Taxes play a crucial role in shaping the economic landscape of every state, including Michigan. If you're wondering what is the Michigan tax rate and how it impacts individuals and businesses, you're in the right place. This article dives deep into Michigan's tax system, offering valuable insights to help you navigate the complexities of taxation in the Great Lakes State.

Understanding the Michigan tax rate is essential for residents, businesses, and anyone planning to relocate or invest in the state. From income taxes to property taxes, Michigan has a well-structured system designed to fund public services and infrastructure development. In this guide, we'll explore the various types of taxes imposed in Michigan and provide practical advice to help you plan your finances effectively.

Whether you're a taxpayer looking to maximize deductions or a business owner trying to comply with state regulations, this article will serve as your ultimate resource. Let's delve into the world of Michigan taxation and uncover the details that matter most to you.

Read also:Discover The Allure Of Pop Melodie R34 A Comprehensive Guide

Table of Contents

- Introduction to Michigan Tax Rate

- Michigan Income Tax

- Michigan Sales Tax

- Michigan Property Tax

- Michigan Business Taxes

- Deductions and Credits

- Federal vs. State Taxes

- Historical Trends in Michigan Tax Rates

- Filing Your Michigan Taxes

- Recent Tax Reforms in Michigan

- Useful Resources for Taxpayers

Introduction to Michigan Tax Rate

Michigan's tax system is designed to generate revenue for essential public services such as education, healthcare, and infrastructure development. The Michigan tax rate varies depending on the type of tax, income level, and property location. Understanding these rates is vital for ensuring compliance and optimizing your financial planning.

Key Features of Michigan's Tax System

Here are some key aspects of Michigan's tax system:

- A flat income tax rate for all residents

- A statewide sales tax rate with local variations

- Property tax rates determined by local jurisdictions

These features make Michigan's tax system both straightforward and complex, requiring careful attention to detail.

Michigan Income Tax

The Michigan income tax rate is one of the simplest components of the state's tax system. Currently, Michigan imposes a flat tax rate on all residents, regardless of income level. This ensures a fair and equitable approach to taxation.

Current Michigan Income Tax Rate

As of 2023, the Michigan income tax rate stands at 4.25%. This rate applies to all taxable income earned by residents of the state. Non-residents who earn income in Michigan are also subject to this rate on their Michigan-sourced income.

For example, if you earn $50,000 annually in Michigan, your state income tax liability would be $2,125 ($50,000 x 4.25%).

Read also:Brown Spotting Before Period Causes Symptoms And Treatment

Michigan Sales Tax

The Michigan sales tax is another critical component of the state's tax system. It applies to most goods and services purchased within the state. Understanding the sales tax rate can help you budget more effectively and avoid unexpected expenses.

Statewide Sales Tax Rate

Mitchigan's statewide sales tax rate is currently 6%. However, some local jurisdictions may impose additional sales taxes, bringing the total rate higher in certain areas. For instance, cities like Detroit have a combined sales tax rate of 6.6%.

It's important to note that certain items, such as groceries and prescription medications, are exempt from sales tax in Michigan.

Michigan Property Tax

Property taxes in Michigan are levied by local governments to fund schools, public safety, and other essential services. The tax rate varies depending on the location of the property and the services provided by the local jurisdiction.

How Property Tax Rates are Determined

Property tax rates in Michigan are expressed as a millage rate, which represents the amount of tax per $1,000 of assessed value. For example, if your property is assessed at $100,000 and the millage rate is 20 mills, your annual property tax would be $2,000 ($100,000 x 0.020).

Michigan also offers a Homestead Property Tax Credit to eligible homeowners, helping to reduce their overall tax burden.

Michigan Business Taxes

Businesses operating in Michigan are subject to various taxes, including corporate income tax, franchise tax, and excise tax. Understanding these taxes is crucial for ensuring compliance and maximizing profitability.

