Are you looking for ways to finance your home improvement projects without breaking the bank? The Home Depot Credit Card 0 interest offers could be your perfect solution. This credit card allows you to make significant purchases while enjoying an interest-free period, giving you the flexibility to pay off your balance without added financial strain.

The Home Depot Credit Card 0 interest promotions have become increasingly popular among homeowners and DIY enthusiasts. Whether you're renovating your kitchen, updating your bathroom, or simply refreshing your outdoor space, this card can help you manage costs effectively. Understanding the benefits and terms of these offers is essential to make the most out of them.

In this comprehensive guide, we'll explore everything you need to know about the Home Depot Credit Card 0 interest offers. From eligibility requirements and application processes to tips for maximizing your savings, we'll ensure you're well-equipped to take advantage of this opportunity. Let's dive in!

Read also:Unveiling The Glamour Of Dti Crystal Couture A Comprehensive Guide

Table of Contents

- Introduction to Home Depot Credit Card

- Understanding the 0 Interest Offer

- Eligibility Criteria

- How to Apply for the Card

- Benefits of the Home Depot Credit Card

- Financing Options

- Tips for Maximizing Your Savings

- Frequently Asked Questions

- Comparison with Other Retail Credit Cards

- Conclusion and Call to Action

Introduction to Home Depot Credit Card

The Home Depot Credit Card is a popular choice for those looking to finance home improvement projects. It offers a range of benefits, including 0 interest promotions on purchases made within a specific timeframe. This card is designed to provide customers with the flexibility and convenience they need to manage their expenses effectively.

Key Features of the Card

Here are some of the standout features of the Home Depot Credit Card:

- 0 interest promotional financing on select purchases

- No annual fee

- Special discounts and exclusive offers for cardholders

- Easy application process

Understanding the 0 Interest Offer

The Home Depot Credit Card 0 interest offer allows customers to make purchases without accruing interest for a specified period. This can be a significant advantage for those undertaking large home improvement projects, as it provides time to pay off the balance without incurring additional charges.

How Does It Work?

To qualify for the 0 interest promotion, customers must make their purchases during the promotional period and pay off the balance before the promotional period ends. Failure to do so may result in interest charges being applied to the remaining balance.

Eligibility Criteria

Not everyone qualifies for the Home Depot Credit Card 0 interest offers. Here are some of the eligibility requirements:

- Good credit score

- Proof of income

- Valid identification

Meeting these criteria increases your chances of being approved for the card.

Read also:Brown Discharge Before Period Causes Symptoms And What You Need To Know

How to Apply for the Card

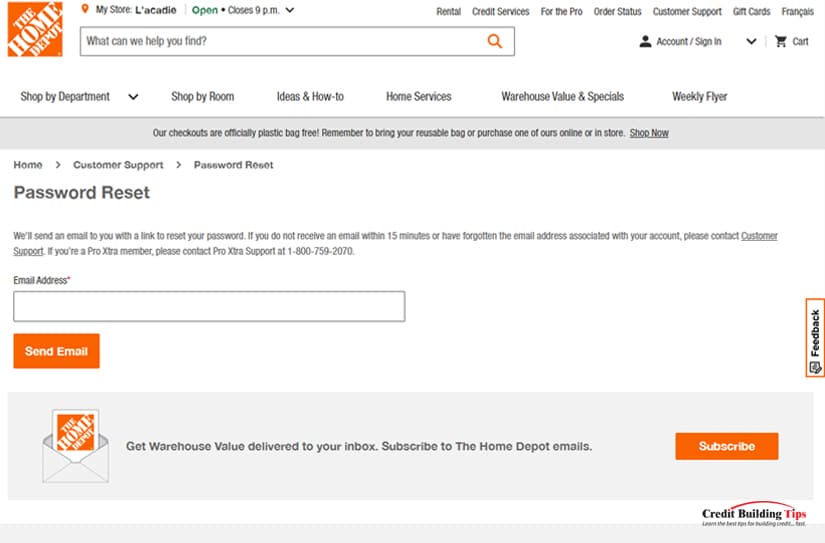

Applying for the Home Depot Credit Card is a straightforward process. You can apply online or in-store. Here's how:

- Visit the official Home Depot Credit Card website or approach a customer service representative in-store.

- Fill out the application form with your personal and financial information.

- Submit your application and await approval.

Approval times vary but are generally quick, often taking just a few minutes.

Benefits of the Home Depot Credit Card

Beyond the 0 interest promotions, the Home Depot Credit Card offers several other benefits:

- No annual fee

- Special discounts on purchases

- Exclusive access to sales and events

- Flexible payment options

These benefits make the card a valuable tool for managing home improvement expenses.

Financing Options

The Home Depot Credit Card provides various financing options to suit different needs. Customers can choose from:

- Standard financing

- 0 interest promotional financing

- Extended payment plans

Each option comes with its own terms and conditions, so it's important to review them carefully before making a decision.

Understanding Payment Plans

Extended payment plans allow customers to spread out their payments over a longer period, making it easier to manage large purchases. These plans often come with competitive interest rates, providing additional savings opportunities.

Tips for Maximizing Your Savings

To make the most out of your Home Depot Credit Card 0 interest offers, consider the following tips:

- Pay off your balance before the promotional period ends to avoid interest charges.

- Take advantage of special discounts and exclusive offers available to cardholders.

- Use the card for large purchases where the 0 interest promotion can provide significant savings.

By following these tips, you can maximize your savings and get the most out of your card.

Frequently Asked Questions

Here are some common questions about the Home Depot Credit Card 0 interest offers:

- Q: How long does the 0 interest promotion last? A: The duration varies but typically ranges from 6 to 12 months.

- Q: Can I use the card for non-Home Depot purchases? A: No, the card is only valid for purchases made at Home Depot locations or on their website.

- Q: What happens if I don't pay off the balance before the promotional period ends? A: Interest charges will be applied to the remaining balance.

Comparison with Other Retail Credit Cards

When compared to other retail credit cards, the Home Depot Credit Card stands out due to its 0 interest promotions and no annual fee. However, it's important to evaluate other factors such as rewards programs, cashback options, and customer service before making a decision.

Key Differences

Here are some key differences between the Home Depot Credit Card and other retail credit cards:

- 0 interest promotional financing

- No annual fee

- Exclusive discounts and offers

Conclusion and Call to Action

In conclusion, the Home Depot Credit Card 0 interest offers provide a valuable opportunity for homeowners and DIY enthusiasts to finance their projects without incurring additional interest charges. By understanding the eligibility requirements, application process, and benefits of the card, you can make an informed decision about whether it's the right choice for you.

We encourage you to take advantage of this opportunity by applying for the card today. Don't forget to share your thoughts and experiences in the comments section below. For more information on home improvement financing options, explore our other articles on the website.

Remember, the key to maximizing your savings lies in careful planning and timely payments. With the Home Depot Credit Card, you can achieve your home improvement goals while keeping your finances in check.