Insurance plays a vital role in safeguarding individuals and businesses from unforeseen risks. When evaluating insurance companies, the AM Best Rating Scale becomes an essential tool. This scale provides a detailed analysis of an insurance company's financial strength and ability to meet its obligations. In this article, we will explore the AM Best Rating Scale in depth and understand why it matters for both consumers and businesses.

The AM Best Rating Scale is widely regarded as one of the most authoritative measures of an insurance company's financial stability. Established in 1899, AM Best has been providing ratings and analysis to the global insurance industry. Their ratings are trusted by millions of consumers and industry professionals alike, making them an indispensable resource when evaluating insurance providers.

As we delve deeper into this topic, we will cover the history, methodology, and significance of the AM Best Rating Scale. Whether you're an individual looking for personal insurance or a business seeking corporate coverage, understanding this scale can help you make informed decisions. Let's explore how AM Best ratings work and why they matter.

Read also:Unveiling The Glamour Of Dti Crystal Couture A Comprehensive Guide

What is the AM Best Rating Scale?

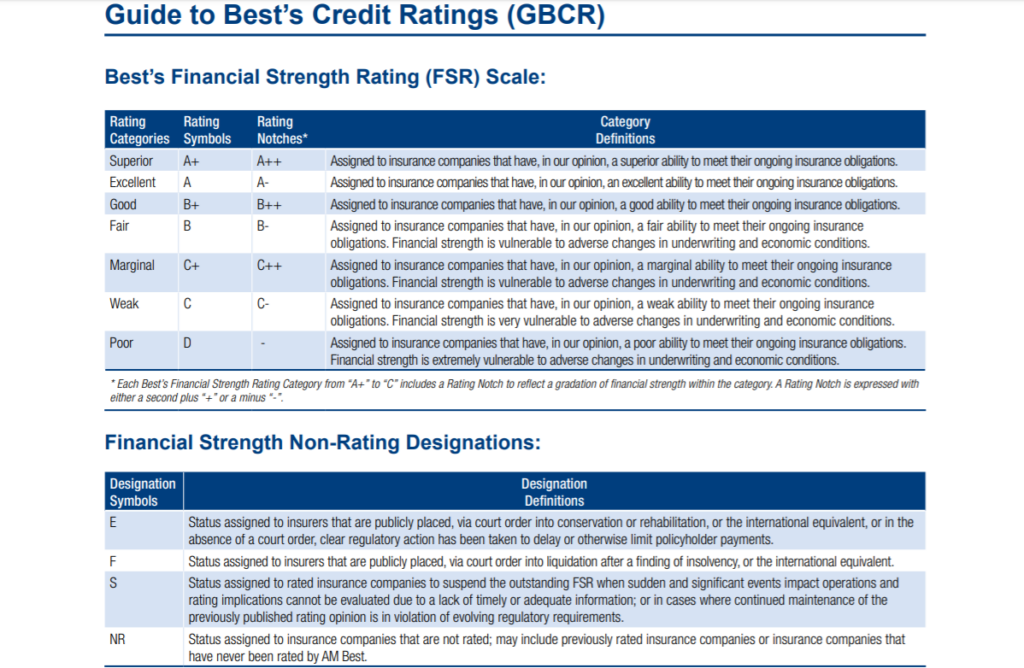

The AM Best Rating Scale is a comprehensive system designed to assess the financial strength and creditworthiness of insurance companies. It provides consumers and stakeholders with a clear understanding of an insurer's ability to meet its long-term obligations. The ratings range from "A++" (Superior) to "F" (In Liquidation), with each category indicating a specific level of financial stability and operational efficiency.

AM Best's ratings are based on a thorough evaluation of various factors, including an insurer's balance sheet, operating performance, business profile, and risk management practices. These ratings are not only crucial for consumers but also serve as benchmarks for investors and regulators in the insurance industry.

Key Features of the AM Best Rating Scale

- Comprehensive financial analysis

- Focus on long-term sustainability

- Transparent methodology

- Regular updates and revisions

History of AM Best Ratings

Founded in 1899 by Alonzo Monroe Best, AM Best has a rich history of providing reliable ratings to the insurance industry. Initially, the company focused on publishing reports about fire insurance companies. Over time, it expanded its scope to include life, health, and property/casualty insurance providers. Today, AM Best is a global leader in insurance ratings, serving clients in over 100 countries.

The evolution of AM Best Ratings reflects the changing landscape of the insurance industry. From its early days as a niche publisher to becoming a global authority, AM Best has consistently adapted to meet the needs of its stakeholders. This commitment to excellence has earned the company a reputation for reliability and trustworthiness.

How Are AM Best Ratings Calculated?

