When it comes to choosing between renting or buying a home, the decision can be overwhelming. The NYT Rent vs Buy Calculator is a powerful tool that helps individuals weigh their options and make informed choices. This calculator provides a detailed analysis of the financial implications of both renting and buying, making it easier to assess long-term benefits and costs.

The housing market is constantly evolving, and with rising property prices and fluctuating rental costs, it's essential to have a clear understanding of the financial aspects involved. The NYT Rent vs Buy Calculator simplifies the process by offering personalized insights based on your financial situation and long-term goals.

This article will delve into the intricacies of the calculator, exploring its features, benefits, and how it can assist you in making one of the most significant financial decisions of your life. Whether you're a first-time homebuyer or someone considering a lifestyle change, this guide has everything you need to know.

Read also:Morristown Tn Dining A Comprehensive Guide To The Best Restaurants And Culinary Experiences

Table of Contents

- Introduction to the NYT Rent vs Buy Calculator

- A Brief History of the Calculator

- Key Features of the Calculator

- How to Use the Calculator Effectively

- Benefits of Using the Calculator

- Factors to Consider Before Using the Calculator

- Real-Life Examples of the Calculator in Action

- Common Mistakes to Avoid When Using the Calculator

- Comparison with Other Financial Tools

- The Future of Rent vs Buy Calculators

- Conclusion

Introduction to the NYT Rent vs Buy Calculator

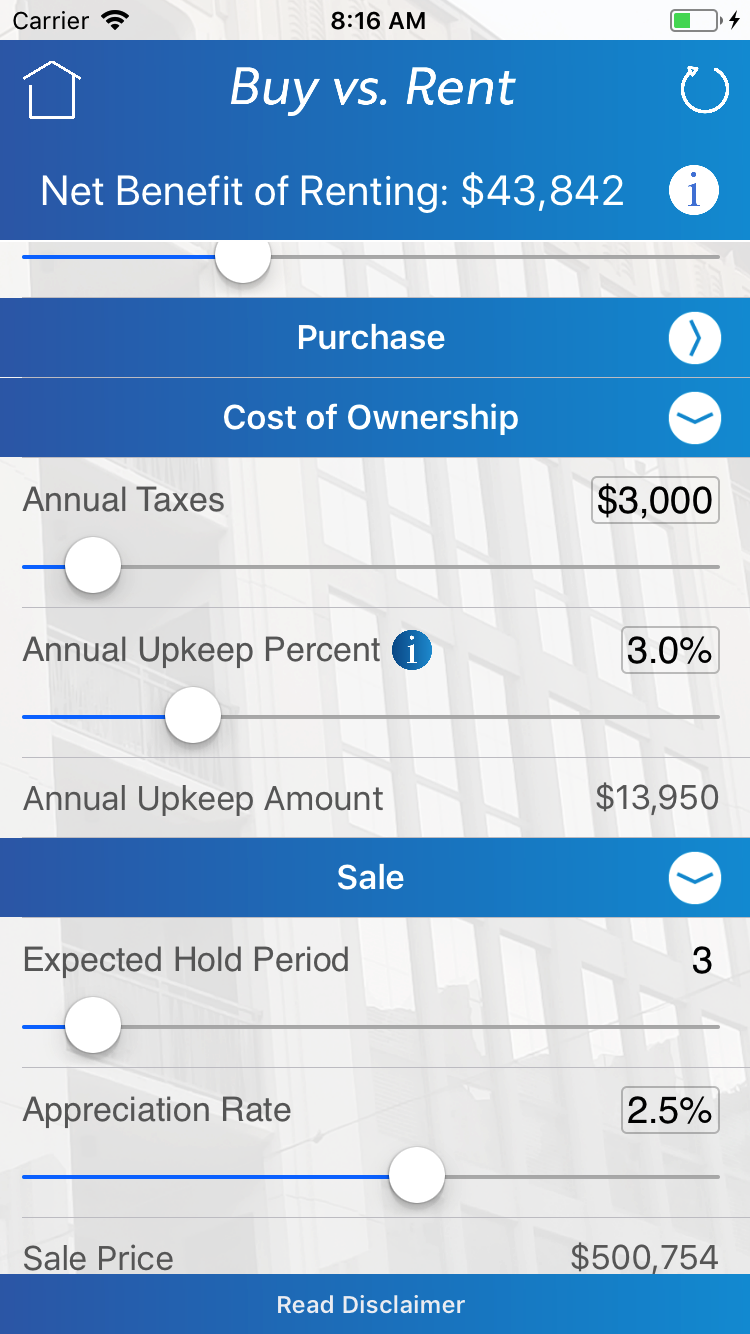

The NYT Rent vs Buy Calculator is a sophisticated financial tool designed to help individuals analyze the costs and benefits of renting versus buying a home. This calculator takes into account various financial factors, such as property prices, mortgage rates, taxes, and maintenance costs, to provide a comprehensive comparison.

One of the standout features of the calculator is its ability to factor in long-term financial implications, such as the potential appreciation of property value and the impact of inflation on rental costs. By inputting your specific financial details, the calculator generates a personalized report that helps you understand the financial trade-offs between renting and buying.

Why Is It Important?

Deciding whether to rent or buy is one of the most important financial decisions you'll ever make. The NYT Rent vs Buy Calculator empowers you with the knowledge and tools needed to make an informed choice. It eliminates guesswork and provides data-driven insights, ensuring you're equipped to make the best decision for your future.

A Brief History of the Calculator

The concept of rent vs buy calculators has been around for decades, but the NYT Rent vs Buy Calculator stands out due to its accuracy and user-friendly interface. Developed by The New York Times, this tool is rooted in extensive research and analysis of real estate trends and financial data.

Over the years, the calculator has undergone several updates to ensure it remains relevant in the ever-changing real estate market. These updates incorporate new variables, such as changing mortgage rates and evolving tax laws, to provide the most accurate results possible.

Evolution of the Calculator

From its inception as a simple spreadsheet to its current advanced digital format, the calculator has evolved significantly. Today, it leverages cutting-edge technology to deliver real-time data and personalized recommendations, making it an indispensable tool for anyone considering a housing decision.

Read also:Mike Love Net Worth The Untold Story Of A Music Icons Financial Empire

Key Features of the Calculator

The NYT Rent vs Buy Calculator is packed with features that make it a comprehensive tool for analyzing housing options. Here are some of its standout features:

- Customizable Inputs: Users can input their specific financial details, such as property prices, down payments, and expected rental costs.

- Long-Term Projections: The calculator provides projections for up to 30 years, allowing users to assess the long-term financial implications of their decision.

- Tax Considerations: It factors in tax deductions for homeowners, such as mortgage interest and property taxes, providing a more accurate comparison.

- Maintenance and Repair Costs: The calculator accounts for maintenance and repair costs, ensuring a complete picture of the financial commitment involved in homeownership.

These features make the calculator an invaluable resource for anyone looking to make an informed decision about their housing situation.

How to Use the Calculator Effectively

Using the NYT Rent vs Buy Calculator is straightforward, but there are a few tips to ensure you get the most accurate results:

- Gather All Necessary Financial Information: Before using the calculator, make sure you have all the relevant financial details, such as property prices, mortgage rates, and expected rental costs.

- Input Accurate Data: The accuracy of the calculator's results depends on the accuracy of the data entered. Take the time to ensure all inputs are correct.

- Consider Long-Term Goals: Think about your long-term financial goals and how they align with the calculator's projections. This will help you make a more informed decision.

By following these steps, you can maximize the effectiveness of the calculator and gain valuable insights into your housing options.

