Home Depot's 0% financing for 24 months offers homeowners a fantastic opportunity to upgrade their living spaces without immediate financial strain. This special financing option allows you to purchase essential home improvement products and equipment while enjoying interest-free payments over two years. Whether you're renovating your kitchen, updating your bathroom, or enhancing your outdoor space, this deal can significantly boost your home's value and functionality.

Homeowners often delay essential upgrades due to budget constraints. However, with the Home Depot 0% financing offer, you can transform your home without worrying about upfront costs. This article will guide you through everything you need to know about this financing option, including eligibility requirements, how to apply, and tips for maximizing its benefits.

By the end of this article, you'll have a comprehensive understanding of how Home Depot's 0% financing for 24 months works and how it can help you achieve your home improvement goals. Let's dive in!

Read also:Club Universidad Nacional Ac Training Complex The Heart Of Chivarivera Dynasty

Table of Contents

- Introduction to Home Depot 0% Financing

- Eligibility Criteria for Home Depot Financing

- How to Apply for Home Depot Financing

- Products Covered Under the Financing Plan

- Advantages of Home Depot 0% Financing

- Potential Disadvantages to Consider

- Tips for Maximizing Your Financing Benefits

- Frequently Asked Questions

- Statistics on Home Improvement Financing

- Conclusion and Call to Action

Introduction to Home Depot 0% Financing

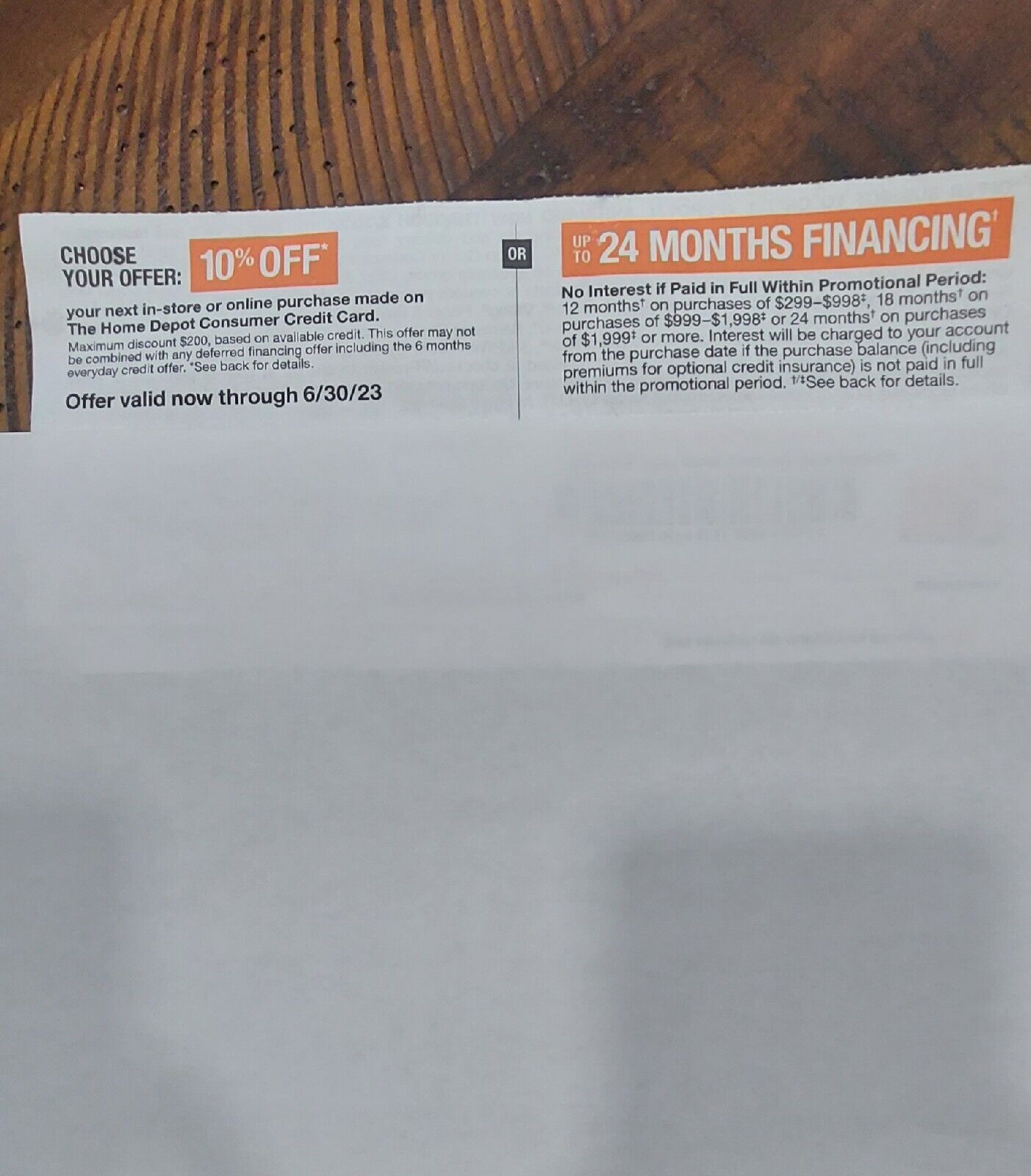

Home Depot has long been a trusted name in the home improvement industry, offering a wide range of products and services to meet the needs of homeowners and contractors alike. One of their most popular offerings is the 0% financing for 24 months, which allows customers to finance their purchases interest-free for two years.

