When it comes to making one of the most significant financial decisions of your life, the "rent vs buy calculator New York Times" can be an invaluable tool. Whether you're a first-time homebuyer or someone considering whether renting is the better option, understanding the nuances of this calculator is essential. This guide will walk you through everything you need to know about the New York Times rent vs buy calculator, helping you make an informed choice.

Buying a home is often seen as a symbol of stability and success. However, with rising property prices and fluctuating market conditions, renting has become an equally attractive option for many. The New York Times rent vs buy calculator provides a practical way to weigh the pros and cons of each choice, allowing you to make a decision that aligns with your financial goals.

In this article, we will explore the ins and outs of the rent vs buy calculator New York Times, including how it works, the factors it considers, and how you can use it effectively. By the end of this guide, you'll have a clear understanding of whether buying or renting is the right choice for you.

Read also:Discover The Allure Of Pop Melodie R34 A Comprehensive Guide

Understanding the Rent vs Buy Calculator New York Times

What is the Rent vs Buy Calculator?

The rent vs buy calculator New York Times is a financial tool designed to help individuals compare the costs of renting versus buying a home. It takes into account various factors, such as property prices, interest rates, maintenance costs, and potential appreciation, to provide a detailed analysis of the long-term financial implications of each option.

This calculator is particularly useful for those who are on the fence about whether to buy or rent. By inputting specific data related to your financial situation and housing preferences, you can get a clearer picture of which option is more financially viable for you.

Why Use the New York Times Rent vs Buy Calculator?

- It offers a comprehensive analysis of the financial aspects of buying versus renting.

- The calculator is user-friendly and allows you to input personalized data for accurate results.

- It considers a wide range of factors, including taxes, insurance, and market conditions, to provide a holistic view.

Using the New York Times rent vs buy calculator ensures that you have all the necessary information at your fingertips, empowering you to make a well-informed decision.

How Does the Rent vs Buy Calculator Work?

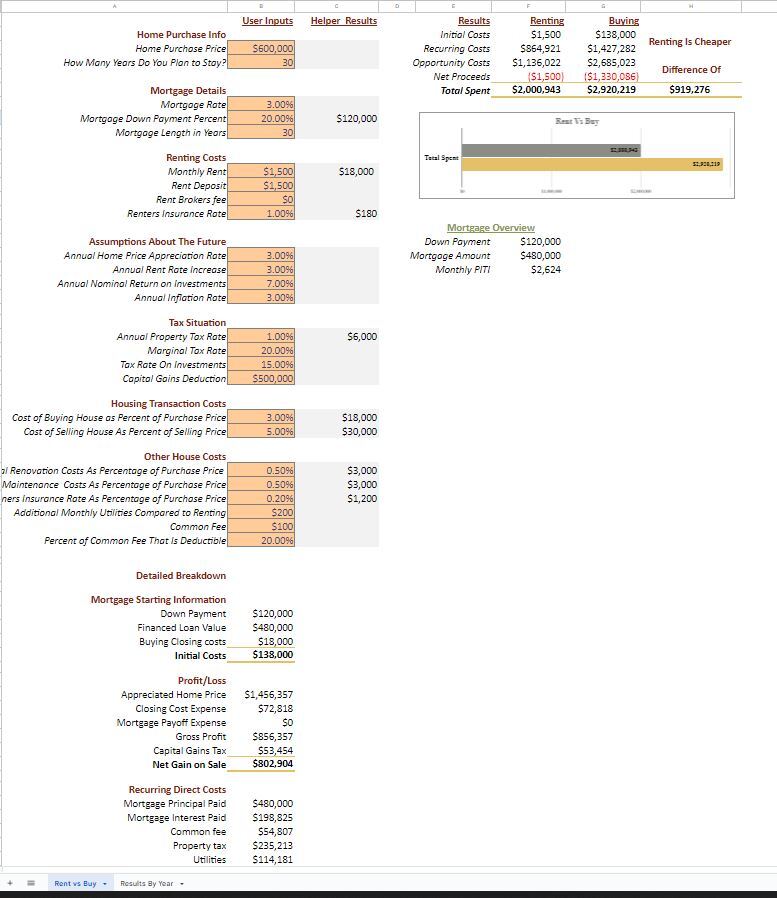

The New York Times rent vs buy calculator uses a series of inputs to calculate the total costs associated with buying and renting. Here's a breakdown of how it works:

- Purchase Price: Enter the estimated cost of the home you're considering purchasing.

- Down Payment: Input the amount you plan to put down as a down payment.

- Mortgage Rate: Enter the current interest rate for your mortgage.

- Rent: Input the monthly rent for a comparable property in the same area.

- Property Taxes and Insurance: Include the estimated costs of property taxes and homeowner's insurance.

- Appreciation Rate: Estimate the annual appreciation rate of the property.

