Experian Boost has revolutionized the way individuals can enhance their credit scores by factoring in utility and subscription payments. If you're wondering what bills qualify for Experian Boost, you're in the right place. This article will provide a detailed breakdown of the program, eligible bills, and how to maximize its benefits. Whether you're looking to build credit from scratch or improve an existing score, Experian Boost offers a valuable opportunity.

Managing finances effectively is a top priority for many individuals, and credit scores play a crucial role in financial health. A strong credit score opens doors to better loan rates, credit card options, and even rental opportunities. Experian Boost empowers users by incorporating everyday payments into credit calculations, leveling the playing field for those who may not have traditional credit history.

In this guide, we'll explore the ins and outs of Experian Boost, including which bills qualify, how the system works, and actionable steps to take advantage of this service. By the end, you'll have a clear understanding of how to leverage Experian Boost to boost your credit score.

Read also:Brown Discharge Before Period Causes Symptoms And What You Need To Know

Table of Contents

- How Experian Boost Works

- What Bills Qualify for Experian Boost?

- Eligibility Criteria for Experian Boost

- Steps to Enroll in Experian Boost

- Benefits of Using Experian Boost

- Limitations of Experian Boost

- Common Questions About Experian Boost

- Data Security and Privacy

- Impact on Your Credit Score

- Final Thoughts and Call to Action

How Experian Boost Works

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows users to include their utility and subscription payments in their credit file, which can positively impact their credit score. The system works by connecting to your bank accounts and identifying eligible transactions. Once verified, these payments are added to your Experian credit report.

This service is particularly beneficial for individuals who may not have a robust credit history or are looking to rebuild their credit. By factoring in regular payments such as phone bills, internet services, and streaming subscriptions, Experian Boost provides a more comprehensive view of financial responsibility.

It's important to note that Experian Boost only affects your Experian credit score and does not influence reports from other bureaus like Equifax or TransUnion. However, many lenders use Experian scores, making this service highly valuable.

What Bills Qualify for Experian Boost?

Utility Payments

Utility payments are among the most common types of bills that qualify for Experian Boost. These include electricity, gas, water, and garbage services. If you consistently pay these bills on time, they can significantly contribute to your credit score improvement.

Telecommunication Bills

Telecommunication bills, such as mobile phone and landline services, are also eligible. Whether you're on a prepaid or postpaid plan, these payments can be included in your credit file through Experian Boost.

Streaming and Subscription Services

Modern subscriptions, including streaming platforms like Netflix, Hulu, or Spotify, as well as monthly memberships like gym subscriptions or cloud storage services, qualify for Experian Boost. These recurring payments demonstrate financial reliability and can enhance your credit profile.

Read also:Top Patreon Alternatives For Creators Building A Thriving Community

Key Takeaway: To qualify for Experian Boost, payments must be made directly from a bank account and must be recurring in nature.

Eligibility Criteria for Experian Boost

To participate in Experian Boost, users must meet certain eligibility criteria. First, you need to have an Experian account. If you don't already have one, creating an account is quick and straightforward. Second, you must connect at least one bank account to Experian Boost. The system will scan your transactions over the past two years to identify eligible payments.

Eligible payments must be recurring and made directly from a bank account. One-time payments or cash transactions do not qualify. Additionally, the service is currently available only in the United States, so international users cannot take advantage of this feature.

Here’s a quick checklist for eligibility:

- Create an Experian account

- Connect at least one bank account

- Ensure payments are recurring and made directly from the bank

- Reside in the United States

Steps to Enroll in Experian Boost

Enrolling in Experian Boost is a simple and user-friendly process. Follow these steps to get started:

- Visit the Experian Boost website and sign up for an account.

- Log in to your account and navigate to the Experian Boost section.

- Connect your bank account by entering your login credentials. Experian uses secure encryption to protect your data.

- Review the transactions identified by Experian Boost. You can choose which payments to include in your credit file.

- Submit your selections, and Experian will update your credit report within minutes.

Once enrolled, you can monitor the impact of Experian Boost on your credit score through your Experian account.

Benefits of Using Experian Boost

Experian Boost offers several advantages for users looking to improve their credit standing:

- Free Service: There are no costs associated with using Experian Boost, making it an accessible option for everyone.

