Experian Boost is a revolutionary tool that allows users to enhance their credit scores by incorporating everyday financial behaviors into their credit profiles. If you've ever wondered how many points Experian Boost can add to your credit score, you're in the right place. This guide will break down everything you need to know about Experian Boost, its functionality, and how it impacts your creditworthiness.

Understanding how Experian Boost works is crucial for anyone looking to improve their financial standing. In today's economy, having a strong credit score can open doors to better interest rates, loan opportunities, and even employment prospects. By leveraging Experian Boost, individuals can take control of their financial future and make informed decisions.

This article will provide an in-depth analysis of Experian Boost, including its benefits, limitations, and how it can potentially increase your credit score. Whether you're new to the concept or looking for advanced insights, this guide will equip you with the knowledge to make the most of this powerful tool.

Read also:Brown Blood Before Period Understanding The Causes And What It Means For Your Health

Table of Contents

- What is Experian Boost?

- How Many Points Does Experian Boost Give You?

- How Does Experian Boost Work?

- Eligibility Requirements

- Benefits of Using Experian Boost

- Limitations of Experian Boost

- How to Sign Up for Experian Boost

- Real-Life Examples

- Common Frequently Asked Questions

- Conclusion

What is Experian Boost?

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows users to include their on-time utility and telecom payments in their credit file, which can positively impact their credit score. Unlike traditional credit scoring models that only consider loans and credit card payments, Experian Boost takes a broader view of financial responsibility.

This innovation addresses the gap for individuals who have limited credit history or those who rely heavily on non-traditional financial activities. By incorporating these payments, Experian Boost aims to provide a more accurate representation of a consumer's financial behavior.

How Experian Boost Differs from Traditional Credit Scoring

- Traditional credit scoring focuses on loans and credit card payments.

- Experian Boost includes utility and telecom payments, offering a more comprehensive view.

- It is designed to help individuals with thin credit files or no credit history at all.

How Many Points Does Experian Boost Give You?

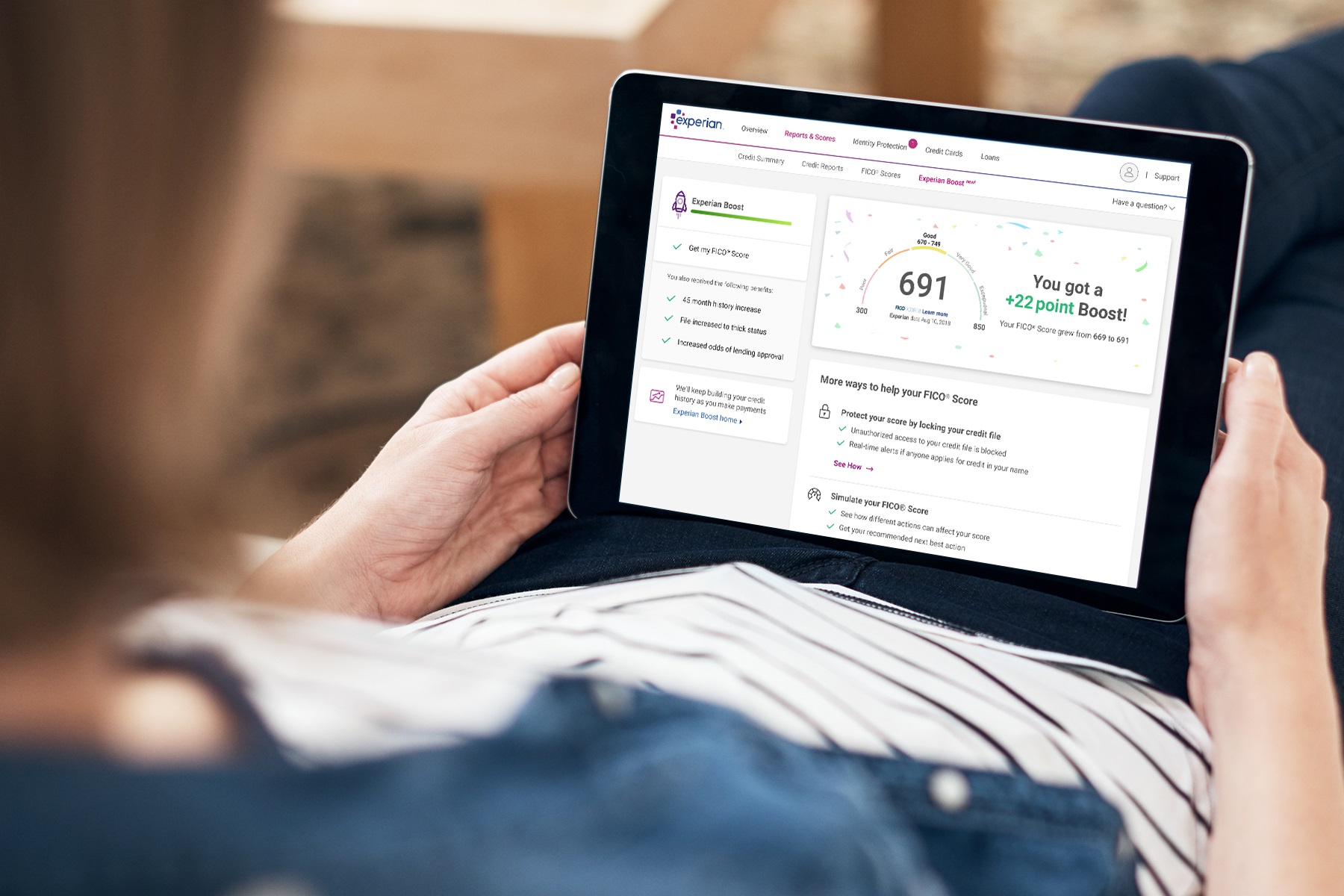

The exact number of points Experian Boost can add to your credit score varies depending on several factors, including your current credit profile and the types of payments you choose to include. On average, users report an increase of 10 to 30 points, but some individuals may see even greater improvements.

