When it comes to protecting your vehicle, finding the right auto insurance is crucial. GEICO, one of the leading insurance providers in the U.S., offers competitive rates and excellent customer service. If you're considering getting a GEICO insurance quote, this guide will help you navigate the process and make an informed decision.

GEICO has been a trusted name in the insurance industry for decades, offering affordable coverage options tailored to meet individual needs. Whether you're a first-time driver or a seasoned motorist, understanding how to call GEICO for a quote is the first step toward securing the best deal.

This article will provide you with all the information you need to contact GEICO, understand their quote process, and explore the factors that influence your premium. Let's dive in!

Read also:Tawartlist Art Directory By Theartworld Your Ultimate Guide To Discovering And Exploring Art

Table of Contents

- Introduction to GEICO Insurance

- Why Choose GEICO?

- The Process of Calling GEICO for a Quote

- Factors Affecting Your GEICO Insurance Quote

- Types of Coverage Offered by GEICO

- Tips for Saving on GEICO Insurance

- GEICO Customer Support and Service

- Online vs. Phone Quotes: Which is Better?

- Common Questions About GEICO Insurance Quotes

- Conclusion

Introduction to GEICO Insurance

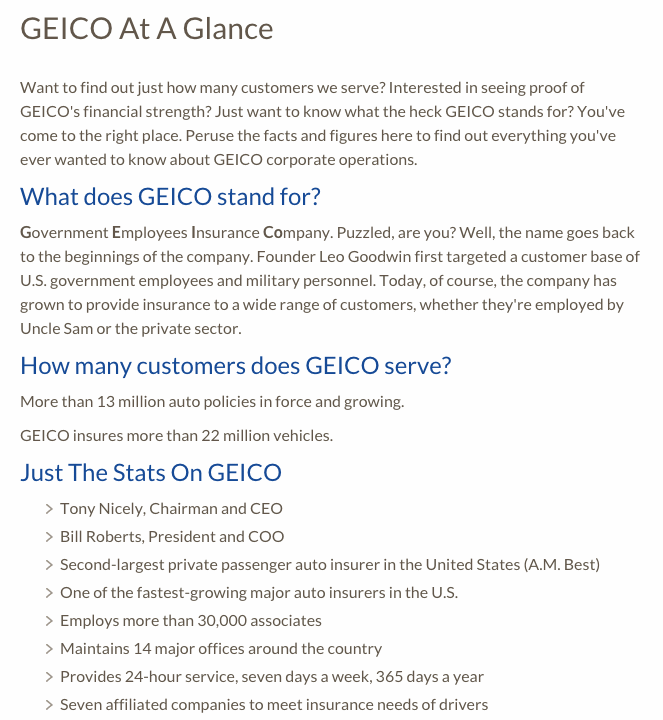

GEICO, which stands for Government Employees Insurance Company, was founded in 1936. Over the years, it has grown into one of the largest auto insurance providers in the United States. Known for its competitive rates and excellent customer service, GEICO serves millions of policyholders nationwide.

History of GEICO

GEICO began as a company offering insurance exclusively to government employees. However, it expanded its services to include all types of drivers, making it accessible to a broader audience. Today, GEICO offers a wide range of insurance products, including auto, motorcycle, boat, and home insurance.

Why GEICO is Popular

- Competitive pricing

- Comprehensive coverage options

- Excellent customer service

- Convenient online and phone services

Why Choose GEICO?

Choosing the right insurance provider can be overwhelming, but GEICO stands out for several reasons. Their commitment to affordability, reliability, and customer satisfaction makes them a top choice for many drivers.

Cost-Effective Solutions

GEICO is known for offering some of the most competitive rates in the industry. By bundling policies and taking advantage of discounts, you can save even more on your premiums.

Excellent Customer Service

GEICO's customer service team is available 24/7 to assist with any questions or concerns you may have. Their representatives are knowledgeable and dedicated to providing personalized service.

