Understanding taxes can be overwhelming, especially when navigating them in a foreign language. TurboTax en Español is designed to help Spanish-speaking individuals file their taxes with ease and confidence. Whether you're new to the U.S. tax system or simply prefer using Spanish, TurboTax offers a user-friendly platform tailored to your needs.

Millions of people rely on TurboTax for its intuitive interface and expert guidance. However, for Spanish speakers, TurboTax en Español takes it a step further by providing all the necessary tools in their preferred language. This ensures that everyone, regardless of language proficiency, can file their taxes accurately and efficiently.

In this article, we will explore everything you need to know about TurboTax en Español. From its features and benefits to step-by-step instructions, we aim to provide you with the information required to make the most of this service. Let's dive in!

Read also:Unveiling The Glamour Of Dti Crystal Couture A Comprehensive Guide

Table of Contents

- What is TurboTax en Español?

- Key Features of TurboTax en Español

- Benefits of Using TurboTax en Español

- How to Use TurboTax en Español

- Pricing Plans for TurboTax en Español

- Common Tax Forms Available in Spanish

- Customer Support for Spanish Speakers

- Tips for Filing Taxes with TurboTax en Español

- Statistics on Spanish-Speaking Taxpayers

- Conclusion

What is TurboTax en Español?

TurboTax en Español is a specialized version of TurboTax designed specifically for Spanish-speaking taxpayers in the United States. It provides a fully translated platform where users can file their taxes in Spanish without needing to switch between languages. This service is particularly beneficial for those who may face language barriers when dealing with complex tax forms.

TurboTax en Español offers a comprehensive suite of tools, including interview-style questionnaires, detailed explanations of tax concepts, and real-time guidance. The platform is updated annually to reflect the latest tax laws and regulations, ensuring that users receive accurate and up-to-date information.

History of TurboTax en Español

Since its introduction, TurboTax en Español has been a game-changer for Spanish-speaking taxpayers. Developed by Intuit, the company behind TurboTax, this service was created in response to the growing demand for tax solutions in Spanish. Over the years, it has evolved to include more features and support options, making it an indispensable tool for many.

Key Features of TurboTax en Español

TurboTax en Español boasts several key features that make it an ideal choice for Spanish-speaking taxpayers. Below are some of the standout features:

- Spanish Language Interface: The entire platform is available in Spanish, including all forms, instructions, and support materials.

- Interview-Style Questionnaire: Users are guided through a series of questions that help determine their tax situation and calculate their refund or payment.

- Real-Time Guidance: TurboTax en Español provides instant feedback and explanations for each step, ensuring users understand the process.

- Comprehensive Tax Coverage: The service supports a wide range of tax forms, including those for self-employed individuals and small business owners.

Accessibility Features

TurboTax en Español also includes accessibility features to ensure that all users can access the platform easily. These features include screen reader compatibility and adjustable font sizes for better readability.

Benefits of Using TurboTax en Español

Choosing TurboTax en Español offers numerous benefits, especially for Spanish-speaking taxpayers. Here are some of the most significant advantages:

Read also:Brown Discharge Before Period Causes Symptoms And What You Need To Know

- Language Comfort: Users can complete their tax filings in their preferred language, reducing confusion and errors.

- Accuracy: With real-time guidance and automatic calculations, TurboTax en Español helps ensure that all tax forms are filled out correctly.

- Convenience: The platform is accessible online, allowing users to file their taxes from anywhere with an internet connection.

- Cost-Effective: TurboTax en Español offers various pricing plans, making it affordable for individuals and families.

Peace of Mind

One of the biggest benefits of TurboTax en Español is the peace of mind it provides. Knowing that your taxes are being handled accurately and efficiently can alleviate a lot of stress during tax season.

How to Use TurboTax en Español

Using TurboTax en Español is straightforward and user-friendly. Follow these simple steps to get started:

- Create an Account: Visit the TurboTax website and select the "en Español" option to create an account.

- Choose a Plan: Select the pricing plan that best suits your needs, whether you're filing as an individual or a small business owner.

- Start the Interview: Begin the interview-style questionnaire, answering questions about your income, deductions, and credits.

- Review and Submit: Once you've completed the interview, review your tax return for accuracy before submitting it electronically.

Step-by-Step Instructions

Each step of the process is clearly explained in Spanish, ensuring that users can navigate the platform with ease. Additionally, TurboTax en Español provides helpful tips and reminders throughout the process to ensure nothing is overlooked.

Pricing Plans for TurboTax en Español

TurboTax en Español offers several pricing plans to accommodate different tax situations. Below is a breakdown of the available options:

- TurboTax Free: Ideal for simple tax situations with a federal filing fee of $0 and a state filing fee of $39.

- TurboTax Deluxe: Suitable for those with investments or self-employment income, priced at $70 for federal filing and $49 for state filing.

- TurboTax Premier: Designed for more complex tax situations, including rental properties and business income, priced at $100 for federal filing and $49 for state filing.

Value for Money

While the pricing plans vary, TurboTax en Español offers excellent value for money. The platform's accuracy and ease of use make it a worthwhile investment for anyone looking to file their taxes confidently.

Common Tax Forms Available in Spanish

TurboTax en Español supports a wide range of tax forms, ensuring that users can file all necessary documents in Spanish. Some of the most common forms include:

- Form 1040: U.S. Individual Income Tax Return

- Form W-2: Wage and Tax Statement

- Form 1099: Miscellaneous Income

- Schedule C: Profit or Loss from Business

Additional Forms

In addition to these common forms, TurboTax en Español also supports specialized forms for specific tax situations, such as those for self-employed individuals or small business owners.

