When considering whether to rent or buy in New York, it's essential to weigh the pros and cons of each option carefully. New York City is one of the most dynamic and expensive cities in the world, and your housing choice will significantly impact your lifestyle and financial future. Whether you're a young professional, a growing family, or a retiree, understanding the factors involved in the rent vs buy decision can help you make the best choice for your situation.

New York offers a wide range of housing options, from luxurious penthouses to cozy apartments. However, the decision to rent or buy is not just about finding the right space but also about aligning your financial goals and personal preferences. This guide will provide you with valuable insights into both options, helping you navigate the complexities of the New York real estate market.

As you explore the possibilities of living in New York, it's important to consider the long-term implications of your housing choice. Renting may provide flexibility and lower upfront costs, while buying offers the potential for equity and stability. Let's dive deeper into the factors that can influence your decision and help you determine whether renting or buying is the right choice for you.

Read also:Unveiling The Glamour Of Dti Crystal Couture A Comprehensive Guide

Table of Contents

- Introduction to Rent vs Buy in New York

- Cost Analysis: Renting vs Buying

- Overview of the New York Real Estate Market

- Financial Considerations When Buying

- Advantages of Renting in New York

- Advantages of Buying in New York

- Lifestyle Factors to Consider

- Long-Term Perspective on Renting vs Buying

- Tax Implications of Renting vs Buying

- Expert Advice on Making the Right Decision

Introduction to Rent vs Buy in New York

The decision to rent or buy in New York is one of the most critical choices you will make when planning your life in the city. New York's real estate market is unique, characterized by high prices, limited inventory, and a vibrant rental scene. Understanding the nuances of both options is crucial for making an informed decision.

Why Renting Might Be the Right Choice

Renting offers flexibility, lower upfront costs, and the ability to relocate easily. For those who are unsure about long-term commitment or anticipate frequent job changes, renting can be an ideal solution. Additionally, renters are not responsible for property maintenance or repairs, which can be a significant advantage for busy professionals.

Why Buying Might Be the Better Option

Buying a home in New York provides the opportunity to build equity, enjoy tax benefits, and achieve financial stability. For families or individuals who plan to stay in the city for an extended period, buying can be a wise investment. However, it requires a substantial financial commitment and careful planning.