According to Experian, approximately 80% of users who activate Experian Boost see an increase in their FICO Score 8, which is widely used by lenders. However, the impact can differ based on the weight of your existing credit history and the consistency of your on-time payments.

Factors That Influence the Number of Points Gained

- Current credit score and credit history

- Frequency and consistency of on-time payments

- Type of accounts linked (e.g., utility bills, telecom services)

How Does Experian Boost Work?

Experian Boost works by connecting to your bank account to identify eligible utility and telecom payments. Once connected, users can review and select which payments they want to include in their credit file. The process is secure, and Experian does not store your bank account information.

After linking your accounts, Experian analyzes your transaction history to identify qualifying payments. Users then have the option to add these payments to their Experian credit file, which can immediately impact their credit score.

Read also:Kylie Jenners Dad The Story Behind The Fame

Steps to Use Experian Boost

- Create an account on the Experian Boost website.

- Link your bank account(s) to the platform.

- Review and select eligible payments to include in your credit file.

- Monitor your updated credit score.

Eligibility Requirements

Not everyone is eligible for Experian Boost. To qualify, you must meet the following criteria:

- Be a resident of the United States.

- Have a bank account with eligible utility and telecom payments.

- Be at least 18 years old.

Additionally, your bank must support the connection to Experian Boost. If your bank is not supported, you may need to use a different account or contact Experian for assistance.

Benefits of Using Experian Boost

Experian Boost offers several advantages for users looking to improve their credit scores:

- Free Service: Experian Boost is completely free to use, with no hidden fees or subscriptions.

- Improved Credit Score: Users can see immediate improvements in their credit scores by including on-time payments.

- Better Financial Opportunities: A higher credit score can lead to better interest rates, loan approvals, and financial stability.

By leveraging Experian Boost, individuals can take proactive steps toward building a stronger financial foundation.

Limitations of Experian Boost

While Experian Boost is a valuable tool, it does have some limitations:

- Not All Lenders Use Experian: Some lenders may not consider Experian Boost-enhanced scores, so the impact may vary.

- Limited to Experian Credit File: Experian Boost only affects your Experian credit file and does not influence other credit bureaus.

- Requires Bank Account Access: Users must link their bank accounts to Experian Boost, which may not be suitable for everyone.

Understanding these limitations can help users set realistic expectations about the tool's effectiveness.

How to Sign Up for Experian Boost

Signing up for Experian Boost is a straightforward process. Follow these steps to get started:

- Visit the Experian Boost website and create an account.

- Verify your identity using the required information.

- Link your bank account(s) to the platform.

- Review and select eligible payments to include in your credit file.

- Monitor your updated credit score and track your progress.

Experian Boost is designed to be user-friendly, ensuring that anyone can take advantage of its benefits.

Real-Life Examples

Let's explore a few real-life examples of how Experian Boost has helped individuals improve their credit scores:

Case Study 1: John's Story

John, a recent college graduate, struggled with a thin credit file after years of relying on cash payments for utilities and telecom services. After signing up for Experian Boost, he added his on-time payments to his credit file and saw an immediate 25-point increase in his credit score. This improvement allowed him to secure a car loan with a favorable interest rate.

Case Study 2: Sarah's Journey

Sarah, a single mother, used Experian Boost to enhance her credit profile by including her consistent utility payments. Her credit score improved by 15 points, enabling her to qualify for a better mortgage rate. This change saved her thousands of dollars over the life of her loan.

Common Frequently Asked Questions

1. Is Experian Boost Safe to Use?

Yes, Experian Boost is safe to use. It employs bank-level security protocols to protect your information, and Experian does not store your bank account details.

2. Can Experian Boost Lower My Credit Score?

No, Experian Boost cannot lower your credit score. It only adds positive payment information to your credit file, which can improve or maintain your score.

3. How Long Does It Take to See Results?

Users typically see results immediately after adding eligible payments to their credit file. However, the impact may vary depending on your current credit profile.

Conclusion

In conclusion, Experian Boost is a powerful tool that can help individuals improve their credit scores by incorporating on-time utility and telecom payments into their credit profiles. While the exact number of points gained varies, many users report significant improvements in their creditworthiness.

We encourage you to take advantage of this free service and start building a stronger financial future. If you found this article helpful, please share it with others who may benefit from learning about Experian Boost. Additionally, feel free to leave a comment below with any questions or feedback.

Remember, improving your credit score is an ongoing process, and Experian Boost is just one step in the right direction. Stay informed, stay proactive, and take control of your financial destiny today!