When it comes to insurance, GEICO (Government Employees Insurance Company) stands out as a leader in providing quality coverage at competitive rates. Founded in 1936, GEICO has grown to become one of the largest automobile insurers in the United States, offering a wide range of insurance products. If you're looking for a GEICO insurance company quote, this comprehensive guide will help you understand how the process works, the factors that influence your premium, and tips to get the best deal.

Insurance is not just a financial safeguard; it's an essential part of modern life. Whether you're insuring your vehicle, home, or other assets, having the right coverage can provide peace of mind. GEICO's reputation for customer service, ease of use, and affordable rates makes it an attractive option for many consumers.

This article will delve into every aspect of GEICO insurance quotes, including how to obtain one, what factors affect your premium, and strategies to save money. By the end of this guide, you'll be well-equipped to make informed decisions about your insurance needs.

Read also:Kylie Jenners Dad The Story Behind The Fame

Table of Contents

- History of GEICO Insurance Company

- Types of Insurance Offered by GEICO

- How to Get a GEICO Insurance Company Quote

- Factors That Affect Your GEICO Insurance Quote

- Tips to Save on GEICO Insurance

- The Online GEICO Quote Process

- GEICO's Customer Service and Reputation

- Comparing GEICO with Other Insurers

- Legal Requirements for Insurance

- Conclusion

History of GEICO Insurance Company

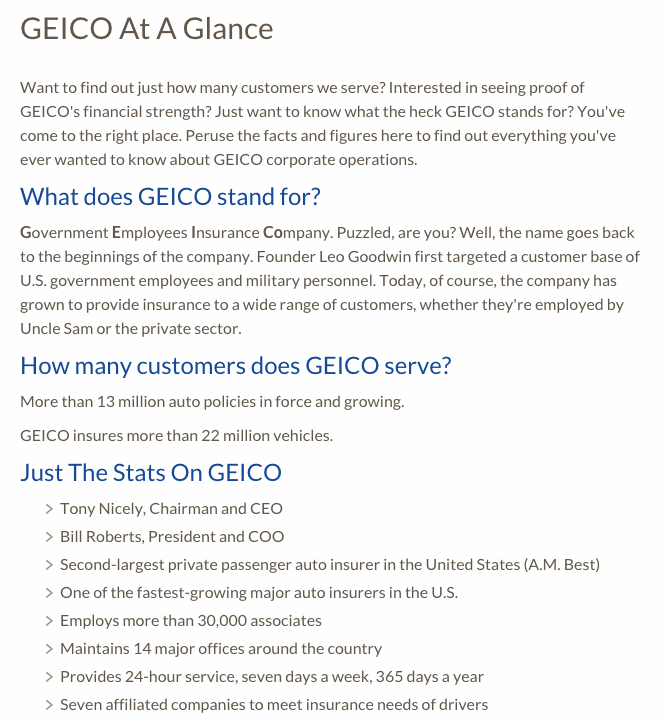

GEICO was founded in 1936 by Leo Goodwin and his wife, Lillian, with the aim of providing affordable auto insurance to government employees. Over the years, GEICO expanded its services to include a broader customer base and diversified its product offerings. Today, GEICO serves millions of policyholders across the United States, offering various types of insurance, including auto, home, renters, and life insurance.

The company is known for its innovative marketing strategies, including the famous GEICO Gecko mascot and its catchy slogan, "15 minutes could save you 15% or more on car insurance." GEICO's commitment to customer satisfaction has earned it a loyal customer base and a strong reputation in the insurance industry.

Types of Insurance Offered by GEICO

Auto Insurance

GEICO's auto insurance is one of its most popular offerings. It provides coverage for damages to your vehicle, liability for accidents, and additional protections such as roadside assistance and rental car reimbursement.

Homeowners Insurance

GEICO also offers homeowners insurance, which protects your home and personal belongings from damages caused by fire, theft, and other covered perils. This insurance can also cover liability claims if someone is injured on your property.

