In today's fast-paced world, having the right financial tools can make all the difference in achieving your goals. JPMCB card, offered by JPMorgan Chase, is more than just a credit card; it's a gateway to exclusive benefits, rewards, and financial empowerment. Whether you're a business owner, traveler, or someone looking to maximize your spending potential, understanding the features of JPMCB card is essential.

The JPMCB card stands out in the crowded financial landscape due to its tailored offerings and robust features designed to meet the needs of modern consumers. With options ranging from cashback rewards to travel perks, this card has become a go-to choice for individuals seeking flexibility and value in their financial products.

As we delve deeper into this comprehensive guide, we will explore everything you need to know about JPMCB card, including its benefits, eligibility criteria, rewards programs, and tips for maximizing its potential. By the end of this article, you'll have a clear understanding of why the JPMCB card could be the perfect addition to your financial toolkit.

Read also:Tawartlist Art Directory By Theartworld Your Ultimate Guide To Discovering And Exploring Art

Table of Contents:

- Biography of JPMorgan Chase

- Overview of JPMCB Card

- Eligibility Requirements

- Rewards Program

- Fees and Charges

- Exclusive Benefits

- Security Features

- JPMCB Card vs Competitors

- Tips for Maximizing Your Card

- Conclusion

Biography of JPMorgan Chase

JPMorgan Chase, one of the largest financial institutions globally, has a rich history that dates back over 200 years. Founded in 1799 as The Bank of the Manhattan Company, it has evolved into a powerhouse offering a wide range of financial services, including banking, investments, and credit cards.

Data and Biodata

| Category | Details |

|---|---|

| Founded | 1799 |

| Headquarters | New York City, USA |

| CEO | Jamie Dimon |

| Revenue | $128.8 billion (2022) |

| Employees | Over 250,000 |

With its vast network and innovative approach, JPMorgan Chase continues to lead the financial industry, providing customers with cutting-edge solutions like the JPMCB card.

Overview of JPMCB Card

The JPMCB card is designed to cater to a diverse range of customers, offering various features that align with individual financial needs. From everyday purchases to luxury travel, this card ensures users enjoy seamless transactions and valuable perks.

Variations of JPMCB Card

JPMorgan Chase offers multiple versions of the JPMCB card, each tailored to specific customer profiles:

- Sapphire Preferred Card: Ideal for frequent travelers with generous travel rewards.

- Freedom Unlimited Card: Perfect for everyday spenders with unlimited cashback options.

- Ink Business Card: Designed for small business owners with expense management tools.