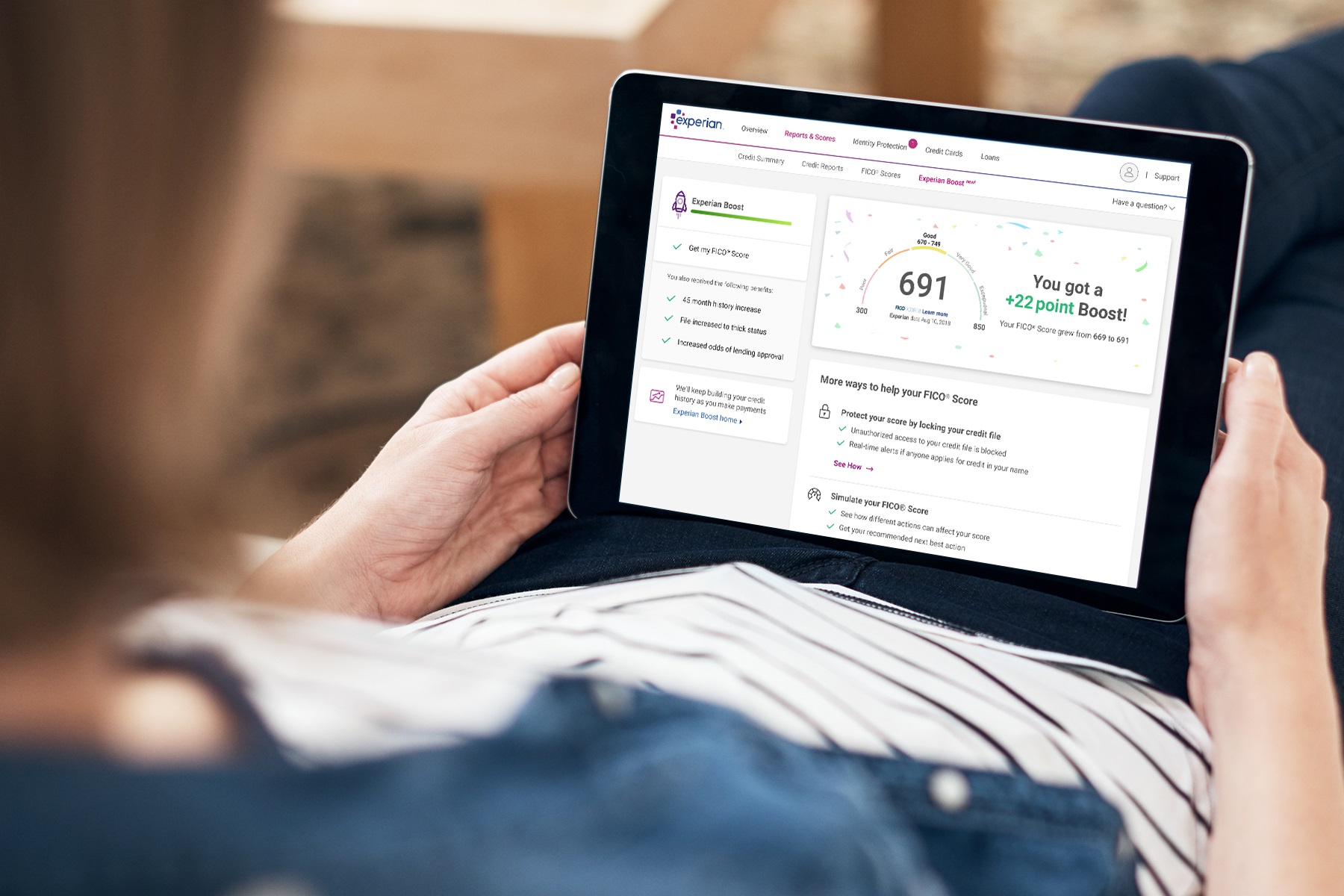

- Quick Results: Updates to your credit report and score are reflected almost immediately after enrollment.

- Improved Credit Access: A higher credit score can lead to better loan terms, lower interest rates, and increased credit card approval chances.

- Recognition of Everyday Payments: Experian Boost acknowledges the financial responsibility demonstrated through utility and subscription payments.

These benefits make Experian Boost a valuable tool for anyone aiming to enhance their financial profile.

Limitations of Experian Boost

While Experian Boost is a powerful tool, it does have some limitations:

- It only affects your Experian credit report and score, not those from other credit bureaus.

- Not all lenders use Experian scores, so the impact may vary depending on the financial institution.

- Eligible payments must be made directly from a bank account, excluding cash or check payments.

Despite these limitations, the benefits often outweigh the drawbacks for many users.

Common Questions About Experian Boost

Does Experian Boost Work for Everyone?

Experian Boost is designed to work for most individuals, but its effectiveness depends on the types of payments you make and how they align with the eligibility criteria. If you primarily use cash or check payments, you may not see significant improvements.

How Long Does It Take to See Results?

Results are typically visible within minutes after submitting your selections. However, the actual impact on your credit score can vary based on your overall credit profile.

Can I Remove Payments from My Credit File?

Yes, you have the option to remove payments from your credit file at any time through your Experian account. This flexibility allows you to customize your credit report according to your needs.

Data Security and Privacy

Experian prioritizes data security and privacy. The platform uses advanced encryption and secure authentication methods to protect your financial information. All transactions reviewed by Experian Boost are handled with the utmost confidentiality, ensuring that your personal data remains safe.

Additionally, Experian adheres to strict regulatory standards, such as the Fair Credit Reporting Act (FCRA), to safeguard user information.

Impact on Your Credit Score

The impact of Experian Boost on your credit score depends on your current credit profile. For individuals with limited credit history, the effect can be substantial, as it introduces new data points for evaluation. On the other hand, those with established credit histories may see more modest improvements.

According to Experian, users who enrolled in the program saw an average increase of 13 points in their FICO Score. However, individual results may vary based on factors such as payment history, credit utilization, and other credit-related activities.

Final Thoughts and Call to Action

Experian Boost offers a unique opportunity to enhance your credit score by incorporating everyday payments into your credit file. By understanding what bills qualify for Experian Boost and following the enrollment steps, you can take control of your financial future.

We encourage you to take action today by signing up for Experian Boost and exploring its benefits. Share your experiences in the comments below and help others learn about this valuable service. Additionally, explore other articles on our site to deepen your knowledge of credit management and financial wellness.

Data Sources: