Deciding whether to rent or buy a home is one of the most significant financial decisions you'll ever make. The New York Times Rent vs Buy Calculator offers a powerful tool to help you weigh the pros and cons of each option. This decision goes beyond mere numbers; it affects your lifestyle, long-term financial stability, and future plans. Whether you're a first-time homebuyer or a seasoned renter, understanding the factors involved is crucial.

Buying a home has long been considered a cornerstone of the American Dream. However, with rising housing costs, fluctuating interest rates, and shifting economic conditions, the decision to buy or rent is more complex than ever. The NYT Rent vs Buy Calculator simplifies this process by providing a clear, data-driven analysis of your unique financial situation.

This article delves deep into the Rent vs Buy Calculator NYT, exploring its features, benefits, and how it can empower you to make informed decisions. Whether you're evaluating short-term needs or planning for the long haul, this guide will equip you with the knowledge to navigate the housing market confidently.

Read also:Monsters Inc Salamander Unveiling The Fascinating World Of Amphibian Stars

Table of Contents

- Introduction to Rent vs Buy Calculator NYT

- How the Calculator Works

- Key Features of the Calculator

- Financial Considerations When Renting vs Buying

- Long-Term Financial Impact

- Emotional and Lifestyle Factors

- Common Mistakes to Avoid

- Case Studies and Real-Life Examples

- Expert Advice on Renting vs Buying

- Conclusion and Next Steps

Introduction to Rent vs Buy Calculator NYT

The New York Times Rent vs Buy Calculator is a widely respected financial tool designed to help individuals and families evaluate the costs and benefits of renting versus buying a home. This calculator takes into account a variety of factors, including property prices, mortgage rates, rental costs, and potential appreciation of home value. By inputting your specific financial information, you can receive a detailed analysis that goes beyond simple comparisons.

Why Use the Rent vs Buy Calculator?

Using the NYT Rent vs Buy Calculator offers several advantages:

- It provides a personalized analysis based on your financial situation.

- It considers both short-term and long-term financial implications.

- It incorporates market data and economic trends to offer a more accurate assessment.

This tool is particularly useful for those who are unsure whether their current financial situation aligns better with renting or buying. It helps demystify the often-overwhelming process of evaluating housing options.