This financing option is particularly appealing to those planning significant home improvements, as it provides the flexibility to pay off purchases over time without accruing interest. Home Depot partners with financial institutions to offer this deal, ensuring a secure and straightforward application process.

Eligibility Criteria for Home Depot Financing

Not everyone qualifies for Home Depot's 0% financing for 24 months. Below are the key eligibility criteria:

- Must be at least 18 years old

- Must have a valid Social Security number

- Must meet specific credit score requirements

- Must provide proof of income in some cases

While Home Depot does not disclose exact credit score thresholds, having a good to excellent credit score significantly increases your chances of approval.

How to Apply for Home Depot Financing

The application process for Home Depot's 0% financing is straightforward and can be completed online or in-store. Here's a step-by-step guide:

- Visit Home Depot's financing page or speak with a store associate

- Fill out the application form with your personal and financial information

- Wait for instant approval or receive a decision via mail

- Once approved, start financing your eligible purchases

Applying online is convenient and often provides faster results, but in-store applications can be helpful if you need immediate financing for a purchase.

Read also:Kylie Jenners Dad The Story Behind The Fame

Products Covered Under the Financing Plan

Home Depot's 0% financing for 24 months covers a wide range of products, including:

- Appliances

- Plumbing fixtures

- Lighting fixtures

- Outdoor power equipment

- Building materials

It's important to note that some exclusions may apply, so always check with a Home Depot representative to confirm eligibility for specific items.

Advantages of Home Depot 0% Financing

Here are some key benefits of Home Depot's 0% financing for 24 months:

- No interest payments: Enjoy interest-free financing for two years, allowing you to budget more effectively.

- Flexibility: Pay off your balance over time without the added burden of interest charges.

- Access to high-value items: Purchase expensive home improvement products without immediate financial strain.

- Improved home value: Enhance your property's value and appeal with upgrades made possible by this financing option.

Potential Disadvantages to Consider

While Home Depot's 0% financing for 24 months offers many advantages, there are some potential downsides:

- Deferred interest: If the balance is not paid in full within 24 months, interest may be charged retroactively from the date of purchase.

- Credit impact: Applying for financing may result in a temporary dip in your credit score.

- Eligibility requirements: Not everyone qualifies, and those with lower credit scores may face challenges.

It's crucial to weigh these factors before committing to the financing plan.

Tips for Maximizing Your Financing Benefits

To make the most of Home Depot's 0% financing for 24 months, consider the following tips:

- Plan your purchases: Identify essential home improvement items and prioritize them.

- Set a payment schedule: Divide the total cost by 24 months to create a manageable monthly payment plan.

- Monitor your balance: Keep track of your payments to ensure the balance is paid off before the interest-free period ends.

- Stay within budget: Avoid overspending by sticking to your planned purchases.

By following these strategies, you can fully leverage the benefits of Home Depot's financing option.

Frequently Asked Questions

Can I use Home Depot financing for all purchases?

No, Home Depot's 0% financing for 24 months applies only to eligible products. Always verify eligibility before making a purchase.

What happens if I don't pay off the balance within 24 months?

If the balance is not paid in full within 24 months, you may be charged interest retroactively from the date of purchase.

Is there an annual fee for Home Depot financing?

No, there are no annual fees associated with Home Depot's financing plans.

Statistics on Home Improvement Financing

According to recent studies, home improvement financing has become increasingly popular among homeowners. In 2022, over 60% of homeowners considered financing options for their projects, with interest-free plans like Home Depot's 0% financing for 24 months being among the most sought-after choices.

Additionally, research shows that homeowners who utilize financing options for home improvements often see a significant return on investment, with property values increasing by an average of 15-20% after major renovations.

Conclusion and Call to Action

Home Depot's 0% financing for 24 months is an excellent opportunity for homeowners looking to upgrade their living spaces without immediate financial strain. By understanding the eligibility criteria, application process, and benefits of this financing option, you can make informed decisions about your home improvement projects.

We encourage you to explore Home Depot's financing plans and take advantage of this opportunity to enhance your home. Don't forget to share your thoughts and experiences in the comments below. For more informative articles on home improvement and financing, explore our website and stay updated on the latest trends and tips.