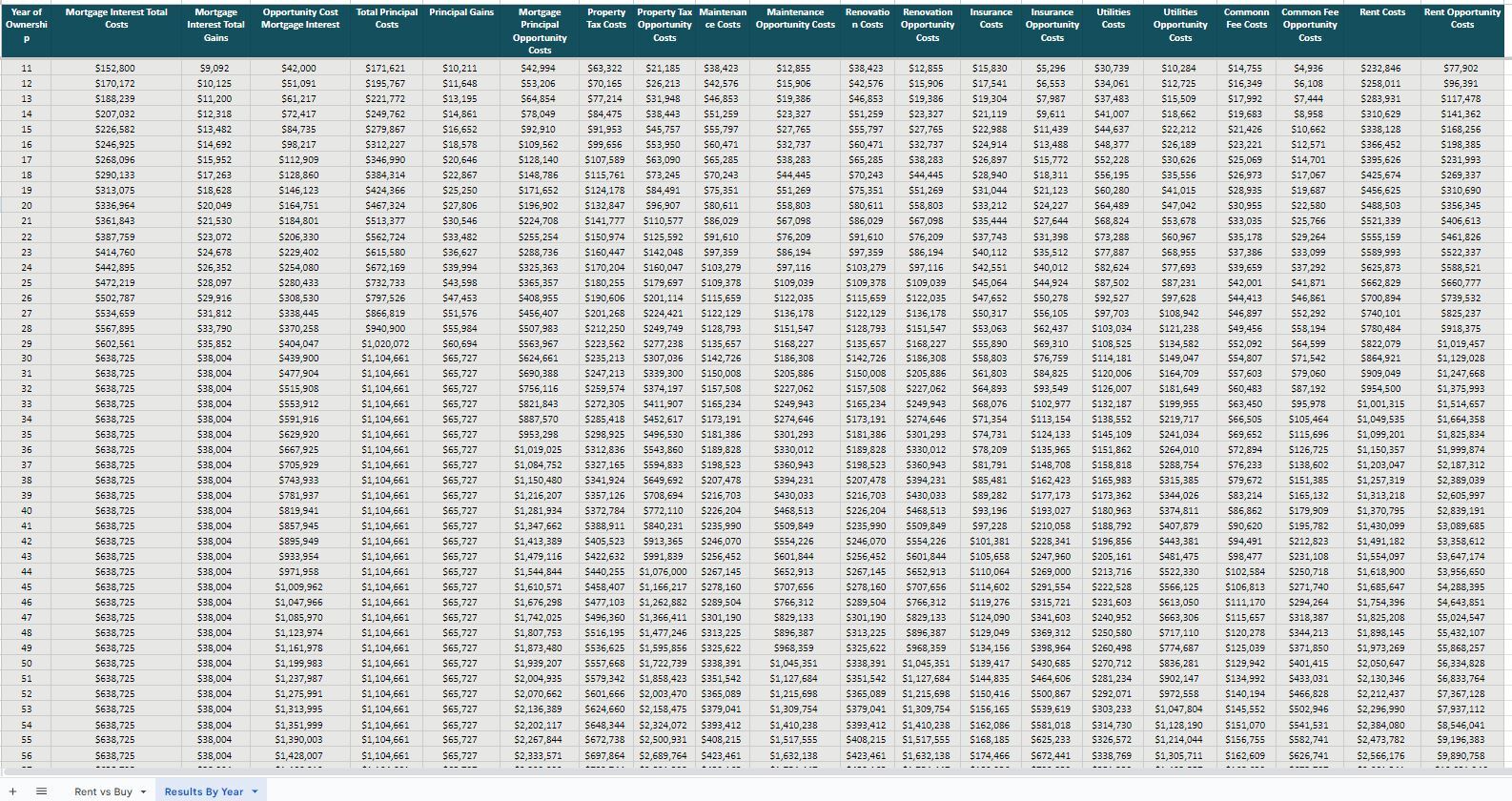

Once you've entered all the necessary data, the calculator will provide a detailed comparison of the costs associated with buying versus renting over a specified period.

Factors to Consider When Using the Calculator

1. Property Appreciation

Property appreciation refers to the increase in value of a home over time. While historical data suggests that property values tend to appreciate, this is not guaranteed. The New York Times rent vs buy calculator allows you to input an estimated appreciation rate, but it's important to remember that market conditions can vary significantly.

Read also:Best Foundation For Combination Skin A Comprehensive Guide To Flawless Complexion

2. Mortgage Interest Rates

Mortgage interest rates play a crucial role in determining the overall cost of buying a home. Lower interest rates can make buying more attractive, while higher rates may make renting a more viable option. The calculator takes into account the current interest rates to provide a more accurate comparison.

