When tax season rolls around, many individuals are on the lookout for affordable or free solutions to file their taxes. One popular name in the tax preparation space is TaxSlayer. But is TaxSlayer free? This article dives deep into the services offered by TaxSlayer, helping you understand whether it's the right choice for your needs.

TaxSlayer has become a household name in the world of tax preparation software. Many users are curious about its offerings, especially its free services. Understanding the nuances of "is TaxSlayer free" can help you make an informed decision about which tax preparation service to choose.

In this article, we'll explore the ins and outs of TaxSlayer's free offerings, its premium features, and how it compares to other tax software in the market. By the end of this guide, you'll have a clear picture of whether TaxSlayer is the right choice for you.

Read also:Best Foundation For Combination Skin A Comprehensive Guide To Flawless Complexion

Table of Contents

- What is TaxSlayer?

- Is TaxSlayer Free?

- Features of TaxSlayer

- Free vs Paid Options

- Benefits of Using TaxSlayer

- Limitations of TaxSlayer

- How to Use TaxSlayer for Free

- TaxSlayer Free File Program

- Comparison with Other Tax Software

- Frequently Asked Questions

What is TaxSlayer?

TaxSlayer is a tax preparation software that allows individuals to file their federal and state tax returns online. It offers a range of services, from free basic filing to premium features for more complex tax situations. With a user-friendly interface and a variety of tools, TaxSlayer aims to simplify the tax filing process for users.

Since its inception, TaxSlayer has been a go-to solution for many taxpayers looking for affordable and efficient tax filing options. The platform caters to a wide range of users, from those with simple tax needs to individuals with more complicated financial situations.

Is TaxSlayer Free?

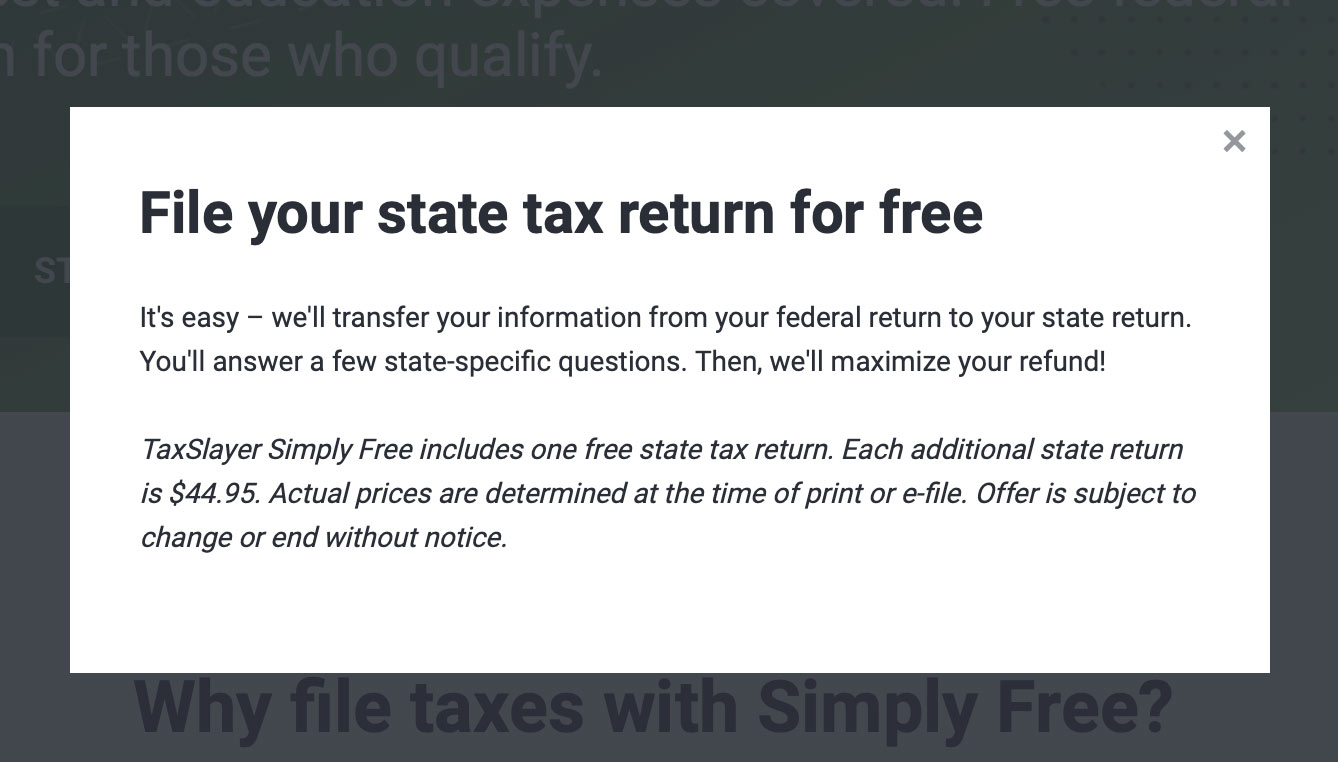

One of the most common questions about TaxSlayer is whether it is free. The answer is both yes and no. TaxSlayer offers a free option for filing federal taxes, but there are certain limitations. For state tax filing, users typically need to pay a fee unless they qualify for specific programs.