How the Calculator Works

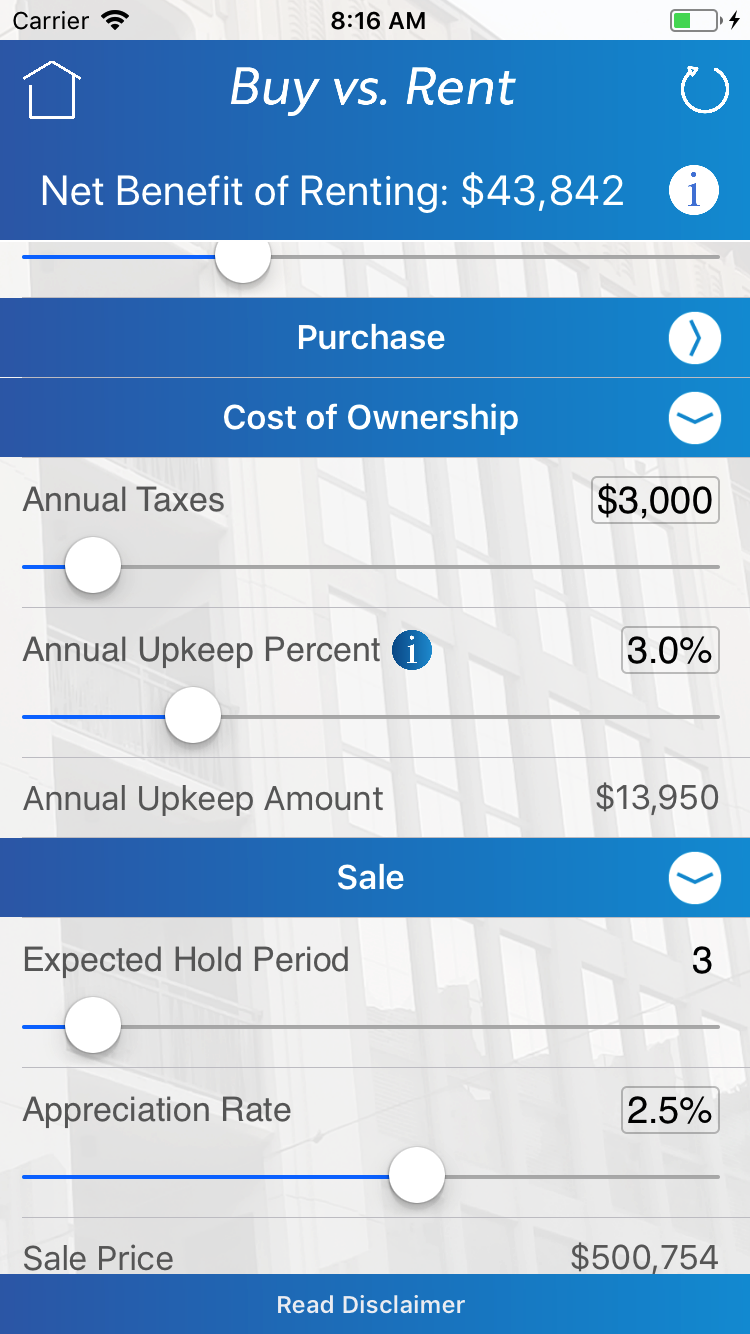

The Rent vs Buy Calculator NYT operates by gathering essential information from users, such as the cost of renting versus buying, expected home price appreciation, and the length of time you plan to stay in your home. It then calculates the financial impact of each option over the specified period.

Inputs Required

Here are some of the key inputs the calculator requires:

- Rental cost per month

- Purchase price of the home

- Down payment percentage

- Mortgage interest rate

- Expected annual home price appreciation

- Property taxes and insurance costs

By inputting these details, users can obtain a comprehensive breakdown of costs associated with both renting and buying, enabling them to make a more informed decision.

Read also:Anna Smrek Height Unveiling The Truth About This Iconic Model

Key Features of the Calculator

The NYT Rent vs Buy Calculator stands out due to its robust features, which cater to a wide range of users with varying financial needs. Below are some of its standout features:

1. Customizable Inputs

Users can adjust inputs to reflect their unique financial situations, ensuring the results are as accurate and personalized as possible.

2. Inclusion of Hidden Costs

The calculator accounts for hidden costs, such as maintenance fees, property taxes, and insurance premiums, which are often overlooked in traditional analyses.

3. Long-Term Projections

It provides projections for up to 30 years, helping users understand the long-term financial implications of their choice.

Financial Considerations When Renting vs Buying

When deciding between renting and buying, it's crucial to consider both immediate and long-term financial factors. Here are some key considerations:

Initial Costs

Buying a home typically involves significant upfront costs, including the down payment, closing costs, and moving expenses. Renting, on the other hand, usually requires only a security deposit and first month's rent, making it a more accessible option for those with limited savings.

Ongoing Expenses

Homeowners are responsible for maintenance, repairs, property taxes, and insurance, which can add up over time. Renters, however, typically only pay rent and utilities, with the landlord handling maintenance and repairs.

Long-Term Financial Impact

The long-term financial impact of renting versus buying can vary significantly depending on several factors:

Equity Building

Buying a home allows you to build equity over time, which can be a valuable asset in the future. Renting, however, does not provide this opportunity, as your monthly payments go directly to the landlord.

Market Conditions

Fluctuations in the housing market and interest rates can greatly affect the financial viability of buying a home. Understanding these dynamics is essential for making a sound decision.

Emotional and Lifestyle Factors

While financial considerations are paramount, emotional and lifestyle factors also play a significant role in the decision to rent or buy:

Flexibility

Renting offers greater flexibility, allowing you to move more easily if your job or personal circumstances change. Buying, on the other hand, ties you to a specific location for a longer period.

Stability

For those seeking stability and a sense of permanence, buying a home can be highly appealing. It offers a place to settle down and create lasting memories.

Common Mistakes to Avoid

When using the Rent vs Buy Calculator NYT, it's important to avoid common pitfalls that could skew your results:

Underestimating Costs

Many users underestimate ongoing costs such as maintenance and property taxes, which can significantly impact the overall cost of homeownership.

Ignoring Market Trends

Failing to account for market trends and economic conditions can lead to inaccurate projections and poor financial decisions.

Case Studies and Real-Life Examples

To better illustrate the Rent vs Buy Calculator's effectiveness, consider the following case studies:

Case Study 1: Urban Professional

A young professional living in a major city compares renting a one-bedroom apartment to buying a condominium. The calculator reveals that buying offers greater long-term financial benefits, despite higher upfront costs.

Case Study 2: Growing Family

A family of four evaluates the costs of renting a house versus buying one in the suburbs. The calculator shows that buying aligns better with their long-term goals and financial stability.

Expert Advice on Renting vs Buying

Financial experts recommend several strategies when using the Rent vs Buy Calculator NYT:

Consult a Financial Advisor

For complex financial situations, consulting a professional can provide additional insights and guidance.

Stay Informed

Keep up with housing market trends and economic news to make the most informed decision possible.

Conclusion and Next Steps

The Rent vs Buy Calculator NYT is an invaluable tool for anyone weighing the pros and cons of renting versus buying a home. By considering both financial and emotional factors, you can make a decision that aligns with your long-term goals and aspirations.

We encourage you to use the calculator and explore additional resources on our website to further enhance your understanding of the housing market. Don't forget to share your thoughts and experiences in the comments section below, and consider exploring other articles for more insights into personal finance.