The Wisconsin Department of Revenue (WDR) plays a crucial role in managing the state's financial health by overseeing tax policies, administering tax programs, and ensuring compliance. Whether you're a resident, business owner, or simply someone interested in understanding the state's fiscal framework, this department is instrumental in shaping Wisconsin's economy. In this article, we'll delve into the functions, services, and responsibilities of the Wisconsin Dept of Revenue, providing you with actionable insights and valuable information.

As one of the key government agencies in Wisconsin, the Department of Revenue is responsible for collecting taxes, enforcing tax laws, and offering support to taxpayers. Its mission is to ensure that the state's revenue system is fair, efficient, and transparent. Whether it's individual income taxes, sales taxes, or corporate taxes, the WDR touches every aspect of the financial lives of Wisconsin residents.

This article aims to provide a thorough understanding of the Wisconsin Dept of Revenue, covering everything from its history and functions to the latest updates in tax regulations. By the end of this guide, you'll have a clearer picture of how the department operates and how it impacts your financial responsibilities as a taxpayer in Wisconsin.

Read also:Mike Love Net Worth The Untold Story Of A Music Icons Financial Empire

Table of Contents

- History of the Wisconsin Dept of Revenue

- Key Functions and Responsibilities

- Types of Taxes Administered by WDR

- Services Offered by the Wisconsin Dept of Revenue

- Taxpayer Compliance and Enforcement

- Resources for Taxpayers

- Important Statistics and Data

- Recent Changes and Updates

- Future Plans and Initiatives

- Conclusion

History of the Wisconsin Dept of Revenue

Established in the early 20th century, the Wisconsin Dept of Revenue has evolved significantly over the years to meet the changing needs of the state's economy. Initially tasked with collecting property taxes, the department's responsibilities have expanded to include a wide range of tax-related activities. The evolution of the WDR reflects Wisconsin's commitment to maintaining a robust and equitable tax system.

Key Milestones in the Department's History

Throughout its history, the Wisconsin Dept of Revenue has achieved several milestones that have shaped its current structure and operations:

- Introduction of the state income tax in the 1930s.

- Expansion of sales tax administration in the 1950s.

- Implementation of electronic filing systems in the 1990s.

Key Functions and Responsibilities

The Wisconsin Dept of Revenue is responsible for a multitude of functions that ensure the smooth operation of the state's tax system. These functions include tax collection, enforcement, and taxpayer assistance. By maintaining a balance between regulatory enforcement and taxpayer support, the department aims to foster trust and compliance among residents and businesses.

Primary Responsibilities of the WDR

- Administering state tax laws and regulations.

- Providing guidance and resources to taxpayers.

- Ensuring compliance through audits and investigations.

Types of Taxes Administered by WDR

The Wisconsin Dept of Revenue oversees several types of taxes that contribute to the state's revenue. Understanding these taxes is essential for both individuals and businesses to meet their financial obligations.

Common Taxes Administered

- Income Tax: Applies to individuals and businesses earning income in Wisconsin.

- Sales Tax: Levied on the sale of goods and services within the state.

- Corporate Tax: Imposed on businesses operating within Wisconsin.