Cost Analysis: Renting vs Buying

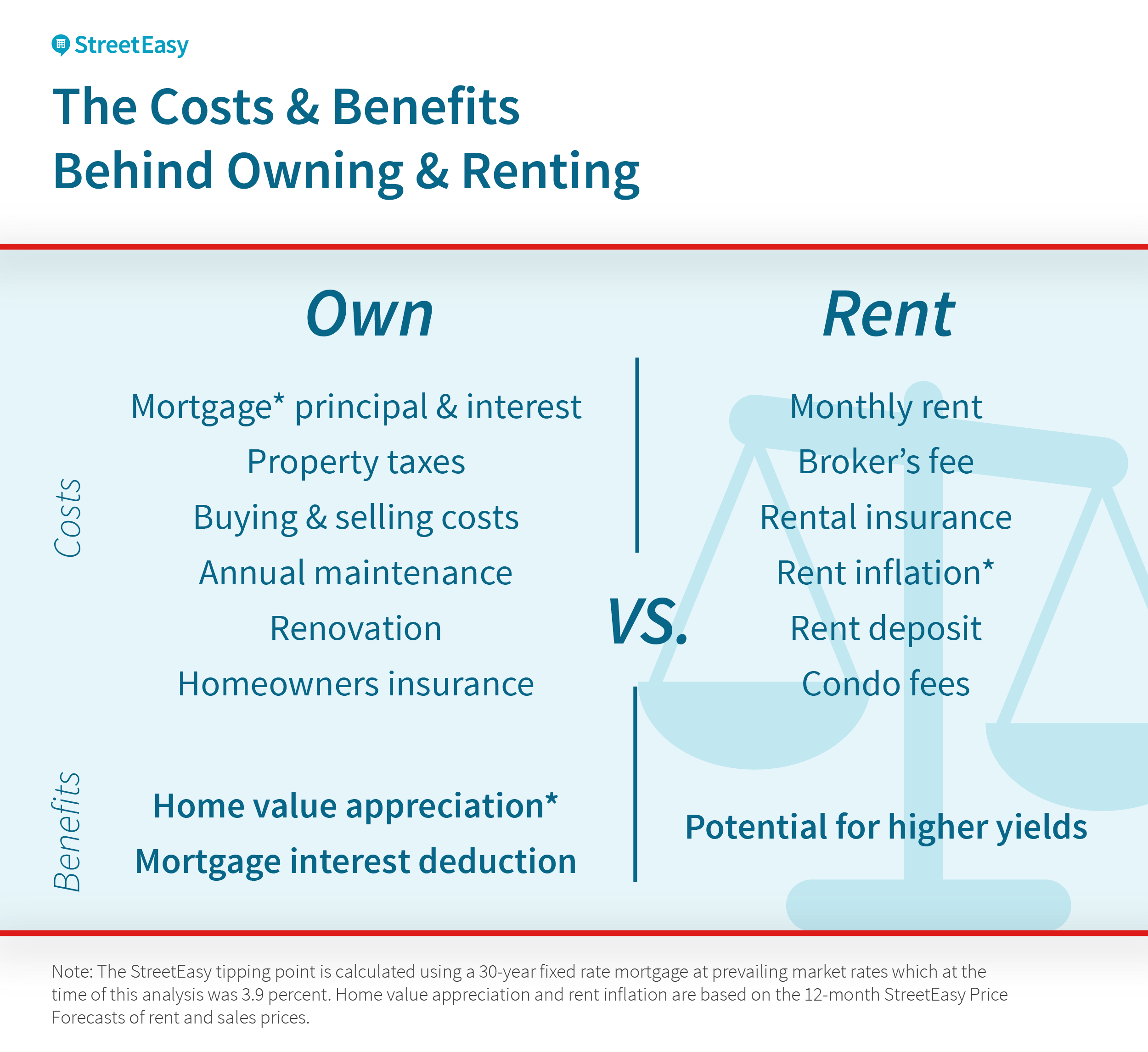

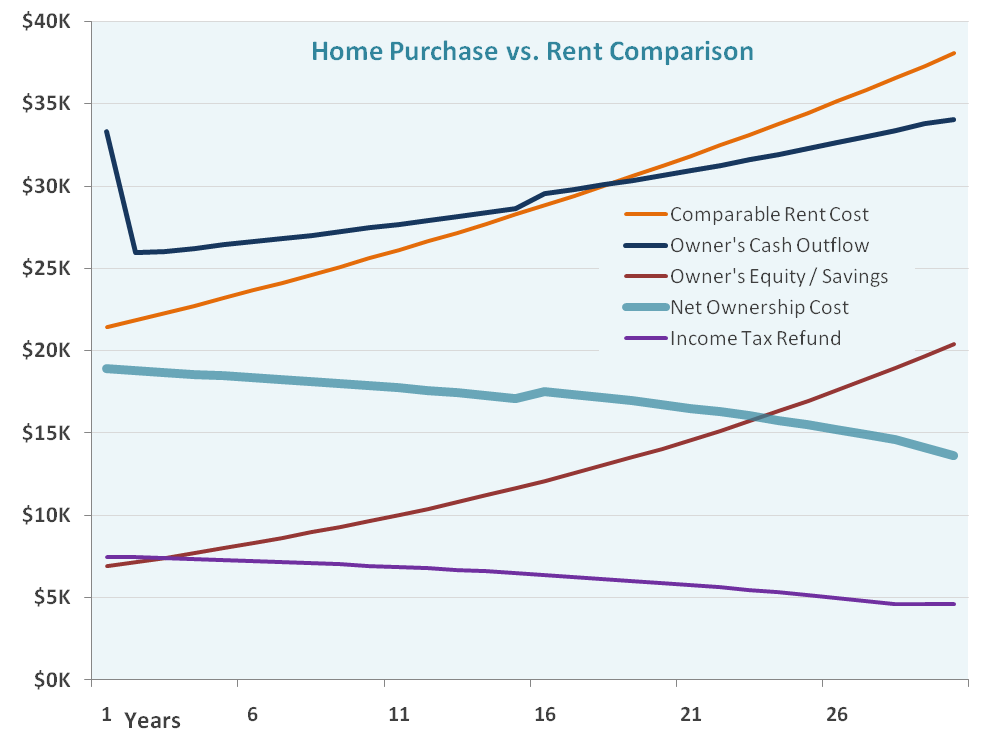

One of the most significant factors in the rent vs buy decision is the cost. New York's housing costs are among the highest in the country, and understanding the financial implications of each option is essential.

Initial Costs

When buying a home, you will need to account for a down payment, closing costs, and other associated fees. Renting, on the other hand, typically requires a security deposit and one month's rent upfront. Here’s a breakdown:

- Buying: Down payment (usually 20% of the property value), closing costs (1-5% of the property value), and moving expenses.

- Renting: Security deposit (1-2 months' rent), first month's rent, and broker fees (if applicable).

Ongoing Costs

Both renting and buying involve ongoing expenses. For renters, the primary cost is monthly rent, while homeowners must consider mortgage payments, property taxes, insurance, and maintenance fees. According to recent data, the average monthly rent in New York City is approximately $3,500, while the average monthly mortgage payment for a $1 million home is around $4,000.

Read also:Mariska Hargitay Height Discover The Truth Behind Her Stature And Career

Overview of the New York Real Estate Market

New York's real estate market is dynamic and constantly evolving. In recent years, the market has seen fluctuations in prices, inventory levels, and demand. Understanding the current state of the market can help you make a more informed decision.

Trends in the Rental Market

The rental market in New York is highly competitive, with a limited supply of available units. However, the pandemic has led to a slight decrease in rental prices in some areas, providing an opportunity for renters to secure more affordable housing. According to a report by Miller Samuel, rental prices have stabilized but remain high in popular neighborhoods.

Trends in the Sales Market

The sales market in New York has been impacted by economic uncertainties and changing buyer preferences. While luxury properties have seen a slowdown in demand, entry-level and mid-range homes continue to attract buyers. The median sales price for a co-op or condo in Manhattan was $1.1 million in 2023, according to Douglas Elliman.

Financial Considerations When Buying

Buying a home in New York requires careful financial planning. From securing financing to managing ongoing expenses, there are several factors to consider before making a purchase.

Securing Financing

Mortgage rates and loan options play a significant role in the affordability of buying a home. In 2023, mortgage rates have fluctuated, with the average 30-year fixed rate hovering around 6.5%. It's essential to shop around for the best rates and work with a reputable lender to secure favorable terms.

Managing Ongoing Expenses

In addition to mortgage payments, homeowners must account for property taxes, insurance, maintenance, and potential renovations. Property taxes in New York City can range from 0.5% to 1.2% of the property's assessed value, depending on the borough and property type. Homeowners should also set aside a budget for unexpected repairs and improvements.

Advantages of Renting in New York

Renting offers several advantages, particularly for those who value flexibility and simplicity. Here are some key benefits:

- Flexibility: Renting allows you to move more easily, making it ideal for those who anticipate frequent job changes or lifestyle adjustments.

- Lower Upfront Costs: Renters typically require less upfront capital compared to buyers, making it easier to secure housing without a large financial commitment.

- No Maintenance Responsibility: Renters are not responsible for property maintenance or repairs, which can save time and money.

Advantages of Buying in New York

Buying a home in New York provides long-term benefits, including the potential for equity and financial stability. Here are some advantages:

- Building Equity: Homeownership allows you to build equity over time, which can be a valuable asset in the future.

- Tax Benefits: Homeowners may qualify for tax deductions on mortgage interest and property taxes, reducing their overall tax liability.

- Stability: Owning a home provides a sense of stability and control over your living environment, which can be especially important for families.

Lifestyle Factors to Consider

Your lifestyle and personal preferences should also play a role in the rent vs buy decision. Consider factors such as your career stability, family plans, and long-term goals when evaluating your options.

Family Considerations

Families often prioritize stability and space when choosing a home. Buying a home can provide a more permanent solution for families looking to settle down in a specific neighborhood. Additionally, homeownership can offer access to better schools and community resources.

Professional Considerations

For professionals who anticipate frequent job changes or travel, renting may be a more practical option. Renting allows for greater flexibility and the ability to relocate quickly without the burden of selling a property.

Long-Term Perspective on Renting vs Buying

When evaluating the rent vs buy decision, it's important to consider the long-term implications of each choice. While renting may offer short-term benefits, buying can provide long-term financial rewards. According to a study by the Federal Reserve, homeowners tend to accumulate more wealth over time compared to renters.

Investment Potential

Buying a home in New York can be a sound investment, particularly in areas with strong market growth. Over time, property values tend to appreciate, providing homeowners with the opportunity to sell at a profit or refinance for additional capital.

Tax Implications of Renting vs Buying

Taxes play a significant role in the financial considerations of renting vs buying. Homeowners may benefit from tax deductions, while renters do not receive the same advantages.

Mortgage Interest Deduction

Homeowners can deduct mortgage interest on their federal tax returns, which can significantly reduce their taxable income. This deduction is particularly beneficial for those with large mortgages or higher interest rates.

Property Tax Deduction

In addition to mortgage interest, homeowners can deduct property taxes from their federal taxes. This deduction can further reduce the overall cost of homeownership, making it more financially attractive compared to renting.

Expert Advice on Making the Right Decision

When it comes to the rent vs buy decision, seeking expert advice can provide valuable insights and guidance. Real estate professionals, financial advisors, and mortgage brokers can help you evaluate your options and make the best choice for your situation.

In conclusion, the decision to rent or buy in New York depends on a variety of factors, including your financial situation, lifestyle preferences, and long-term goals. By carefully weighing the pros and cons of each option and considering the current state of the market, you can make an informed decision that aligns with your needs and aspirations.

We invite you to share your thoughts and experiences in the comments below. Have you faced the rent vs buy dilemma in New York? What factors influenced your decision? Let us know, and don't forget to explore other articles on our site for more insights into New York's vibrant real estate market.