AM Best Ratings are calculated through a rigorous process that involves both quantitative and qualitative analysis. The evaluation process considers several key factors:

- Financial strength

- Operating performance

- Business profile

- Risk management practices

Each factor is assessed individually, and the results are combined to determine the final rating. AM Best employs a team of experienced analysts who specialize in evaluating insurance companies. Their expertise ensures that the ratings are accurate and reliable.

Read also:Club Universidad Nacional Ac Training Complex The Heart Of Chivarivera Dynasty

Factors Influencing AM Best Ratings

Several factors influence AM Best Ratings, including:

- Capital adequacy and solvency

- Investment portfolio performance

- Claims settlement history

- Market position and competitive landscape

These factors are carefully analyzed to provide a comprehensive view of an insurer's financial health. By considering both quantitative data and qualitative insights, AM Best ensures that its ratings reflect the true state of an insurance company.

AM Best Rating Categories

The AM Best Rating Scale consists of several categories, each indicating a specific level of financial strength. The ratings are as follows:

- A++ (Superior)

- A+ (Superior)

- A (Excellent)

- A- (Excellent)

- B++ (Good)

- B+ (Good)

- B (Fair)

- B- (Fair)

- C++ (Marginal)

- C+ (Marginal)

- C (Weak)

- F (In Liquidation)

Each category provides a clear indication of an insurer's financial stability and ability to meet its obligations. Understanding these categories is essential for making informed decisions when choosing an insurance provider.

Significance of AM Best Ratings

AM Best Ratings are significant for several reasons:

- They provide consumers with a reliable measure of an insurer's financial strength.

- They help businesses evaluate potential partners and collaborators.

- They serve as a benchmark for investors and regulators in the insurance industry.

By relying on AM Best Ratings, stakeholders can make informed decisions that align with their financial goals and risk tolerance.

Why AM Best Ratings Matter

AM Best Ratings matter because they provide a clear and reliable measure of an insurer's financial health. For consumers, these ratings offer peace of mind, knowing that their chosen provider is financially stable and capable of meeting its obligations. For businesses, AM Best Ratings help identify potential partners with strong financial foundations.

In addition, AM Best Ratings play a crucial role in the regulatory landscape. Many jurisdictions require insurance companies to maintain a certain rating to operate legally. This ensures that consumers and businesses are protected from financial instability in the insurance market.

How to Interpret AM Best Ratings

Interpreting AM Best Ratings requires an understanding of the scale and its categories. Here are some key points to consider:

- Ratings from A++ to A- indicate superior to excellent financial strength.

- Ratings from B++ to B- indicate good to fair financial strength.

- Ratings from C++ to C indicate marginal to weak financial strength.

- A rating of F indicates that the company is in liquidation.

When evaluating an insurer's rating, it's important to consider the context and industry conditions. A company with a lower rating may still be a viable option if it operates in a niche market or specializes in specific types of coverage.

Common Misconceptions About AM Best Ratings

There are several misconceptions about AM Best Ratings that consumers and businesses should be aware of:

- AM Best Ratings are not a guarantee of future performance.

- A high rating does not necessarily mean a company is immune to market fluctuations.

- Ratings can change over time based on new information or changing conditions.

Understanding these nuances is essential for making informed decisions based on AM Best Ratings.

AM Best Ratings vs. Other Rating Agencies

While AM Best is one of the most prominent rating agencies in the insurance industry, it is not the only one. Other agencies, such as Moody's, Standard & Poor's, and Fitch, also provide ratings for insurance companies. However, AM Best stands out for its specialized focus on the insurance sector and its deep understanding of the industry.

Comparing AM Best Ratings with those from other agencies can provide additional insights into an insurer's financial health. However, it's important to remember that each agency uses its own methodology and criteria, so ratings may vary between agencies.

Key Differences Between AM Best and Other Agencies

Some key differences between AM Best and other rating agencies include:

- Focus on the insurance industry

- Specialized methodology and criteria

- Long-standing reputation and expertise

These differences make AM Best Ratings particularly valuable for stakeholders in the insurance sector.

Benefits of AM Best Ratings for Consumers

For consumers, AM Best Ratings offer several benefits:

- They provide a reliable measure of an insurer's financial strength.

- They help consumers make informed decisions when choosing an insurance provider.

- They offer peace of mind, knowing that their chosen provider is financially stable.

By relying on AM Best Ratings, consumers can ensure that they are working with a reputable and financially sound insurance company.

Conclusion

In conclusion, the AM Best Rating Scale is an essential tool for evaluating the financial strength and creditworthiness of insurance companies. By providing a clear and reliable measure of an insurer's ability to meet its obligations, AM Best Ratings help consumers and businesses make informed decisions. Understanding the scale and its categories is crucial for anyone involved in the insurance industry.

We invite you to share your thoughts and experiences with AM Best Ratings in the comments section below. Additionally, feel free to explore other articles on our site for more insights into the insurance industry. Together, we can build a more informed and secure financial future.

Table of Contents