Eligibility Requirements

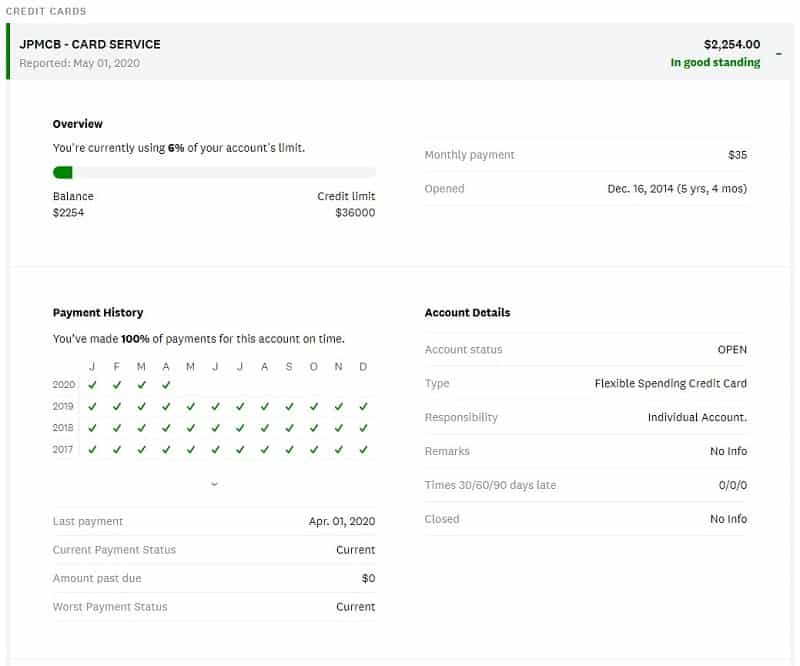

To qualify for a JPMCB card, applicants must meet certain eligibility criteria. These include a good credit score, stable income, and compliance with age restrictions. JPMorgan Chase evaluates each application carefully to ensure responsible lending practices.

Read also:Morristown Tn Dining A Comprehensive Guide To The Best Restaurants And Culinary Experiences

Credit Score Guidelines

A credit score of at least 700 is generally recommended for approval, although this can vary based on additional factors such as credit history and financial stability. Maintaining a healthy credit score not only increases your chances of approval but also helps secure favorable interest rates.

Rewards Program

One of the standout features of the JPMCB card is its robust rewards program. Cardholders can earn points, miles, or cashback on eligible purchases, depending on the specific card variant they choose.

Redemption Options

Rewards earned through the JPMCB card can be redeemed in various ways:

- Travel bookings through Chase Ultimate Rewards

- Cashback deposits to your Chase account

- Gift cards and merchandise

These flexible redemption options allow cardholders to optimize their rewards based on personal preferences and financial goals.

Fees and Charges

Understanding the fees associated with the JPMCB card is crucial for making an informed decision. While some cards come with an annual fee, others offer fee waivers under specific conditions. It's essential to weigh the benefits against the costs to determine the best fit for your financial situation.

Common Fees

- Annual Fee: Varies by card type ($0-$550)

- Foreign Transaction Fee: Typically 3% of transaction value

- Late Payment Fee: Up to $40

By staying aware of these fees, cardholders can avoid unnecessary expenses and maximize their card's value.

Exclusive Benefits

Cardholders enjoy a range of exclusive benefits that enhance their overall experience. From travel protections to purchase safeguards, the JPMCB card offers peace of mind and added convenience.

Travel Perks

Some of the notable travel benefits include:

- Priority Pass lounge access

- Travel accident insurance

- Baggage delay reimbursement

These perks make the JPMCB card an excellent choice for globetrotters and adventure seekers alike.

Security Features

JPMorgan Chase prioritizes the security of its cardholders, implementing advanced measures to protect sensitive information. Features such as chip technology, fraud monitoring, and mobile app alerts ensure that users remain safe from unauthorized transactions.

Mobile App Integration

The Chase Mobile App provides users with real-time updates, transaction notifications, and the ability to lock/unlock their card instantly. This level of control empowers cardholders to manage their accounts securely and efficiently.

JPMCB Card vs Competitors

When comparing the JPMCB card to other credit cards in the market, several key advantages emerge. Its competitive rewards structure, extensive benefits, and robust security features set it apart from rivals.

Key Differentiators

- Higher reward rates on select categories

- Comprehensive travel protections

- Seamless integration with digital wallets

By analyzing these aspects, potential applicants can better assess how the JPMCB card aligns with their financial priorities.

Tips for Maximizing Your Card

To fully leverage the potential of your JPMCB card, consider implementing the following strategies:

- Track your spending to optimize rewards accumulation

- Take advantage of sign-up bonuses and promotional offers

- Regularly review your account for any discrepancies

By staying proactive and informed, you can enhance your card's value and achieve greater financial success.

Conclusion

In conclusion, the JPMCB card offers a comprehensive suite of features designed to meet the diverse needs of modern consumers. From generous rewards programs to robust security measures, this card stands out as a premier financial tool. By understanding its benefits, eligibility requirements, and best practices, you can make the most of your JPMCB card experience.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, explore our other articles for more insights into personal finance and credit card management. Together, let's unlock the path to financial freedom!

References: