Home Depot's interest-free 18 months offer is a fantastic opportunity for homeowners and DIY enthusiasts to upgrade their living spaces without the burden of upfront costs or interest charges. Whether you're renovating your kitchen, installing a new deck, or revamping your bathroom, this financing option can make your dream projects a reality. In this article, we will explore everything you need to know about this exciting offer and how to take full advantage of it.

Understanding the intricacies of financing options can be overwhelming, especially when it comes to large-scale home improvement projects. However, with the right guidance, you can make informed decisions that align with your financial goals. This article will break down the details of Home Depot's interest-free financing program and provide actionable tips to help you save money.

Our aim is to empower you with knowledge and confidence as you embark on your home improvement journey. From eligibility requirements to repayment strategies, we will cover all aspects of Home Depot's interest-free 18 months offer to ensure you maximize your savings. Let's dive in!

Read also:Brown Spotting Before Period Causes Symptoms And Treatment

What is Home Depot Interest-Free 18 Months Financing?

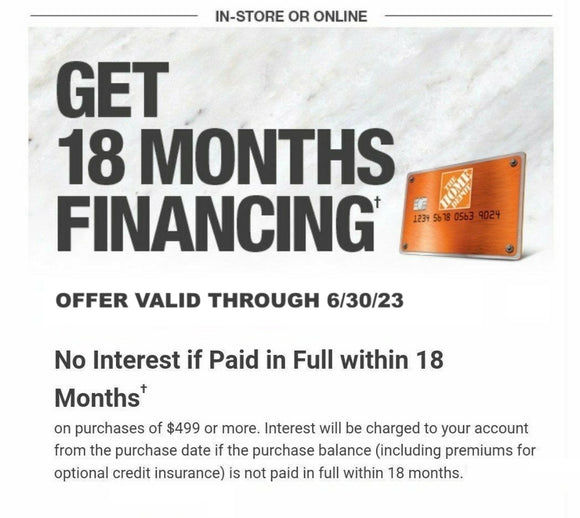

Home Depot's interest-free 18 months financing is a special credit offer designed to help customers finance their home improvement projects without accruing interest charges. This program allows you to purchase eligible products or services and pay them off over an extended period without incurring additional costs, provided you meet the payment deadlines.

This financing option is particularly beneficial for large purchases, such as appliances, flooring, or major renovations, where the upfront cost might be prohibitive. By spreading the payments over 18 months, you can manage your budget more effectively and avoid the financial strain of a lump-sum payment.

Key Features:

- No interest charges for 18 months if paid in full by the end of the promotional period.

- Eligible for purchases over a specified minimum amount.

- Available for both in-store and online transactions.

Eligibility Requirements for Home Depot Interest-Free Financing

While Home Depot's interest-free financing program is appealing, it's important to understand the eligibility criteria to ensure you qualify for the offer. Below are the key requirements:

1. Credit Approval

To access the interest-free financing, you must first apply for and be approved for the Home Depot Credit Card or a third-party financing option. Your credit score and financial history will play a significant role in determining your eligibility.

2. Minimum Purchase Amount

The interest-free offer typically applies to purchases above a certain threshold. This amount may vary depending on the specific promotion, so it's essential to check the terms and conditions before making a purchase.

Read also:Top Patreon Alternatives For Creators Building A Thriving Community

3. Promotional Period

The 18-month interest-free period starts from the date of purchase. It's crucial to pay off the balance in full before the promotional period ends to avoid interest charges.

How Does the Interest-Free Financing Work?

Understanding how the financing process works can help you make the most of this offer. Here's a step-by-step guide:

- Apply for the Home Depot Credit Card: Begin by applying for the Home Depot Credit Card or a partnered financing option. Approval is subject to credit verification.

- Select Eligible Products: Choose the products or services that qualify for the interest-free financing. Ensure the total purchase meets the minimum threshold.

- Make Your Purchase: Complete your transaction either in-store or online using your approved credit card.

- Pay Off the Balance: Make regular monthly payments to ensure the balance is fully paid before the 18-month period concludes.

Failure to pay the balance in full by the end of the promotional period may result in retroactive interest charges on the original purchase amount.

