Are you looking to take advantage of the Home Depot card no interest deals? If so, you're in the right place. Many homeowners and DIY enthusiasts turn to Home Depot's credit card for its incredible benefits, including interest-free financing. Understanding how this works can help you make smarter financial decisions when it comes to home improvement projects.

The Home Depot credit card offers a range of perks, but perhaps none are as enticing as the no-interest financing options. With these deals, you can purchase the tools, materials, and appliances you need for your home improvement projects without worrying about accruing interest charges. This guide will walk you through everything you need to know about the Home Depot card no interest offers.

Whether you're planning a major renovation or simply looking to upgrade your kitchen appliances, the Home Depot card no interest option can be a valuable financial tool. In this article, we'll explore the benefits, eligibility requirements, and tips for maximizing your savings. Let's dive in!

Read also:Morristown Tn Dining A Comprehensive Guide To The Best Restaurants And Culinary Experiences

Table of Contents

- Introduction to Home Depot Card

- How Does No Interest Work?

- Eligibility Requirements

- Steps to Apply

- Benefits of Home Depot Card

- Common Questions About No Interest

- Strategies for Maximizing Savings

- Tips for Managing Credit

- Real-Life Examples

- Conclusion

Introduction to Home Depot Card

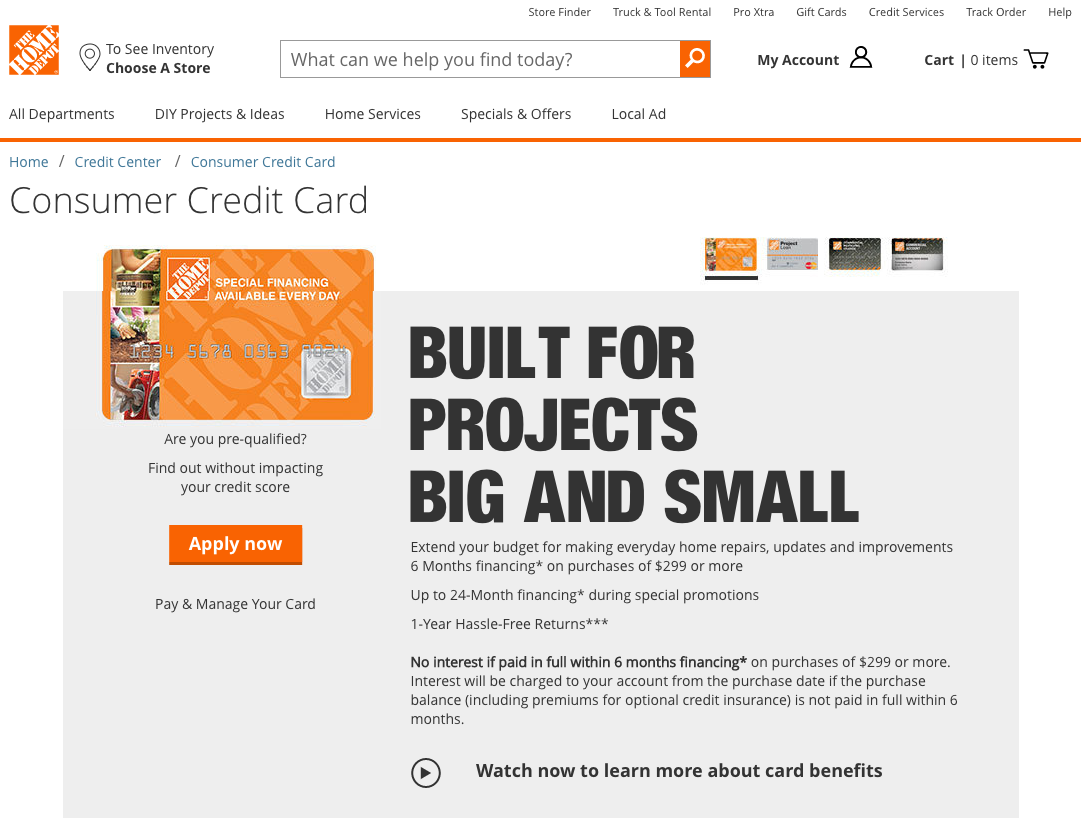

The Home Depot credit card is a popular choice for those who frequently shop at the retail giant. It offers a variety of benefits, including exclusive discounts, rewards points, and most importantly, no-interest financing on qualifying purchases. This card is designed to make it easier for customers to finance their home improvement projects without the added burden of interest charges.

Key Features of the Home Depot Card

Here are some of the standout features of the Home Depot card:

- No interest on qualifying purchases for a specified period

- 5% savings rewards on purchases made at Home Depot

- Special financing offers for big-ticket items

- No annual fee

These features make the Home Depot card an attractive option for anyone looking to upgrade their home or tackle a DIY project.

