The AM Best rating is one of the most important metrics in the insurance industry, providing valuable insights into a company's financial health and ability to meet its obligations. Whether you're an investor, policyholder, or industry professional, understanding what this rating means is crucial for making informed decisions. In this article, we'll explore the significance of AM Best ratings, how they are calculated, and why they matter to stakeholders.

Insurance companies play a critical role in protecting individuals and businesses from financial risks. However, not all insurers are created equal. Some have stronger financial positions than others, which directly impacts their ability to honor claims. This is where AM Best ratings come into play, offering a standardized way to assess the strength of insurance companies.

As one of the oldest and most respected rating agencies in the world, AM Best has been providing ratings for over a century. Their ratings are widely regarded as the gold standard in the insurance industry, influencing decisions made by millions of people globally. In this article, we'll delve deeper into what these ratings mean and how they affect various stakeholders.

Read also:Morristown Tn Dining A Comprehensive Guide To The Best Restaurants And Culinary Experiences

Table of Contents

- History of AM Best Ratings

- AM Best Rating Scale

- How AM Best Ratings Are Calculated

- Why AM Best Ratings Are Important

- Impact on Different Stakeholders

- Limitations of AM Best Ratings

- Comparison with Other Rating Agencies

- Role in the Insurance Industry

- Future of AM Best Ratings

- Conclusion and Next Steps

History of AM Best Ratings

Established in 1899, AM Best has a long history of providing reliable ratings to the insurance industry. Initially founded by Alfred M. Best, the company began as a directory of insurance companies. Over time, it evolved into a full-fledged rating agency, offering detailed assessments of insurers' financial strength.

Evolution of the Rating System

The rating system has undergone significant changes over the years to adapt to the evolving needs of the industry. Today, AM Best uses a sophisticated methodology that considers multiple factors, including capital adequacy, operating performance, business profile, and risk management.

Key milestones in the evolution of AM Best ratings include:

- Introduction of letter-grade ratings in the early 20th century

- Expansion to international markets in the late 20th century

- Development of advanced analytics and data tools in recent years

AM Best Rating Scale

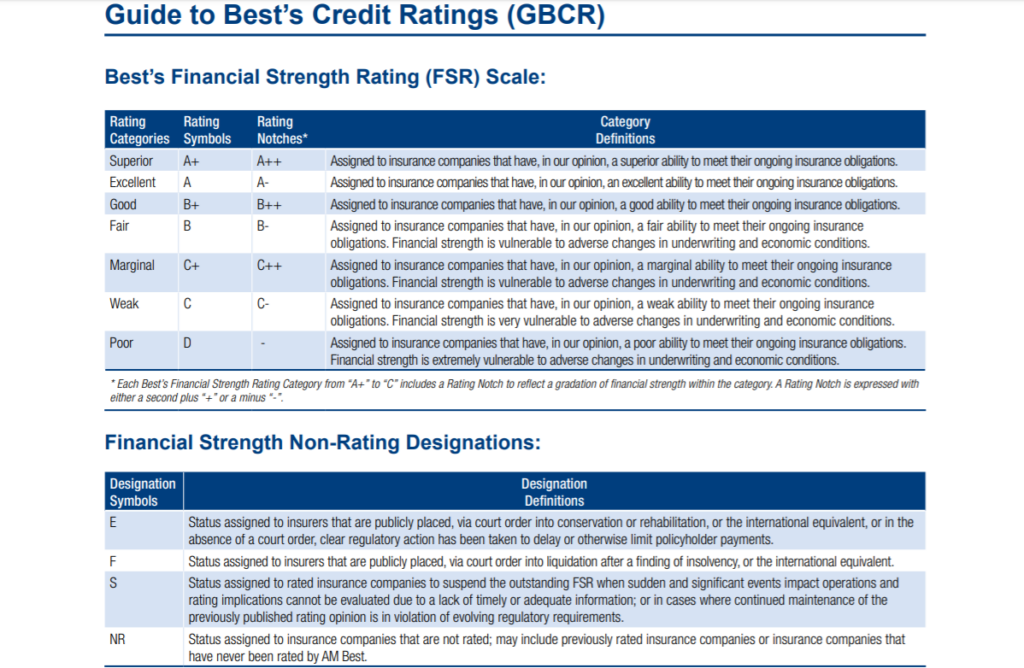

Understanding the AM Best rating scale is essential for interpreting the ratings accurately. The scale ranges from A++ (Superior) to F (In Liquidation), with each category representing a specific level of financial strength.