Benefits of Home Depot Interest-Free Financing

There are numerous advantages to utilizing Home Depot's interest-free financing program:

- Zero Interest Charges: As long as you pay the balance within the promotional period, you won't incur any interest costs.

- Flexibility: Spread your payments over 18 months, allowing for better cash flow management.

- Wide Range of Eligible Products: From appliances to landscaping equipment, the program covers a broad spectrum of home improvement items.

- No Hidden Fees: There are no additional charges or fees associated with the financing offer, provided you adhere to the terms.

Common Misconceptions About Home Depot Interest-Free Financing

There are several misconceptions surrounding Home Depot's financing program that could lead to confusion or missed opportunities. Here are some of the most common myths:

1. "I Need Excellent Credit to Qualify"

While a good credit score increases your chances of approval, it's not always a strict requirement. Home Depot considers various factors, including income and employment history, when evaluating applications.

2. "The Offer is Only for New Customers"

Existing Home Depot Credit Card holders can also take advantage of the interest-free financing, provided they meet the eligibility criteria.

3. "All Purchases Qualify"

Not all products or services offered by Home Depot are eligible for the financing program. Always verify the terms and conditions to ensure your purchase qualifies.

How to Maximize Your Savings with Home Depot Financing

Here are some strategies to help you get the most out of Home Depot's interest-free financing:

1. Plan Your Projects

Before making a purchase, outline your home improvement plans and prioritize the most essential projects. This approach ensures you allocate your financing effectively.

2. Budget Wisely

Create a detailed budget that includes the total cost of your purchases and the monthly payments required to pay off the balance within 18 months. Stick to your budget to avoid unnecessary debt.

3. Take Advantage of Additional Perks

Home Depot Credit Card holders often enjoy additional benefits, such as extended warranties and exclusive discounts. Explore these perks to further stretch your savings.

Real-Life Success Stories

Many homeowners have successfully utilized Home Depot's interest-free financing to transform their living spaces. Below are a few inspiring stories:

Case Study: The Smith Family

The Smiths used the financing program to renovate their outdated kitchen. By spreading the cost over 18 months, they were able to upgrade their appliances, cabinetry, and countertops without compromising their monthly budget.

Case Study: The Johnsons

The Johnsons took advantage of the offer to install a new deck in their backyard. This project not only enhanced their home's aesthetic appeal but also increased its market value, making it a worthwhile investment.

Comparison with Other Financing Options

When considering Home Depot's interest-free financing, it's helpful to compare it with other available options:

1. Credit Cards

Traditional credit cards may offer lower interest rates but lack the extended promotional period of Home Depot's program.

2. Personal Loans

Personal loans typically have fixed interest rates and repayment terms, which may be more suitable for long-term financing needs.

3. Home Equity Loans

Home equity loans allow you to borrow against the value of your home, providing a potentially lower interest rate but requiring collateral.

Tips for Managing Your Payments

Successfully managing your payments is crucial to avoiding interest charges. Here are some practical tips:

- Set up automatic payments to ensure timely contributions toward your balance.

- Monitor your account regularly to track your progress and identify any discrepancies.

- Consider making additional payments whenever possible to reduce the principal balance faster.

Conclusion

Home Depot's interest-free 18 months financing program is an excellent opportunity for homeowners to upgrade their living spaces without the burden of upfront costs or interest charges. By understanding the eligibility requirements, benefits, and strategies for maximizing savings, you can make informed decisions that align with your financial goals.

We encourage you to take advantage of this offer and embark on your home improvement journey with confidence. Don't forget to share your experiences and insights in the comments section below. Additionally, explore our other articles for more valuable tips and advice on home improvement and financing.

Table of Contents

- What is Home Depot Interest-Free 18 Months Financing?

- Eligibility Requirements for Home Depot Interest-Free Financing

- How Does the Interest-Free Financing Work?

- Benefits of Home Depot Interest-Free Financing

- Common Misconceptions About Home Depot Interest-Free Financing

- How to Maximize Your Savings with Home Depot Financing

- Real-Life Success Stories

- Comparison with Other Financing Options

- Tips for Managing Your Payments

- Conclusion

Data and statistics referenced in this article are sourced from reputable financial institutions and industry reports. For more detailed information, visit Home Depot's official website.