How Does No Interest Work?

The concept of no-interest financing can be confusing for some consumers. Essentially, it means that you can purchase items without accruing interest charges for a certain period. However, there are some important details to understand.

Important Considerations

To fully benefit from the Home Depot card no interest offers, you need to pay off the balance in full before the promotional period ends. If you fail to do so, you may be charged interest retroactively on the entire purchase amount.

Here are some key points to keep in mind:

Read also:Lauren Lake Net Worth A Comprehensive Analysis Of Her Financial Journey

- No interest applies only to qualifying purchases

- Promotional periods typically range from 6 to 24 months

- Interest charges may apply if the balance is not paid in full by the end of the promotional period

Eligibility Requirements

Not everyone qualifies for the Home Depot card no interest offers. To be eligible, you must meet certain criteria, including having a good credit score and meeting income requirements. Additionally, you must make purchases that qualify for the no-interest financing option.

Factors That Affect Eligibility

Here are some factors that can impact your eligibility for the Home Depot card no interest offers:

- Credit score: A higher credit score increases your chances of approval

- Income level: You must demonstrate sufficient income to repay the balance

- Purchase amount: Only purchases above a certain threshold qualify for no-interest financing

It's important to review these requirements carefully before applying for the card.

Steps to Apply

Applying for the Home Depot card is a straightforward process. Follow these steps to get started:

Step 1: Visit the Home Depot Website

Go to the official Home Depot website and navigate to the credit card application page.

Step 2: Fill Out the Application Form

Provide your personal and financial information, including your name, address, and income details.

Step 3: Submit Your Application

Once you've completed the form, submit your application. You'll receive an instant decision in most cases.

Benefits of Home Depot Card

Beyond the no-interest financing option, the Home Depot card offers several other benefits that make it a worthwhile choice for homeowners and DIY enthusiasts.

Exclusive Discounts

Cardholders enjoy exclusive discounts on a wide range of products, including tools, appliances, and building materials.

Rewards Program

Earn 5% savings rewards on purchases made at Home Depot, which can be redeemed for future purchases.

Special Financing Offers

In addition to the no-interest financing option, cardholders may qualify for other special financing deals on big-ticket items.

Common Questions About No Interest

Here are some frequently asked questions about the Home Depot card no interest offers:

Q: How long does the no-interest period last?

A: The promotional period typically ranges from 6 to 24 months, depending on the offer.

Q: What happens if I don't pay off the balance in full?

A: If you fail to pay off the balance in full by the end of the promotional period, you may be charged interest retroactively on the entire purchase amount.

Q: Are there any fees associated with the card?

A: There is no annual fee for the Home Depot card. However, late payment fees and interest charges may apply if you miss a payment or fail to pay off the balance in full.

Strategies for Maximizing Savings

Here are some strategies to help you make the most of the Home Depot card no interest offers:

Plan Your Purchases

Before making a purchase, ensure that it qualifies for the no-interest financing option. This will help you avoid unexpected charges.

Set Up Automatic Payments

Automate your payments to ensure that you pay off the balance in full before the promotional period ends. This will help you avoid interest charges and late fees.

Monitor Your Account

Keep a close eye on your account to track your spending and ensure that you stay within your budget.

Tips for Managing Credit

Using the Home Depot card responsibly can help you build a strong credit history. Here are some tips for managing your credit effectively:

Pay Your Bills on Time

Timely payments are crucial for maintaining a good credit score. Set up reminders or automate payments to ensure that you never miss a deadline.

Keep Your Credit Utilization Low

Aim to use no more than 30% of your available credit. This will help you maintain a healthy credit utilization ratio.

Avoid Opening Too Many Accounts

Opening multiple credit accounts in a short period can negatively impact your credit score. Only apply for new credit when necessary.

Real-Life Examples

Here are some real-life examples of how the Home Depot card no interest offers have helped customers save money:

Example 1: Kitchen Renovation

John used the Home Depot card to finance a kitchen renovation project. By paying off the balance in full within the promotional period, he saved hundreds of dollars in interest charges.

Example 2: Appliance Upgrade

Sarah used the card to purchase a new refrigerator and dishwasher. She took advantage of the no-interest financing option and paid off the balance in 12 months, avoiding any interest charges.

Conclusion

In conclusion, the Home Depot card no interest offers can be a valuable tool for anyone looking to finance home improvement projects. By understanding how these offers work and following the tips outlined in this guide, you can maximize your savings and make smarter financial decisions.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, don't forget to explore other articles on our website for more tips and advice on home improvement and personal finance. Together, let's build a brighter financial future!