has long been a trusted name in home improvement and construction supplies. With its expansive range of products and services, it caters to both professional contractors and everyday homeowners. The company's commitment to offering flexible payment solutions ensures that customers can invest in their homes without worrying about upfront costs.

In this comprehensive guide, we'll explore how Home Depot's 24-month financing works, its eligibility criteria, potential savings, and important considerations before signing up. By the end of this article, you'll have all the information you need to decide if this financing option is right for your next home improvement project.

Read also:Jr Ridinger Cause Of Death A Comprehensive Exploration

Table of Contents

- Introduction to Home Depot 24 Months Financing

- Eligibility Criteria for Home Depot Financing

- Benefits of Home Depot 24 Months Financing

- How Home Depot 24 Months Financing Works

- Potential Savings with Home Depot Financing

- Terms and Conditions of Home Depot Financing

- Comparing Home Depot Financing to Other Options

- Tips for Maximizing Home Depot Financing

- Frequently Asked Questions About Home Depot Financing

- Conclusion and Next Steps

Introduction to Home Depot 24 Months Financing

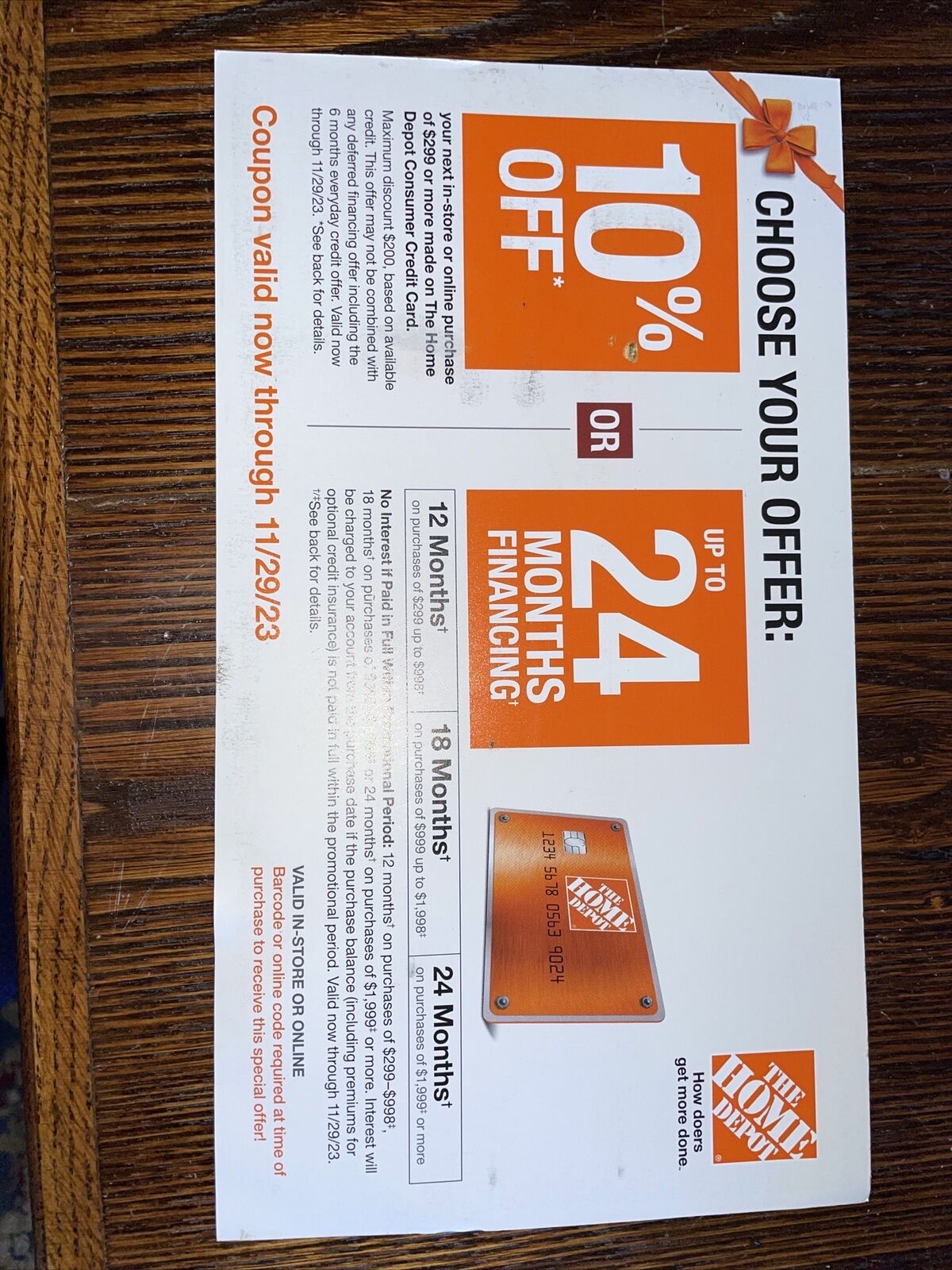

Home Depot's 24 months financing option is a no-interest payment plan designed to make large home improvement purchases more affordable. This special financing offer allows customers to spread out payments over two years without accruing interest, provided the balance is paid in full within the promotional period. It's an excellent choice for those planning significant upgrades or renovations.

One of the standout features of this financing option is its accessibility. Customers can apply for the plan at the point of purchase, either in-store or online. Upon approval, they can immediately use the financing to cover eligible purchases. This convenience makes it a popular choice among Home Depot shoppers.

Understanding the Basics

Home Depot's financing program is available through a partnership with Synchrony Bank, a leading provider of consumer credit solutions. The program offers competitive terms and conditions, ensuring transparency and fairness for all users. Below are some key points to consider:

- Zero-interest financing for 24 months on eligible purchases.

- Flexible repayment options to suit individual budgets.

- Eligibility based on creditworthiness and financial history.

- Wide range of products covered under the financing plan.

Eligibility Criteria for Home Depot Financing

To qualify for Home Depot's 24 months financing, customers must meet specific eligibility criteria. These requirements ensure that only responsible borrowers with strong financial standing can access the program. Below are the primary factors considered during the application process:

Credit Score Requirements

A good credit score is essential for approval. While Home Depot does not publicly disclose the exact minimum score needed, applicants with scores above 680 generally have a higher chance of being approved. Additionally, factors such as credit history, debt-to-income ratio, and existing financial obligations are evaluated.

Important Note: Even if you don't meet the initial criteria, Home Depot may offer alternative financing options, such as shorter promotional periods or reduced interest rates.

Read also:Morristown Tn Dining A Comprehensive Guide To The Best Restaurants And Culinary Experiences

Benefits of Home Depot 24 Months Financing

Home Depot's 24 months financing plan comes with numerous advantages that make it an attractive option for home improvement projects. Here are some of the key benefits:

1. No Interest for 24 Months

Perhaps the most significant advantage is the ability to defer interest payments for two years. This allows customers to budget their expenses more effectively and avoid unnecessary financial strain.

2. Wide Range of Eligible Products

From appliances and furniture to tools and building materials, Home Depot's financing covers a broad spectrum of products. This versatility ensures that customers can find everything they need for their projects in one place.

3. Convenient Application Process

Applying for Home Depot financing is quick and straightforward. Customers can complete the application in minutes, either in-store or online, and receive an instant decision.

How Home Depot 24 Months Financing Works

Understanding how Home Depot's financing plan operates is crucial for making the most of its benefits. Here's a step-by-step guide to the process:

Step 1: Select Eligible Products

Begin by choosing the products you wish to purchase. Ensure that they qualify for the 24 months financing plan, as not all items in the store are eligible.

Step 2: Apply for Financing

Complete the application form, either online or in-store. You'll need to provide basic personal and financial information to proceed.

Step 3: Receive Approval

Once your application is processed, you'll receive an instant decision. If approved, you can use the financing immediately to complete your purchase.

Step 4: Make Monthly Payments

Set up a payment schedule that works for you. Remember, to avoid interest charges, the entire balance must be paid off within the 24-month promotional period.

Potential Savings with Home Depot Financing

Home Depot's 24 months financing can result in substantial savings for customers. By eliminating interest charges for two years, you can save hundreds or even thousands of dollars on large purchases. For example, financing a $5,000 kitchen remodel at 0% interest could save you approximately $1,000 compared to a traditional loan with a 20% interest rate.

Calculating Your Savings

To estimate your potential savings, consider the following factors:

- Total purchase amount.

- Standard interest rates for similar loans.

- Monthly payment schedule.

Using these inputs, you can calculate the difference between paying interest and taking advantage of Home Depot's financing plan.

Terms and Conditions of Home Depot Financing

Before signing up for Home Depot's 24 months financing, it's essential to review the terms and conditions carefully. Below are some key points to keep in mind:

1. Promotional Period

The 24-month promotional period begins on the date of purchase. If the balance is not paid in full by the end of this period, interest charges will be applied retroactively to the original purchase amount.

2. Minimum Monthly Payments

Customers are required to make minimum monthly payments during the promotional period. Failure to do so may result in additional fees or penalties.

3. Eligible Products

Not all products in Home Depot stores qualify for the financing plan. Be sure to check the eligibility status of each item before finalizing your purchase.

Comparing Home Depot Financing to Other Options

While Home Depot's 24 months financing is an excellent option, it's worth comparing it to other financing solutions. Below is a brief overview of alternative choices:

1. Credit Cards

Credit cards often come with high interest rates, making them less favorable for large purchases. However, they offer flexibility and rewards programs that can offset some costs.

2. Personal Loans

Personal loans typically have lower interest rates than credit cards but require a more rigorous application process. They may also have stricter repayment terms than Home Depot's financing plan.

3. Home Equity Loans

Home equity loans allow homeowners to borrow against the value of their property. While they offer competitive interest rates, they involve more risk and complexity.

Tips for Maximizing Home Depot Financing

To get the most out of Home Depot's 24 months financing, consider the following tips:

1. Create a Payment Plan

Set up a detailed payment schedule to ensure you pay off the balance within the promotional period. Use automatic payments to avoid missed deadlines.

2. Stay Within Budget

Only purchase what you can comfortably afford to repay within 24 months. Avoid overspending to maintain financial stability.

3. Monitor Your Account

Regularly check your account statements to track your progress and ensure all payments are processed correctly.

Frequently Asked Questions About Home Depot Financing

Q1: Can I combine multiple purchases under one financing plan?

Yes, you can combine eligible purchases into a single financing plan. However, all items must qualify for the 24 months financing option.

Q2: What happens if I don't pay off the balance within 24 months?

If the balance is not paid in full by the end of the promotional period, interest charges will be applied retroactively to the original purchase amount.

Q3: Is there an annual fee for Home Depot financing?

No, Home Depot does not charge an annual fee for its financing plans. However, late payment fees may apply if minimum payments are missed.

Conclusion and Next Steps

Home Depot's 24 months financing offers a valuable opportunity for homeowners and DIY enthusiasts to upgrade their spaces without incurring immediate costs. By understanding the eligibility criteria, terms, and benefits of this financing option, you can make informed decisions about your next home improvement project.

We encourage you to take action by exploring Home Depot's financing plans and planning your purchases accordingly. Don't forget to share your thoughts in the comments section below or explore other articles on our website for more insights into home improvement and financial planning.

Disclaimer: The information provided in this article is based on publicly available data and should not be considered financial advice. Always consult with a professional before making significant financial decisions.