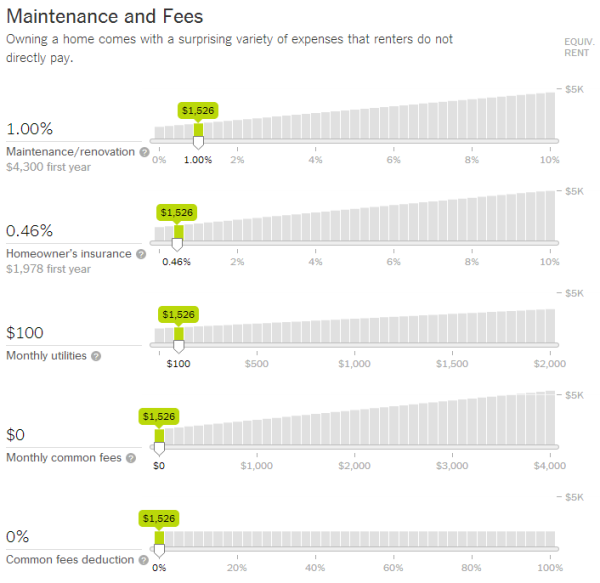

3. Maintenance and Repair Costs

Owning a home comes with additional costs, such as maintenance and repairs. These expenses can add up over time and should be factored into your decision-making process. The New York Times calculator includes an estimate for these costs, helping you get a more complete picture of the financial commitment involved in homeownership.

Advantages of Renting

Renting offers several advantages that may make it a more attractive option for some individuals:

- Flexibility: Renting provides the freedom to move more easily, which can be beneficial for those who frequently relocate for work or personal reasons.

- Lower Upfront Costs: Unlike buying, renting typically requires less upfront capital, making it a more accessible option for those with limited savings.

- No Maintenance Responsibility: Renters are generally not responsible for major repairs or maintenance, which can save both time and money.

While renting may not offer the same long-term financial benefits as buying, it can be a more practical choice for those who value flexibility and lower upfront costs.

Advantages of Buying

Buying a home also has its own set of advantages:

- Building Equity: As you pay down your mortgage, you build equity in your home, which can be a valuable asset in the future.

- Tax Benefits: Homeowners may be eligible for tax deductions on mortgage interest and property taxes, reducing their overall tax liability.

- Stability: Owning a home provides a sense of stability and permanence, which can be appealing for families or those who plan to stay in one place for an extended period.

While buying requires a significant financial commitment, the potential long-term benefits can make it a worthwhile investment for many.

Common Misconceptions About Rent vs Buy

1. Buying Always Saves Money

One common misconception is that buying a home always saves money compared to renting. While this may be true in some cases, it depends on various factors, such as property prices, interest rates, and market conditions. The New York Times rent vs buy calculator helps debunk this myth by providing a detailed comparison of the costs associated with each option.

2. Renting is a Waste of Money

Another misconception is that renting is a waste of money because it doesn't contribute to building equity. However, renting can be a smart financial decision for those who prefer flexibility or are unable to commit to the long-term financial obligations of homeownership.

3. The Market Always Goes Up

While historical data suggests that property values tend to appreciate over time, this is not guaranteed. The New York Times calculator allows you to input an estimated appreciation rate, but it's important to remember that market conditions can vary significantly.

Expert Tips for Using the Rent vs Buy Calculator

Here are some expert tips to help you get the most out of the New York Times rent vs buy calculator:

- Be Realistic: Input realistic data based on your financial situation and housing preferences to get accurate results.

- Consider Long-Term Goals: Think about your long-term financial goals and how they align with the decision to buy or rent.

- Consult a Financial Advisor: If you're unsure about which option is right for you, consider consulting a financial advisor for personalized advice.

Using the calculator in conjunction with expert advice can help you make a more informed decision about whether to buy or rent.

Data and Statistics Supporting the Calculator

According to data from the National Association of Realtors, the median existing-home price in the United States was $388,800 in 2022. Meanwhile, the average monthly rent for a two-bedroom apartment in major U.S. cities ranged from $2,000 to $4,000. These figures highlight the importance of using a tool like the New York Times rent vs buy calculator to compare the costs of buying versus renting in your specific area.

In addition, a study by Zillow found that homeowners who purchased a home in 2012 saw an average return on investment of 30% by 2022. While these figures are encouraging, it's important to remember that past performance is not indicative of future results.

Conclusion

The "rent vs buy calculator New York Times" is an invaluable tool for anyone considering whether to buy or rent a home. By taking into account a wide range of factors, including property prices, interest rates, and maintenance costs, the calculator provides a comprehensive analysis of the financial implications of each option.

In conclusion, the decision to buy or rent depends on your individual financial situation and long-term goals. By using the New York Times rent vs buy calculator and considering expert advice, you can make a well-informed decision that aligns with your needs and aspirations.

We invite you to share your thoughts and experiences in the comments below. If you found this article helpful, please consider sharing it with others who may benefit from the information. Additionally, feel free to explore other articles on our site for more insights into personal finance and real estate.

Table of Contents

- Understanding the Rent vs Buy Calculator New York Times

- How Does the Rent vs Buy Calculator Work?

- Factors to Consider When Using the Calculator

- Advantages of Renting

- Advantages of Buying

- Common Misconceptions About Rent vs Buy

- Expert Tips for Using the Rent vs Buy Calculator

- Data and Statistics Supporting the Calculator

- Conclusion