The Process of Calling GEICO for a Quote

Getting a GEICO insurance quote over the phone is straightforward and efficient. Here's a step-by-step guide to help you through the process:

Read also:Brown Discharge Before Period Causes Symptoms And What You Need To Know

Step 1: Gather Your Information

Before you call, make sure you have the following details handy:

- Vehicle information (make, model, year)

- Driver information (name, date of birth, license number)

- Current insurance policy details (if applicable)

Step 2: Dial the GEICO Phone Number

Call GEICO's customer service line at 1-800-841-3000 to speak with a representative. They will guide you through the quoting process and answer any questions you may have.

Step 3: Provide Your Details

Once connected, the representative will ask for your personal and vehicle information. Be prepared to answer questions about your driving history and any discounts you may qualify for.

Factors Affecting Your GEICO Insurance Quote

Several factors influence the cost of your GEICO insurance premium. Understanding these factors can help you manage your expectations and potentially lower your rates.

1. Driving Record

Your driving history plays a significant role in determining your insurance rates. A clean record with no accidents or violations typically results in lower premiums.

2. Vehicle Type

The make, model, and year of your vehicle affect your insurance costs. Sports cars and luxury vehicles generally have higher premiums due to their higher value and repair costs.

3. Location

Where you live can impact your insurance rates. Urban areas with higher crime and accident rates often have higher premiums compared to rural areas.

Types of Coverage Offered by GEICO

GEICO offers a variety of coverage options to ensure you're protected in various scenarios. Here's a breakdown of the main types of coverage:

Liability Coverage

This covers damages or injuries you cause to others in an accident. It's a mandatory coverage in most states.

Collision Coverage

This pays for repairs or replacement of your vehicle if it's damaged in an accident, regardless of who is at fault.

Comprehensive Coverage

This covers non-collision damages such as theft, vandalism, or natural disasters.

Tips for Saving on GEICO Insurance

There are several ways to reduce your GEICO insurance costs without compromising coverage. Consider the following tips:

1. Bundle Policies

Combine your auto insurance with other policies, such as home or renters insurance, to receive a discount.

2. Take Advantage of Discounts

GEICO offers various discounts for safe drivers, good students, military members, and more. Ask your representative about available discounts.

3. Increase Deductible

Opting for a higher deductible can lower your monthly premium, but be sure you can afford the deductible if you need to file a claim.

GEICO Customer Support and Service

GEICO's customer support is renowned for its efficiency and professionalism. Their representatives are trained to assist with all aspects of your policy, from quoting to claims processing.

24/7 Availability

GEICO's customer service is available around the clock, ensuring you can get help whenever you need it.

Mobile App

Download the GEICO Mobile app to manage your policy, pay bills, and access roadside assistance on the go.

Online vs. Phone Quotes: Which is Better?

Both online and phone quotes from GEICO have their advantages. Here's a comparison to help you decide:

Online Quotes

- Quick and convenient

- Available anytime

- May not include personalized recommendations

Phone Quotes

- Personalized assistance

- Opportunity to ask questions

- May take longer to complete

Common Questions About GEICO Insurance Quotes

Here are answers to some frequently asked questions about GEICO insurance quotes:

1. How Long Does It Take to Get a Quote?

Getting a quote usually takes about 10-15 minutes, depending on the method you choose and the complexity of your needs.

2. Can I Get a Quote Without Providing Personal Information?

You can get an estimate without providing personal details, but for a more accurate quote, you'll need to share some basic information about yourself and your vehicle.

3. Is GEICO Available in All States?

Yes, GEICO operates in all 50 states and the District of Columbia.

Conclusion

Calling GEICO for an insurance quote is a simple and effective way to find affordable coverage for your vehicle. By understanding the factors that influence your premium and taking advantage of available discounts, you can save money while ensuring you're adequately protected.

We encourage you to take action by contacting GEICO today to get your personalized quote. Don't forget to share this article with friends and family who may benefit from the information. For more tips and insights on insurance, explore our other articles on the website.