Renters Insurance

Renters insurance from GEICO provides coverage for your personal belongings and liability protection if you rent your home or apartment. It's an affordable way to safeguard your possessions and protect yourself from potential lawsuits.

How to Get a GEICO Insurance Company Quote

Obtaining a GEICO insurance company quote is straightforward and can be done in several ways:

Read also:Lauren Lake Net Worth A Comprehensive Analysis Of Her Financial Journey

- Online: Visit GEICO's official website and use their online quote tool to get an instant quote.

- Phone: Call GEICO's customer service line and speak with a representative who can guide you through the process.

- In Person: Visit a local GEICO office or authorized agent to discuss your insurance needs and receive a personalized quote.

Regardless of the method you choose, you'll be asked to provide information about your vehicle, driving history, and desired coverage options to generate an accurate quote.

Factors That Affect Your GEICO Insurance Quote

Driving Record

Your driving history plays a significant role in determining your insurance premium. A clean driving record with no accidents or traffic violations can lead to lower rates.

Vehicle Type

The type of vehicle you own can influence your insurance cost. Luxury cars or high-performance vehicles typically cost more to insure due to their higher value and repair costs.

Location

Where you live also affects your GEICO insurance quote. Urban areas with higher crime rates or more accidents may result in higher premiums compared to rural areas.

Tips to Save on GEICO Insurance

Here are some strategies to help you save money on your GEICO insurance:

- Bundle Policies: Combining multiple policies, such as auto and home insurance, can often lead to significant discounts.

- Improve Your Credit Score: Many insurance companies, including GEICO, consider your credit score when determining your premium. A higher credit score can result in lower rates.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium, although it means you'll pay more out-of-pocket in the event of a claim.

The Online GEICO Quote Process

Getting a GEICO insurance company quote online is quick and convenient. Here's a step-by-step guide to the process:

- Visit GEICO's official website and navigate to the quote section.

- Enter your zip code to begin the process.

- Provide details about your vehicle, including make, model, and year.

- Answer questions about your driving history and coverage preferences.

- Review your quote and make any necessary adjustments.

- Submit your information to receive your final quote.

This process typically takes around 10-15 minutes, and you'll receive an instant quote based on the information you provide.

GEICO's Customer Service and Reputation

GEICO is renowned for its exceptional customer service. The company offers 24/7 support through its website, mobile app, and customer service hotline. GEICO's representatives are trained to assist with policy questions, claims processing, and other insurance-related inquiries.

According to J.D. Power's annual insurance satisfaction rankings, GEICO consistently ranks highly for customer service, ease of use, and claims handling. This strong reputation contributes to its popularity among consumers.

Comparing GEICO with Other Insurers

State Farm

State Farm is another major player in the insurance industry, offering similar products to GEICO. While both companies provide competitive rates, GEICO is often praised for its faster claims processing and more straightforward policies.

Allstate

Allstate is known for its Good Hands customer service and comprehensive coverage options. However, GEICO often offers lower rates for similar coverage, making it an attractive choice for budget-conscious consumers.

Legal Requirements for Insurance

It's important to understand the legal requirements for insurance in your state. Most states mandate that drivers carry a minimum level of liability insurance to cover damages in the event of an accident. GEICO ensures compliance with these regulations and offers additional coverage options to meet your specific needs.

Always verify the specific requirements in your state and ensure your policy meets or exceeds those standards.

Conclusion

In conclusion, obtaining a GEICO insurance company quote is a simple process that can lead to significant savings on your insurance premiums. By understanding the factors that influence your quote and utilizing strategies to save money, you can secure the coverage you need at an affordable price.

We encourage you to share your thoughts and experiences with GEICO in the comments section below. Additionally, feel free to explore other articles on our website for more valuable insights into insurance and personal finance. Thank you for reading, and we hope this guide has been helpful in your insurance journey!

Source: GEICO Official Website