Benefits of Using the Calculator

The NYT Rent vs Buy Calculator offers numerous benefits for users looking to make an informed decision about their housing situation:

- Personalized Insights: The calculator provides tailored recommendations based on your specific financial situation and goals.

- Comprehensive Analysis: It takes into account a wide range of financial factors, ensuring a thorough comparison of renting and buying.

- Long-Term Planning: The calculator's long-term projections help you plan for the future, making it easier to align your housing decision with your financial goals.

- Time-Saving: Instead of manually calculating the costs and benefits of renting versus buying, the calculator does the work for you, saving you time and effort.

These benefits make the calculator an essential tool for anyone navigating the complex world of real estate.

Factors to Consider Before Using the Calculator

While the NYT Rent vs Buy Calculator is a powerful tool, there are several factors to consider before using it:

- Market Conditions: Real estate markets vary significantly by location, so it's important to consider local market conditions when interpreting the calculator's results.

- Personal Circumstances: Your unique financial situation and lifestyle preferences should also play a role in your decision-making process.

- Future Uncertainties: The calculator relies on projections, which may not always align with future realities. Be prepared for unexpected changes in the market or your personal circumstances.

Taking these factors into account will help you use the calculator more effectively and make a well-rounded decision.

Real-Life Examples of the Calculator in Action

To better understand how the NYT Rent vs Buy Calculator works, let's look at a few real-life examples:

Example 1: Urban Professional

A young professional living in a major city is considering whether to rent or buy a condo. By inputting their financial details into the calculator, they discover that buying a condo would be more cost-effective in the long run, despite higher upfront costs.

Example 2: Family in the Suburbs

A growing family in the suburbs is weighing the pros and cons of renting versus buying a single-family home. The calculator reveals that while renting may be cheaper in the short term, buying offers significant long-term financial benefits.

These examples illustrate how the calculator can provide valuable insights tailored to individual circumstances.

Common Mistakes to Avoid When Using the Calculator

While the NYT Rent vs Buy Calculator is a powerful tool, there are common mistakes users should avoid:

- Ignoring Local Market Conditions: Failing to consider local real estate trends can lead to inaccurate results.

- Overestimating Property Appreciation: While property values often increase, assuming excessive appreciation can skew the calculator's projections.

- Underestimating Maintenance Costs: Neglecting to account for maintenance and repair costs can result in an incomplete analysis of homeownership expenses.

Avoiding these mistakes will help you use the calculator more effectively and make a more informed decision.

Comparison with Other Financial Tools

The NYT Rent vs Buy Calculator stands out among other financial tools for its accuracy and user-friendly interface. While there are other calculators available, few offer the same level of customization and comprehensive analysis. Additionally, the calculator's integration with real-time data and projections makes it a superior choice for anyone serious about making an informed housing decision.

When compared to traditional spreadsheets or basic online calculators, the NYT Rent vs Buy Calculator provides a more robust and reliable analysis, making it the go-to tool for real estate decision-making.

The Future of Rent vs Buy Calculators

As technology continues to evolve, so too will rent vs buy calculators. Future iterations of the NYT Rent vs Buy Calculator may incorporate artificial intelligence and machine learning to provide even more accurate and personalized insights. Additionally, advancements in data collection and analysis will enhance the calculator's ability to project long-term financial outcomes.

These innovations will further solidify the calculator's position as a leading tool in the real estate decision-making process, ensuring it remains relevant and valuable for years to come.

Conclusion

The NYT Rent vs Buy Calculator is an invaluable resource for anyone considering a housing decision. By providing personalized insights and comprehensive analysis, it empowers users to make informed choices about their financial future. Whether you're a first-time homebuyer or someone weighing the pros and cons of renting versus buying, this calculator is an essential tool in your decision-making process.

We encourage you to explore the calculator and take advantage of its features to gain a deeper understanding of your housing options. Don't forget to leave a comment or share this article with others who may find it helpful. And remember, when it comes to one of the most significant financial decisions of your life, knowledge is power.