Corporate Income Tax Rate

Mitchigan's corporate income tax rate is currently 6%. This rate applies to the net income of corporations doing business in the state. Small businesses may qualify for certain exemptions or reduced rates, depending on their structure and revenue.

Additionally, Michigan imposes a Commercial Activity Tax (CAT) on certain types of businesses, with rates ranging from 0.098% to 0.196% of gross receipts.

Deductions and Credits

Mitchigan offers several deductions and credits to help taxpayers reduce their overall tax liability. These include itemized deductions, standard deductions, and various tax credits for specific expenses.

Common Tax Deductions in Michigan

- Home mortgage interest

- Charitable contributions

- Medical expenses

- State and local taxes

Taxpayers can choose between itemizing their deductions or taking the standard deduction, which is $4,900 for single filers and $9,800 for married couples filing jointly in 2023.

Federal vs. State Taxes

While Michigan's tax system is relatively straightforward, it's important to understand how it interacts with federal tax regulations. Both systems have their own set of rules and requirements, which can impact your overall tax liability.

Key Differences Between Federal and State Taxes

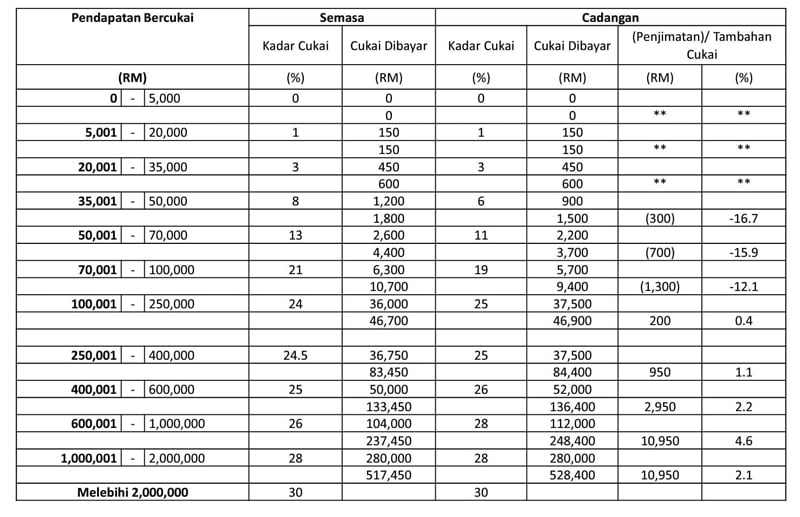

One of the main differences between federal and state taxes is the tax rate structure. While Michigan uses a flat tax rate for income tax, the federal government employs a progressive tax system, where higher income levels are taxed at higher rates.

Another difference lies in the types of deductions and credits available. Some deductions allowed at the federal level may not be applicable at the state level, and vice versa.

Historical Trends in Michigan Tax Rates

Mitchigan's tax rates have evolved over the years in response to economic conditions and legislative changes. Understanding these trends can provide valuable insights into the state's fiscal policies and their impact on taxpayers.

Recent Changes in Michigan Tax Rates

In recent years, Michigan has made several adjustments to its tax rates, including:

- A reduction in the personal income tax rate from 4.35% to 4.25% in 2012

- The introduction of the Homestead Property Tax Credit in 2000

- Reforms to the Commercial Activity Tax in 2015

These changes reflect the state's ongoing efforts to balance revenue generation with taxpayer relief.

