Understanding Michigan tax rate is essential for residents, businesses, and anyone planning to relocate or invest in the state. Taxes play a crucial role in shaping financial decisions, and having detailed knowledge about the tax structure can help individuals and corporations make informed choices. Whether you're dealing with income tax, sales tax, or property tax, being well-versed in Michigan's tax rates ensures better financial planning.

Michigan, known for its vibrant economy and scenic beauty, imposes various taxes that contribute to public services, infrastructure development, and social programs. This article aims to provide a thorough overview of the Michigan tax system, focusing on key aspects such as income tax, sales tax, property tax, and other levies. By the end of this guide, you'll have a clear understanding of how these taxes work and their implications.

Whether you're a taxpayer, a business owner, or simply curious about Michigan's financial landscape, this article offers valuable insights into the state's taxation policies. Let's dive in and explore the intricacies of Michigan tax rates.

Read also:Jr Ridinger Cause Of Death A Comprehensive Exploration

Table of Contents

- Introduction to Michigan Tax Rates

- Michigan Income Tax

- Michigan Sales Tax

- Michigan Property Tax

- Michigan Business Taxes

- Tax Exemptions and Credits

- Filing Michigan Taxes

- Historical Overview of Michigan Tax Rates

- Future Trends in Michigan Taxation

- Useful Resources for Michigan Taxpayers

- Conclusion

Introduction to Michigan Tax Rates

Michigan tax rates are structured to ensure a balanced approach to revenue generation while supporting the state's economic growth. The state imposes several types of taxes, each with its own set of rules and rates. Understanding these tax rates is crucial for both individuals and businesses operating within Michigan.

The primary taxes in Michigan include income tax, sales tax, and property tax. Each of these taxes has specific rates and regulations that taxpayers must adhere to. Additionally, Michigan offers various tax credits and exemptions to ease the financial burden on eligible residents.

Key Features of Michigan Taxation

- Flat income tax rate for individuals.

- Standard sales tax rate applied statewide.

- Property tax rates vary by local jurisdictions.

Michigan Income Tax

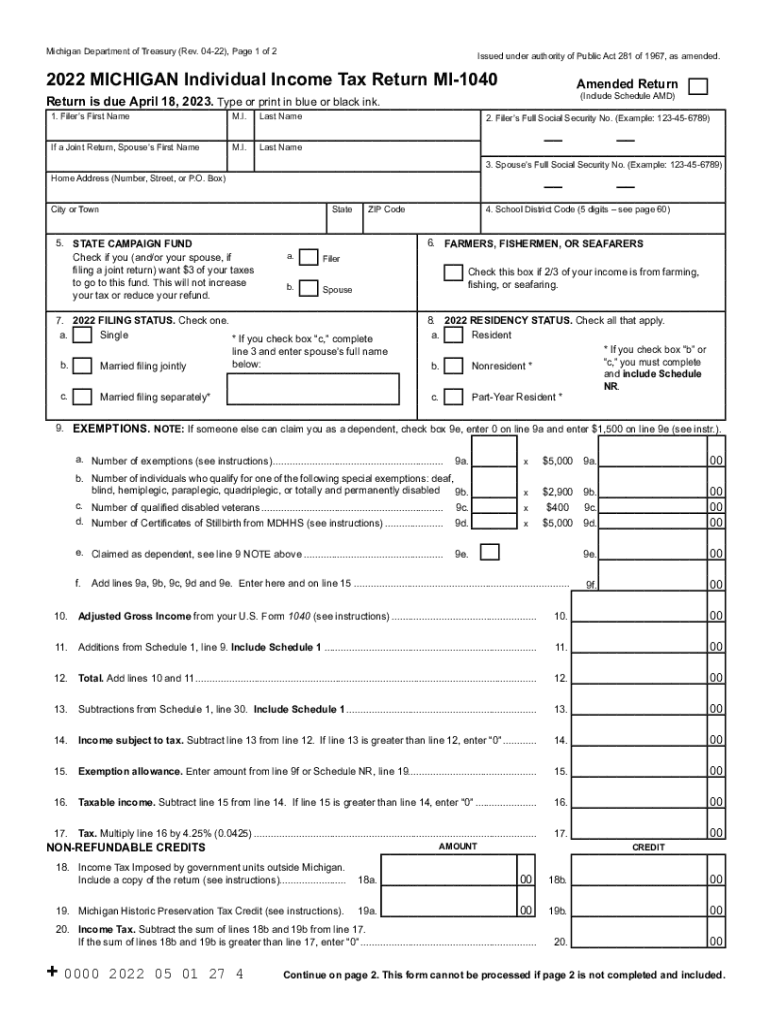

Michigan income tax is levied on the earnings of residents and businesses within the state. As of the latest updates, Michigan has a flat income tax rate, which simplifies the tax calculation process for taxpayers. This flat rate ensures that all individuals pay the same percentage of their income in taxes, regardless of their income level.