Breakdown of the Rating Categories

The rating scale is divided into several categories, each with its own subcategories:

- A++ and A+ (Superior): Indicates the highest level of financial strength and ability to meet obligations

- A and A- (Excellent): Represents strong financial health with slightly higher risks

- B++ and B+ (Good): Indicates adequate financial strength but with some vulnerabilities

- B, B-, C++, and C+ (Fair): Suggests marginal financial strength with significant risks

- C, C-, D, E, and F: Represents weak financial health and inability to meet obligations

How AM Best Ratings Are Calculated

The process of calculating AM Best ratings involves a thorough analysis of various financial and non-financial factors. The agency evaluates each insurer based on its unique circumstances, ensuring that the ratings reflect the company's true financial position.

Read also:Top Hotels Near Northbrook Court Mall Your Ultimate Guide

Key Factors in the Calculation Process

Some of the key factors considered in the rating process include:

- Capital adequacy and surplus

- Operating performance and profitability

- Business profile and market position

- Risk management practices

- Management quality and strategic planning

According to a report by AM Best, companies with higher ratings typically demonstrate stronger performance in these areas compared to their peers.

Why AM Best Ratings Are Important

AM Best ratings are crucial for several reasons. They provide stakeholders with a clear picture of an insurer's financial health, helping them make informed decisions. For policyholders, a high rating indicates that the company is likely to honor its claims. For investors, it signals a potentially stable investment opportunity.

Furthermore, regulators often use AM Best ratings as a benchmark for assessing the solvency of insurance companies. This adds another layer of importance to the ratings, making them a vital component of the insurance ecosystem.

Impact on Different Stakeholders

The impact of AM Best ratings varies depending on the stakeholder group. Below, we examine how different groups are affected by these ratings:

Policyholders

For policyholders, AM Best ratings serve as a measure of confidence in their insurer's ability to pay claims. A high rating reassures them that their financial protection is secure.

Investors

Investors rely on AM Best ratings to evaluate the risk and return potential of insurance companies. A strong rating can enhance the attractiveness of an insurer as an investment opportunity.

Regulators

Regulators use AM Best ratings as part of their oversight process, ensuring that insurers maintain adequate financial reserves to protect policyholders.

Limitations of AM Best Ratings

While AM Best ratings are highly regarded, they do have limitations. For instance, they focus primarily on financial strength and may not fully capture other aspects of a company's operations, such as customer service or innovation.

Additionally, ratings are based on historical data and may not always predict future performance. Insurers can experience unexpected challenges that affect their financial health, which may not be immediately reflected in their ratings.

Comparison with Other Rating Agencies

AM Best is not the only rating agency in the insurance industry. Other prominent agencies, such as Standard & Poor's and Moody's, also provide ratings for insurers. However, AM Best stands out due to its specialized focus on the insurance sector.

A study published in the Journal of Risk and Insurance found that AM Best ratings tend to be more closely aligned with the actual performance of insurance companies compared to ratings from general-purpose agencies.

Role in the Insurance Industry

AM Best ratings play a pivotal role in shaping the insurance industry. They influence everything from pricing strategies to risk management practices. Insurers with higher ratings often enjoy better access to capital and lower borrowing costs, giving them a competitive edge.

Moreover, ratings help foster trust between insurers and their customers, contributing to the overall stability of the industry.

Future of AM Best Ratings

As the insurance industry continues to evolve, so too will AM Best ratings. The agency is constantly updating its methodologies to incorporate new data sources and analytical techniques. For example, advancements in artificial intelligence and machine learning are being explored to enhance the accuracy and timeliness of ratings.

Looking ahead, AM Best is expected to expand its reach into emerging markets, providing ratings for insurers in regions previously underserved by traditional rating agencies.

Conclusion and Next Steps

In conclusion, AM Best ratings are an indispensable tool for anyone involved in the insurance industry. They provide valuable insights into the financial health of insurers, helping stakeholders make informed decisions. Whether you're a policyholder, investor, or regulator, understanding what these ratings mean is crucial for navigating the complexities of the insurance landscape.

We encourage you to take the following steps:

- Review the AM Best ratings of your current insurer

- Explore how these ratings impact your financial decisions

- Stay informed about updates and changes in the rating methodologies

Feel free to share your thoughts in the comments section below or explore other articles on our site for more information on insurance and financial topics.