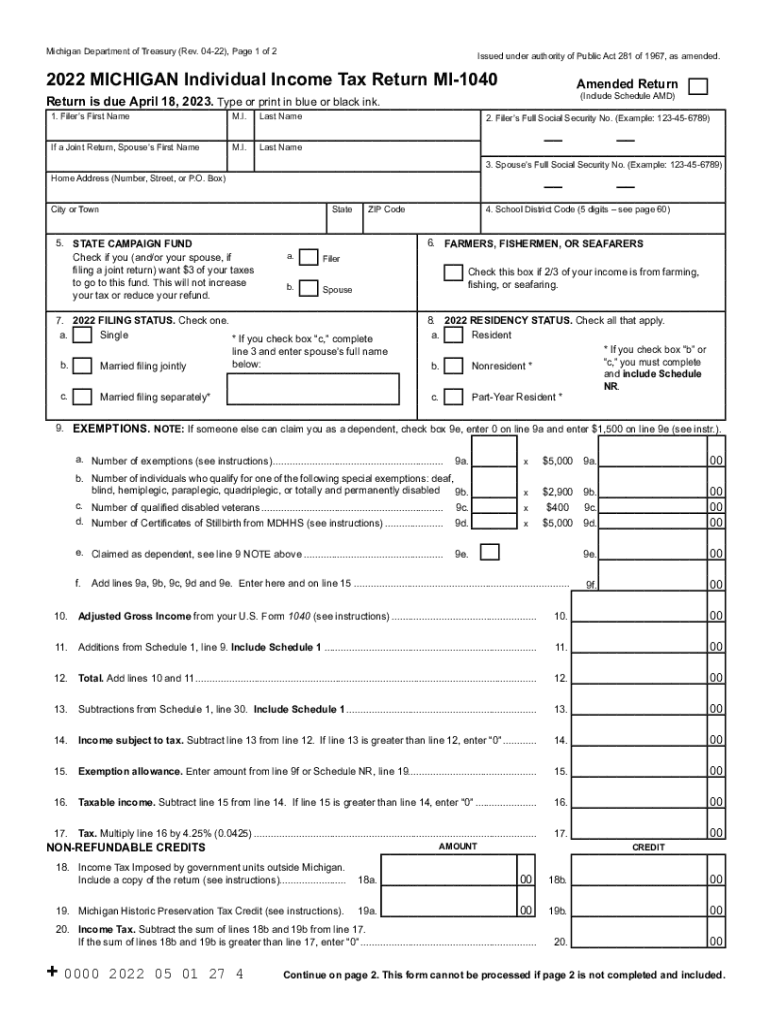

Filing Your Michigan Taxes

Filing your Michigan taxes is a straightforward process, thanks to the state's user-friendly online system. Whether you choose to file electronically or submit a paper return, it's important to gather all necessary documents and information beforehand.

Tips for Filing Michigan Taxes

- Keep accurate records of your income, expenses, and deductions

- Use the Michigan Department of Treasury's online filing portal for convenience

- Consult a tax professional if you have complex financial situations

By following these tips, you can ensure a smooth and stress-free filing experience.

Recent Tax Reforms in Michigan

Mitchigan has implemented several tax reforms in recent years to address economic challenges and improve the state's fiscal health. These reforms have had a significant impact on taxpayers and businesses alike.

Key Tax Reforms in Michigan

Some of the most notable tax reforms in Michigan include:

- The elimination of the personal property tax for small businesses in 2013

- The introduction of the Michigan Business Tax in 2008, replaced by the Corporate Income Tax in 2012

- Reforms to the Homestead Property Tax Credit to increase its value for low-income homeowners

These reforms aim to create a more business-friendly environment while maintaining essential public services.

Useful Resources for Taxpayers

To help you navigate Michigan's tax system, here are some useful resources:

- Michigan Department of Treasury website

- Internal Revenue Service (IRS) website

- Local tax professionals and accountants

These resources provide valuable information and guidance to help you make informed decisions about your taxes.

Conclusion

In conclusion, understanding the Michigan tax rate is essential for anyone living, working, or investing in the state. From the flat income tax rate to the statewide sales tax, Michigan's tax system offers a balanced approach to revenue generation and taxpayer relief.

We encourage you to take advantage of the deductions and credits available to reduce your tax liability and optimize your financial planning. For more information, visit the resources listed above or consult a tax professional.

Don't forget to share this article with your friends and family, and leave a comment below if you have any questions or feedback. Together, let's make sense of Michigan's tax system and build a brighter financial future for all!