Current Income Tax Rate

The current Michigan income tax rate is 4.25%. This rate applies to all taxable income earned by residents and businesses in the state. Unlike some states that use a progressive tax system, Michigan's flat tax rate provides a straightforward and predictable tax burden for taxpayers.

How to Calculate Michigan Income Tax

- Determine your taxable income after deductions and exemptions.

- Multiply your taxable income by the 4.25% tax rate.

- Subtract any applicable tax credits to determine your final tax liability.

Michigan Sales Tax

Michigan sales tax is a consumption tax applied to the sale of goods and certain services within the state. The sales tax rate in Michigan is standardized across the state, making it easier for consumers and businesses to calculate their tax obligations.

Standard Sales Tax Rate

The standard sales tax rate in Michigan is 6%. This rate applies to most tangible goods purchased in the state. However, some items, such as groceries and prescription medications, are exempt from sales tax.

Read also:Unveiling The Glamour Of Dti Crystal Couture A Comprehensive Guide

Additional Sales Tax Considerations

- Local municipalities cannot impose additional sales taxes in Michigan.

- Businesses must collect and remit sales tax to the Michigan Department of Treasury.

Michigan Property Tax

Property tax in Michigan is assessed on real estate and personal property. The rates vary depending on the local jurisdiction, as each county and municipality determines its own millage rates. Property taxes fund local services such as schools, public safety, and infrastructure.

How Property Tax Rates Are Determined

Property tax rates in Michigan are calculated based on the assessed value of the property and the millage rates set by local governments. The assessed value is typically half of the market value of the property.

Tax Abatements and Exemptions

- Homestead property tax credit for primary residences.

- Senior citizen property tax exemptions.

- Disability tax reductions for eligible individuals.

Michigan Business Taxes

Businesses operating in Michigan are subject to various taxes, including corporate income tax, franchise tax, and excise taxes. These taxes are designed to ensure that businesses contribute to the state's revenue while promoting economic growth.

Corporate Income Tax

The corporate income tax rate in Michigan is 6%. This rate applies to the net income of corporations doing business in the state. Businesses must file annual tax returns and pay taxes on their taxable income.

Other Business Taxes

- Franchise tax for financial institutions.

- Excise taxes on specific goods and services.

Tax Exemptions and Credits

Michigan offers several tax exemptions and credits to assist taxpayers in reducing their tax liabilities. These incentives are designed to support specific groups, such as low-income families, seniors, and disabled individuals.

Common Tax Exemptions

- Homestead property tax credit.

- Child care credit.

- Senior citizen property tax exemption.

Eligibility Criteria

To qualify for tax exemptions and credits, taxpayers must meet specific criteria set by the Michigan Department of Treasury. These criteria often include income thresholds, residency requirements, and other conditions.

Filing Michigan Taxes

Filing taxes in Michigan can be done through various methods, including online platforms and traditional paper forms. The Michigan Department of Treasury provides resources and guidance to help taxpayers navigate the filing process.

Steps to File Michigan Taxes

- Gather necessary documents, such as W-2 forms and income statements.

- Choose a filing method: online or paper.

- Complete the required tax forms accurately.

- Submit your tax return by the deadline to avoid penalties.

Historical Overview of Michigan Tax Rates

The history of Michigan tax rates reflects the state's evolving approach to taxation. Over the years, Michigan has adjusted its tax policies to address changing economic conditions and societal needs. Understanding this history provides valuable context for current tax rates and future trends.

Key Historical Changes

- Introduction of the flat income tax rate in 1967.

- Reduction of the income tax rate from 4.35% to 4.25% in 2012.

- Implementation of various tax credits and exemptions to support specific groups.

Future Trends in Michigan Taxation

Looking ahead, Michigan is likely to continue refining its tax policies to address emerging challenges and opportunities. Potential changes may include adjustments to tax rates, the introduction of new tax credits, and enhancements to digital filing systems.

Possible Future Developments

- Increased focus on digital transformation in tax filing processes.

- Expansion of tax incentives for renewable energy and sustainable practices.

- Reevaluation of property tax structures to ensure fairness and equity.

Useful Resources for Michigan Taxpayers

For more information on Michigan tax rates and policies, taxpayers can refer to the following resources:

Conclusion

In conclusion, understanding Michigan tax rates is essential for anyone living, working, or investing in the state. By familiarizing yourself with the various types of taxes, exemptions, and filing procedures, you can better manage your financial responsibilities. We encourage you to explore the resources provided and stay informed about any updates or changes in Michigan's tax policies.

Feel free to leave a comment or share this article with others who may benefit from this information. For more insights into Michigan's financial landscape, explore other articles on our site.