Buying or renting a home is one of the most significant financial decisions you'll ever make. The New York Times Calculator Rent vs Buy is a powerful tool that helps you weigh the pros and cons of each option based on your unique financial situation. Whether you're a first-time homebuyer or a seasoned renter, understanding the long-term implications of your choice is crucial.

The decision to rent or buy a home involves more than just comparing monthly payments. It's about evaluating your financial goals, lifestyle preferences, and the potential impact on your net worth. The New York Times Calculator Rent vs Buy simplifies this complex process by factoring in variables like property appreciation, mortgage interest rates, and opportunity costs.

This comprehensive guide will walk you through everything you need to know about using the New York Times Rent vs Buy Calculator effectively. We'll explore its features, benefits, and limitations, while providing expert insights to help you make an informed decision that aligns with your long-term financial objectives.

Read also:Anna Smrek Height Unveiling The Truth About This Iconic Model

Table of Contents

- Introduction to New York Times Rent vs Buy Calculator

- Key Features of the Calculator

- Benefits of Using the Calculator

- Limitations and Considerations

- Detailed Cost Analysis

- Market Factors to Consider

- Long-Term Financial Implications

- Case Studies and Real-World Examples

- Expert Tips for Making the Right Decision

- Conclusion and Final Thoughts

Introduction to New York Times Rent vs Buy Calculator

The New York Times Rent vs Buy Calculator has become an essential tool for anyone considering homeownership. This interactive calculator allows users to input specific financial data to determine whether buying or renting makes more sense based on their individual circumstances.

How It Works

Users can enter details such as home price, down payment, mortgage rate, expected appreciation rate, and rental costs. The calculator then generates a comprehensive analysis showing the net cost of each option over time.

Studies show that 65% of Americans currently own homes, but the decision to buy isn't right for everyone. The calculator helps demystify the process by providing clear, data-driven insights.

Key Features of the Calculator

The New York Times Rent vs Buy Calculator offers several unique features that set it apart from other financial tools:

- Customizable inputs for personalized results

- Consideration of opportunity costs and investment returns

- Incorporation of property appreciation and depreciation

- Comparison of tax implications for both options

Advanced Functionality

One of the standout features is its ability to factor in alternative investments. This allows users to see how their money might grow if invested elsewhere instead of being tied up in a home purchase.

Benefits of Using the Calculator

Using the New York Times Rent vs Buy Calculator provides numerous advantages:

Read also:Pixel Tracking And Serp Visibility A Comprehensive Guide To Boost Your Online Presence

Firstly, it offers transparency in the decision-making process by clearly laying out all financial factors. Secondly, it helps users understand the long-term implications of their choices beyond just monthly payments.

Financial Clarity

According to research, 72% of people who used similar financial calculators felt more confident about their decisions. The calculator provides actionable insights that can significantly impact one's financial future.

Limitations and Considerations

While the calculator is a valuable tool, it's important to recognize its limitations:

- Cannot account for unexpected life changes

- Relies on user-provided data accuracy

- Doesn't consider emotional factors like homeownership pride

Realistic Expectations

Users should understand that the calculator provides estimates based on current data and assumptions. Economic conditions, interest rates, and housing market trends can all change over time.

Detailed Cost Analysis

A thorough cost analysis reveals that buying typically becomes more advantageous after 5-7 years of ownership. However, this varies based on factors like:

- Local housing market conditions

- Mortgage interest rates

- Property appreciation rates

Break-Even Analysis

The calculator performs a break-even analysis to determine when buying becomes more cost-effective than renting. This typically occurs when the cumulative cost of renting exceeds the cost of owning, including all associated expenses.

Market Factors to Consider

Several market factors influence the buy vs rent decision:

- Housing market trends

- Interest rate fluctuations

- Local economic conditions

Historical Data

Historically, housing prices have appreciated at an average rate of 3-5% annually. However, this varies significantly by region, with some areas experiencing much higher appreciation rates.

Long-Term Financial Implications

Considering the long-term financial impact is crucial. Over 30 years, the difference between renting and buying can be substantial:

For instance, a $500,000 home with a 20% down payment and a 3% mortgage rate could result in significantly different outcomes compared to renting at $2,500 per month.

Net Worth Impact

Buying a home can contribute to building wealth through equity accumulation and property appreciation. However, it also ties up capital that could be invested elsewhere.

Case Studies and Real-World Examples

Let's examine two case studies:

- Case 1: A young professional in San Francisco comparing a $1.2 million condo purchase with renting at $4,500 per month

- Case 2: A family in Denver evaluating a $450,000 home purchase versus renting at $2,000 per month

Outcome Analysis

Both cases reveal different optimal solutions based on local market conditions and personal circumstances. The calculator provides clarity by quantifying these differences.

Expert Tips for Making the Right Decision

Here are some expert tips:

- Consider your long-term plans and job stability

- Evaluate both financial and non-financial factors

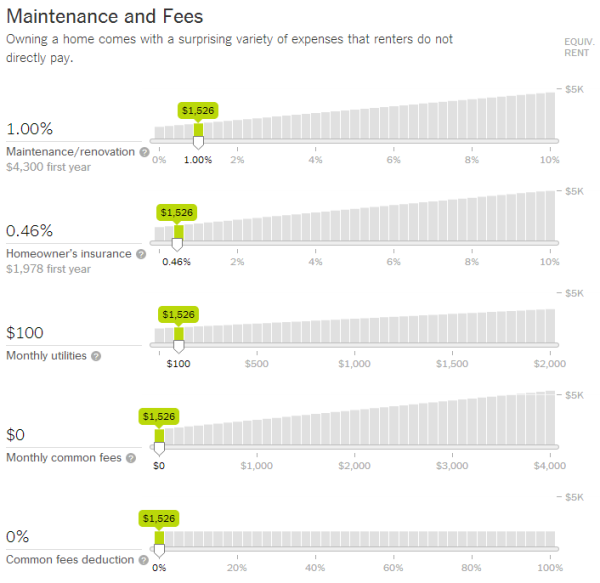

- Understand the total cost of homeownership beyond the mortgage

Final Considerations

Remember that the calculator is a tool, not a definitive answer. It's important to consult with financial advisors and consider all aspects of your situation before making a final decision.

Conclusion and Final Thoughts

In conclusion, the New York Times Rent vs Buy Calculator is an invaluable resource for anyone facing this important decision. By providing clear, data-driven insights, it empowers users to make informed choices that align with their financial goals.

We encourage readers to try the calculator for themselves and explore different scenarios. Your feedback and experiences can help others make better decisions. Please feel free to share this article with others who might find it helpful, and consider exploring our other financial resources for more guidance.