Are you looking to take advantage of the Home Depot credit card no interest offers? If so, you’re in the right place. This article will provide an in-depth exploration of how Home Depot credit cards work, the benefits of no-interest financing, and how you can make the most of these opportunities. Whether you’re planning a home renovation or simply need to upgrade your appliances, understanding the ins and outs of this credit card can save you significant money.

The Home Depot credit card has become a popular choice among homeowners and DIY enthusiasts due to its attractive no-interest financing offers. With a wide range of benefits, including deferred interest periods and special promotions, it’s no wonder that many people opt for this card. However, before diving in, it’s essential to understand how these offers work and what conditions apply.

In this article, we’ll break down everything you need to know about Home Depot credit card no interest financing. From eligibility requirements to repayment strategies, we’ll cover it all. By the end of this guide, you’ll be equipped with the knowledge to make informed decisions and maximize your savings.

Read also:Top Patreon Alternatives For Creators Building A Thriving Community

Table of Contents

- Introduction to Home Depot Credit Card

- Understanding No Interest Offers

- Eligibility Requirements

- Deferred Interest Explained

- Benefits of Home Depot Credit Card

- Strategies to Maximize Savings

- Common Questions About Home Depot Credit Card

- Statistics on Home Depot Credit Card Usage

- Alternatives to Home Depot Credit Card

- Conclusion and Next Steps

Introduction to Home Depot Credit Card

The Home Depot credit card is a powerful financial tool designed to help customers finance home improvement projects. Offered by Citibank, this card provides exclusive benefits to Home Depot shoppers, including no-interest financing on eligible purchases. Whether you’re buying appliances, tools, or materials, this card can help you manage costs effectively.

How the Home Depot Credit Card Works

When you apply for the Home Depot credit card, you gain access to a range of features, including:

- No-interest financing on specific purchases for a limited time.

- Special discounts and promotions available only to cardholders.

- Convenient payment options to suit your budget.

Understanding how the card works is crucial to taking full advantage of its benefits. Be sure to read the terms and conditions carefully to avoid unexpected charges.

Understanding No Interest Offers

One of the most attractive features of the Home Depot credit card is its no-interest financing offers. These promotions allow you to purchase big-ticket items without accruing interest for a specified period. However, it’s important to note that these offers typically come with deferred interest terms.

Key Features of No-Interest Financing

Here are some key points to consider when it comes to Home Depot credit card no interest offers:

- The no-interest period usually lasts between 6 and 12 months, depending on the promotion.

- You must pay off the full balance before the promotional period ends to avoid deferred interest charges.

- Eligible purchases are clearly marked in-store and online, so be sure to check for the no-interest financing logo.

Eligibility Requirements

Before applying for the Home Depot credit card, it’s important to understand the eligibility requirements. While the card is available to most consumers, certain factors can impact your approval:

Read also:Anna Smrek Height Unveiling The Truth About This Iconic Model

Factors That Affect Eligibility

Here are some factors that may influence whether you qualify for the Home Depot credit card:

- Credit score: A good or excellent credit score increases your chances of approval.

- Income level: Demonstrating a stable income can strengthen your application.

- Debt-to-income ratio: Lenders consider your existing debt obligations when evaluating your application.

By ensuring that you meet these criteria, you can improve your likelihood of being approved for the card.

Deferred Interest Explained

Deferred interest is a key concept to understand when using the Home Depot credit card no interest offers. While the card allows you to avoid interest during the promotional period, failing to pay off the balance in full can result in significant charges.

How Deferred Interest Works

Here’s how deferred interest works:

- During the promotional period, you won’t accrue interest on eligible purchases.

- If you don’t pay off the balance in full by the end of the promotional period, you’ll be charged interest retroactively on the entire purchase amount.

- To avoid deferred interest, make sure to pay off the balance before the promotional period ends.

Understanding deferred interest is crucial to avoiding unexpected charges and maximizing your savings.

Benefits of Home Depot Credit Card

Aside from no-interest financing, the Home Depot credit card offers a variety of benefits that make it a valuable tool for home improvement projects. Here are some of the key advantages:

Exclusive Discounts and Promotions

Cardholders enjoy exclusive discounts and promotions throughout the year. These offers can help you save even more on your purchases, making the card an excellent choice for frequent Home Depot shoppers.