Services Offered by the Wisconsin Dept of Revenue

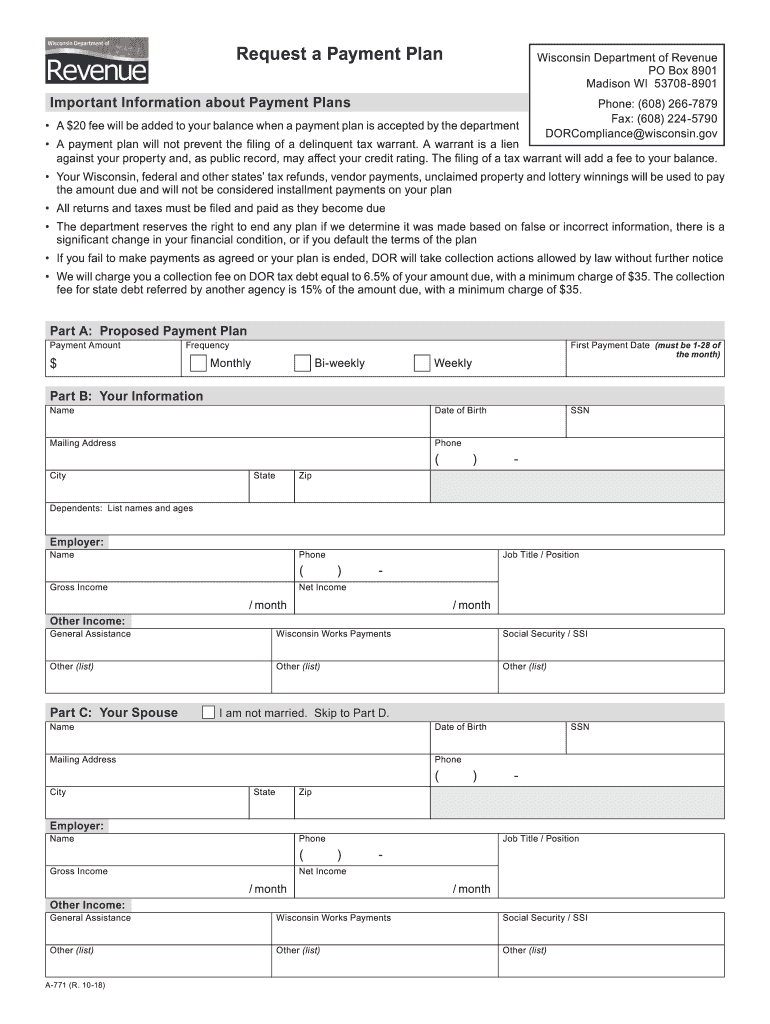

One of the key aspects of the Wisconsin Dept of Revenue is the wide array of services it offers to taxpayers. These services are designed to simplify the tax filing process and provide assistance when needed.

Notable Services

- Online filing options for various tax forms.

- Customer support through phone, email, and in-person assistance.

- Publications and guides for taxpayers to better understand tax obligations.

Taxpayer Compliance and Enforcement

Ensuring taxpayer compliance is a critical function of the Wisconsin Dept of Revenue. The department employs various strategies to encourage voluntary compliance while also addressing cases of non-compliance.

Read also:Jr Ridinger Cause Of Death A Comprehensive Exploration

Enforcement Strategies

The WDR uses a combination of audits, penalties, and educational outreach to promote compliance. By focusing on education and support, the department aims to minimize instances of intentional non-compliance.

Resources for Taxpayers

The Wisconsin Dept of Revenue provides numerous resources to help taxpayers navigate the complexities of tax laws. These resources include online tools, publications, and educational programs.

Popular Resources

- Interactive tax calculators.

- Guides for specific tax situations, such as self-employment or rental income.

- Workshops and seminars for businesses and individuals.

Important Statistics and Data

Data and statistics play a vital role in understanding the impact of the Wisconsin Dept of Revenue on the state's economy. Below are some key figures that highlight the department's contributions:

Key Statistics

- Annual revenue collected: Over $20 billion.

- Number of tax returns processed annually: Approximately 3 million.

- Percentage of taxpayers filing electronically: 85%.

Recent Changes and Updates

The Wisconsin Dept of Revenue regularly updates its policies and procedures to align with changing economic conditions and legislative mandates. Recent changes include updates to tax rates, filing deadlines, and electronic filing requirements.

Notable Updates

- Adjustments to income tax brackets for the current fiscal year.

- New guidelines for remote workers and their tax obligations.

Future Plans and Initiatives

Looking ahead, the Wisconsin Dept of Revenue has several initiatives planned to enhance its services and improve taxpayer experiences. These initiatives focus on technology upgrades, increased educational outreach, and streamlined processes.

Upcoming Initiatives

- Implementation of advanced data analytics for better taxpayer support.

- Expansion of online services to include more tax forms and processes.

Conclusion

The Wisconsin Dept of Revenue is a vital component of the state's fiscal infrastructure, ensuring that taxes are collected fairly and efficiently. By understanding its functions, services, and responsibilities, taxpayers can better navigate their financial obligations and take advantage of the resources available.

We encourage you to explore the resources provided by the WDR and stay informed about the latest updates in tax regulations. If you have any questions or need further assistance, don't hesitate to reach out to the department or consult with a tax professional. Share this article with others who may benefit from the information, and consider exploring related topics on our website for a comprehensive understanding of Wisconsin's tax landscape.

For more information, refer to the official website of the Wisconsin Dept of Revenue or consult authoritative sources such as the IRS and Wisconsin State Legislature publications.