Customer Support for Spanish Speakers

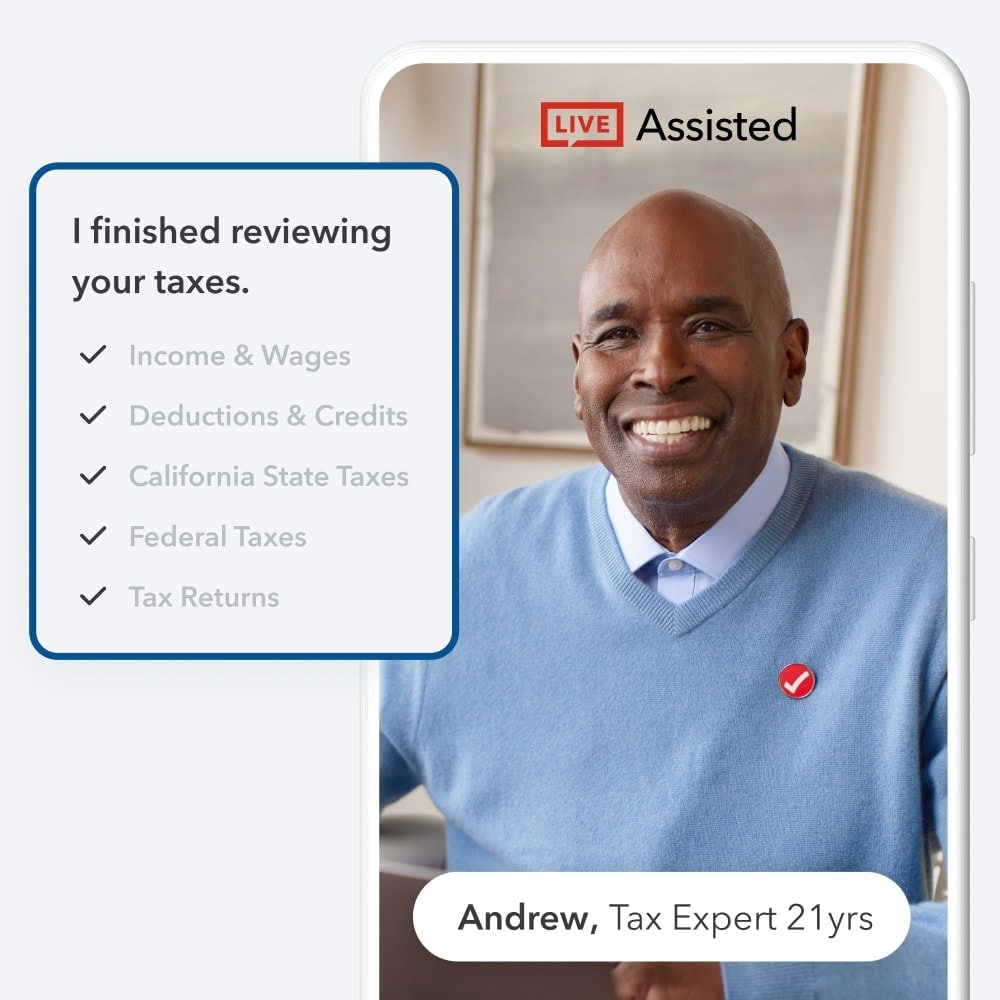

TurboTax en Español offers robust customer support options specifically tailored for Spanish-speaking users. These include:

- Live Chat: Real-time assistance from bilingual tax experts.

- Phone Support: Dedicated phone lines for Spanish-speaking customers.

- FAQ Section: A comprehensive list of frequently asked questions and answers in Spanish.

Support Availability

Customer support is available throughout the tax season, ensuring that users can get help whenever they need it. The support team is knowledgeable and responsive, providing quick solutions to any issues that may arise.

Tips for Filing Taxes with TurboTax en Español

Here are some tips to make the most of TurboTax en Español when filing your taxes:

- Gather All Necessary Documents: Before starting, ensure you have all relevant tax documents, such as W-2s and 1099s.

- Set Aside Enough Time: Allocate sufficient time to complete the process, especially if you have a complex tax situation.

- Review Your Return: Carefully review your tax return before submitting it to catch any potential errors.

Maximizing Your Refund

Using TurboTax en Español can help you maximize your tax refund by ensuring that you claim all eligible deductions and credits. The platform's guidance and support make it easier to identify opportunities for savings.

Statistics on Spanish-Speaking Taxpayers

According to the U.S. Census Bureau, there are over 41 million Spanish speakers in the United States. This demographic represents a significant portion of the population, and many rely on services like TurboTax en Español to file their taxes. Studies show that Spanish-speaking taxpayers are more likely to use tax preparation software when it is available in their preferred language.

Growth in Usage

The usage of TurboTax en Español has been steadily increasing, reflecting the growing demand for Spanish-language tax solutions. This trend is expected to continue as more Spanish speakers become aware of the service and its benefits.

Conclusion

TurboTax en Español is a powerful tool for Spanish-speaking taxpayers looking to file their taxes with confidence and ease. With its comprehensive features, user-friendly interface, and dedicated customer support, it stands out as a top choice for handling tax-related matters.

We encourage you to take advantage of TurboTax en Español and simplify your tax filing process. For more information or assistance, feel free to leave a comment or explore other articles on our website. Remember, filing your taxes doesn't have to be stressful—let TurboTax en Español do the work for you!