Flexible Payment Options

With flexible payment options, you can manage your finances more effectively. Choose a payment plan that suits your budget and avoid the stress of unexpected expenses.

Strategies to Maximize Savings

Knowing how to use the Home Depot credit card effectively can help you maximize your savings. Here are some strategies to consider:

Pay Off Balances Before the Promotional Period Ends

The most important strategy is to pay off your balance in full before the promotional period ends. This ensures that you avoid deferred interest charges and take full advantage of the no-interest financing offer.

Take Advantage of Exclusive Promotions

Keep an eye out for exclusive promotions available to Home Depot credit card holders. These offers can provide additional savings and make your purchases even more affordable.

Common Questions About Home Depot Credit Card

Here are some frequently asked questions about the Home Depot credit card:

Can I Use the Card Outside of Home Depot?

Yes, the Home Depot credit card can be used at other retailers, but it may not offer the same benefits as when used at Home Depot. Be sure to check the terms and conditions for details.

What Happens If I Miss a Payment?

Missing a payment can result in late fees and may impact your credit score. To avoid these consequences, set up automatic payments or reminders to ensure you never miss a due date.

Statistics on Home Depot Credit Card Usage

According to recent data, the Home Depot credit card is one of the most popular retail credit cards in the United States. Here are some statistics to consider:

- Over 70 million customers have used the Home Depot credit card for home improvement projects.

- More than 60% of cardholders take advantage of the no-interest financing offers.

- The average cardholder saves over $500 annually by using the card for eligible purchases.

Alternatives to Home Depot Credit Card

While the Home Depot credit card offers many benefits, it’s not the only option available. Here are some alternatives to consider:

Store-Specific Credit Cards

Other retailers, such as Lowe’s and Walmart, offer credit cards with similar features. Compare these options to determine which card best suits your needs.

General-Purpose Credit Cards

If you prefer a card that can be used at multiple retailers, consider a general-purpose credit card with a low-interest rate or cash-back rewards.

Conclusion and Next Steps

In conclusion, the Home Depot credit card offers a valuable opportunity to save money on home improvement projects through no-interest financing. By understanding how the card works and following the strategies outlined in this guide, you can make the most of its benefits and avoid unnecessary charges.

We encourage you to take action today by:

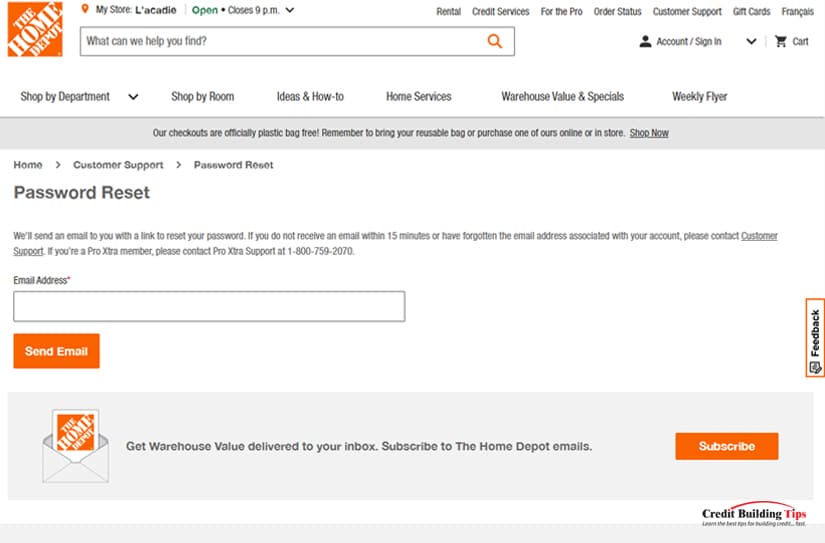

- Applying for the Home Depot credit card if you haven’t already.

- Exploring the no-interest financing offers available for your next project.

- Sharing this article with others who may benefit from the information.

Remember, knowledge is power. Armed with the information provided in this guide, you’re ready to make informed decisions and maximize your savings with the Home Depot credit card no interest offers.