Free Federal Filing

TaxSlayer provides free federal tax filing for individuals who meet certain criteria. This includes those with straightforward tax situations, such as single filers with no dependents and simple income sources. However, if your tax situation is more complex, you may need to upgrade to a paid plan.

Features of TaxSlayer

TaxSlayer offers a variety of features designed to make tax filing easier and more efficient. Some of the key features include:

Read also:Mike Love Net Worth The Untold Story Of A Music Icons Financial Empire

- Free federal tax filing for eligible users

- State tax filing options (for a fee)

- Support for multiple forms and schedules

- Step-by-step guidance through the filing process

- Access to tax professionals for additional assistance

These features make TaxSlayer a versatile option for taxpayers with varying needs.

Free vs Paid Options

Understanding the difference between TaxSlayer's free and paid options is crucial for making the right choice. Here's a breakdown of what each option offers:

Free Options

The free option at TaxSlayer is ideal for individuals with simple tax situations. It includes:

- Free federal tax filing

- Basic tax forms and schedules

- Step-by-step guidance

Paid Options

For those with more complex tax needs, TaxSlayer offers paid plans that include:

- State tax filing

- Access to advanced tax forms

- Additional support from tax professionals

Benefits of Using TaxSlayer

There are several advantages to using TaxSlayer for your tax preparation needs:

- Affordable pricing options

- User-friendly interface

- Wide range of supported tax forms

- Free federal filing for eligible users

- Access to tax professionals for additional support

These benefits make TaxSlayer a compelling choice for many taxpayers.

Limitations of TaxSlayer

While TaxSlayer has many strengths, there are some limitations to consider:

- State tax filing is not free

- Advanced features may require upgrading to a paid plan

- Less robust customer support compared to some competitors

Understanding these limitations can help you decide if TaxSlayer is the right fit for your tax filing needs.

How to Use TaxSlayer for Free

Using TaxSlayer for free is straightforward if you qualify for the program. Here's how you can take advantage of the free federal filing option:

- Create an account on the TaxSlayer website

- Determine if you meet the eligibility criteria for free filing

- Follow the step-by-step instructions to complete your federal tax return

- Submit your tax return electronically

By following these steps, you can file your federal taxes for free using TaxSlayer.

TaxSlayer Free File Program

TaxSlayer participates in the IRS Free File Program, which offers free tax preparation and filing services to eligible taxpayers. This program is designed to help low- and moderate-income individuals file their taxes without incurring any fees.

To qualify for the TaxSlayer Free File Program, you must meet certain income requirements and other criteria set by the IRS. If you qualify, you can file both your federal and state taxes for free through TaxSlayer.

Comparison with Other Tax Software

When considering TaxSlayer, it's important to compare it with other tax preparation software on the market. Here's how TaxSlayer stacks up against some of its competitors:

TurboTax

TurboTax is another popular tax preparation software that offers a range of features. While TurboTax is known for its robust customer support and user-friendly interface, it tends to be more expensive than TaxSlayer. However, TurboTax's free option is more limited compared to TaxSlayer's offerings.

H&R Block

H&R Block is another strong contender in the tax preparation space. It offers similar features to TaxSlayer but often comes with a higher price tag. H&R Block is known for its extensive network of tax professionals, which can be a significant advantage for users who need additional support.

Frequently Asked Questions

Can I file both federal and state taxes for free with TaxSlayer?

While TaxSlayer offers free federal tax filing for eligible users, state tax filing typically requires a fee unless you qualify for specific programs like the IRS Free File Program.

What forms are supported by TaxSlayer's free option?

TaxSlayer's free option supports basic tax forms and schedules, including the 1040 form and common deductions. However, more advanced forms may require upgrading to a paid plan.

Does TaxSlayer offer customer support?

Yes, TaxSlayer offers customer support through various channels, including email and live chat. However, the level of support may vary depending on the plan you choose.

Is TaxSlayer safe to use?

TaxSlayer employs robust security measures to protect your personal and financial information. The platform uses encryption and other security protocols to ensure your data remains secure.

Conclusion

In conclusion, TaxSlayer offers a solid option for individuals looking to file their taxes online. While the free option is limited to federal filing for eligible users, it provides a cost-effective solution for many taxpayers. By understanding the features, benefits, and limitations of TaxSlayer, you can make an informed decision about whether it's the right choice for your tax filing needs.

We encourage you to leave a comment below sharing your experience with TaxSlayer or asking any questions you may have. Don't forget to share this article with others who might find it helpful. For more insights on tax preparation and financial management, explore our other articles on the site.

Remember, when it comes to taxes, knowledge is power. Stay informed and take advantage of the resources available to make the most of your tax filing experience.